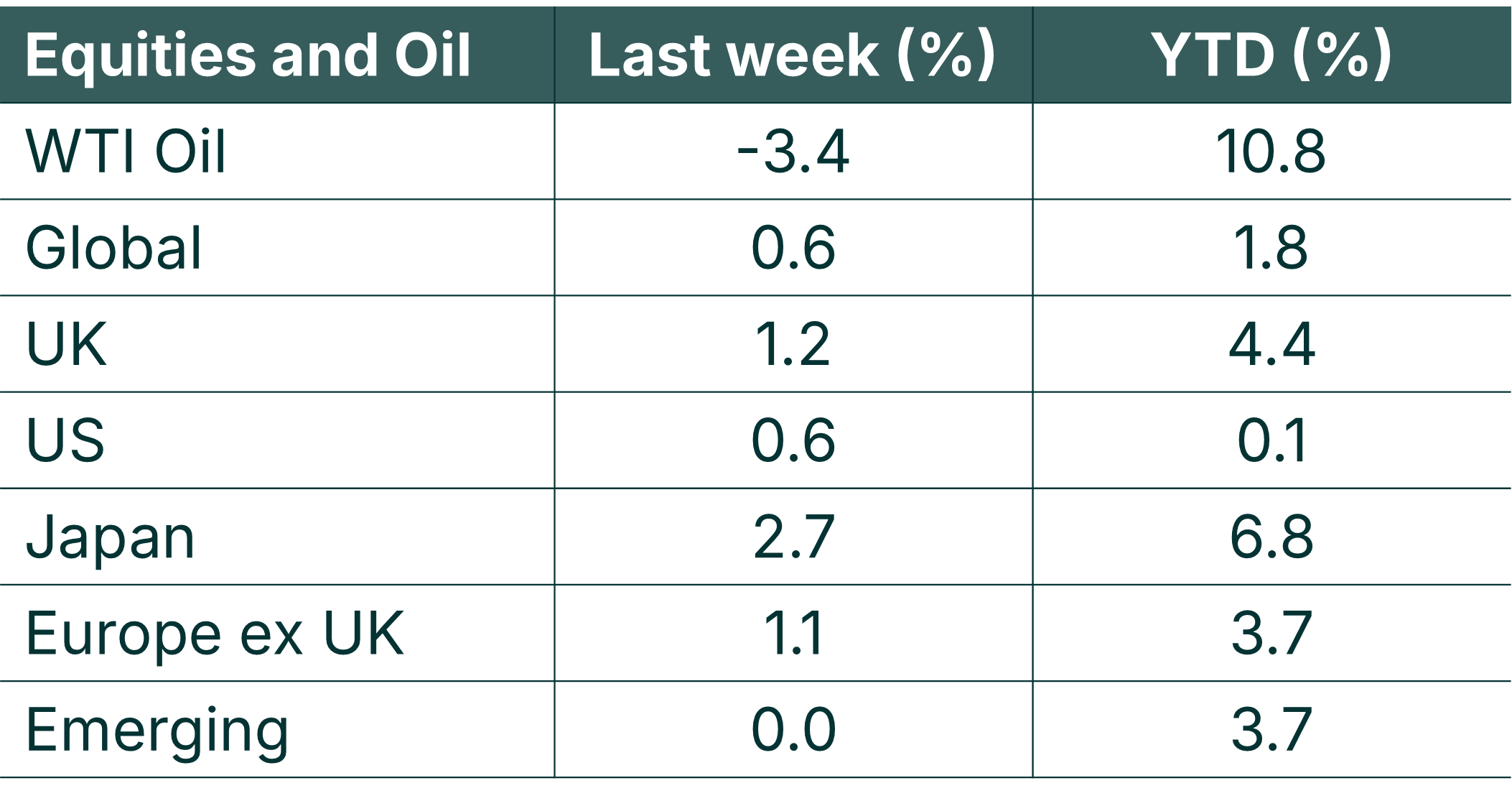

February has begun much as January ended: equity markets trending higher, albeit with notable intra-week volatility. Global equities rose c.0.6% in the first week of February, led once again by Japan, which gained 2.7% and extended those gains into early trading this week.

We are now firmly in the peak of earnings season, which continues to be the dominant driver of equity market performance. Results to date have been broadly strong, though not without surprise, and investor scrutiny around AI monetisation and capital allocation is clearly intensifying.

In the week ahead, corporate earnings will remain front and centre as more large-cap companies report. With most major central bank meetings now behind us, macroeconomic focus is likely to shift toward growth, inflation and manufacturing data.

Last week

- Stock markets were up on the weak, led by Japan – a trend that has already continued into this week following Takaichi’s election victory.

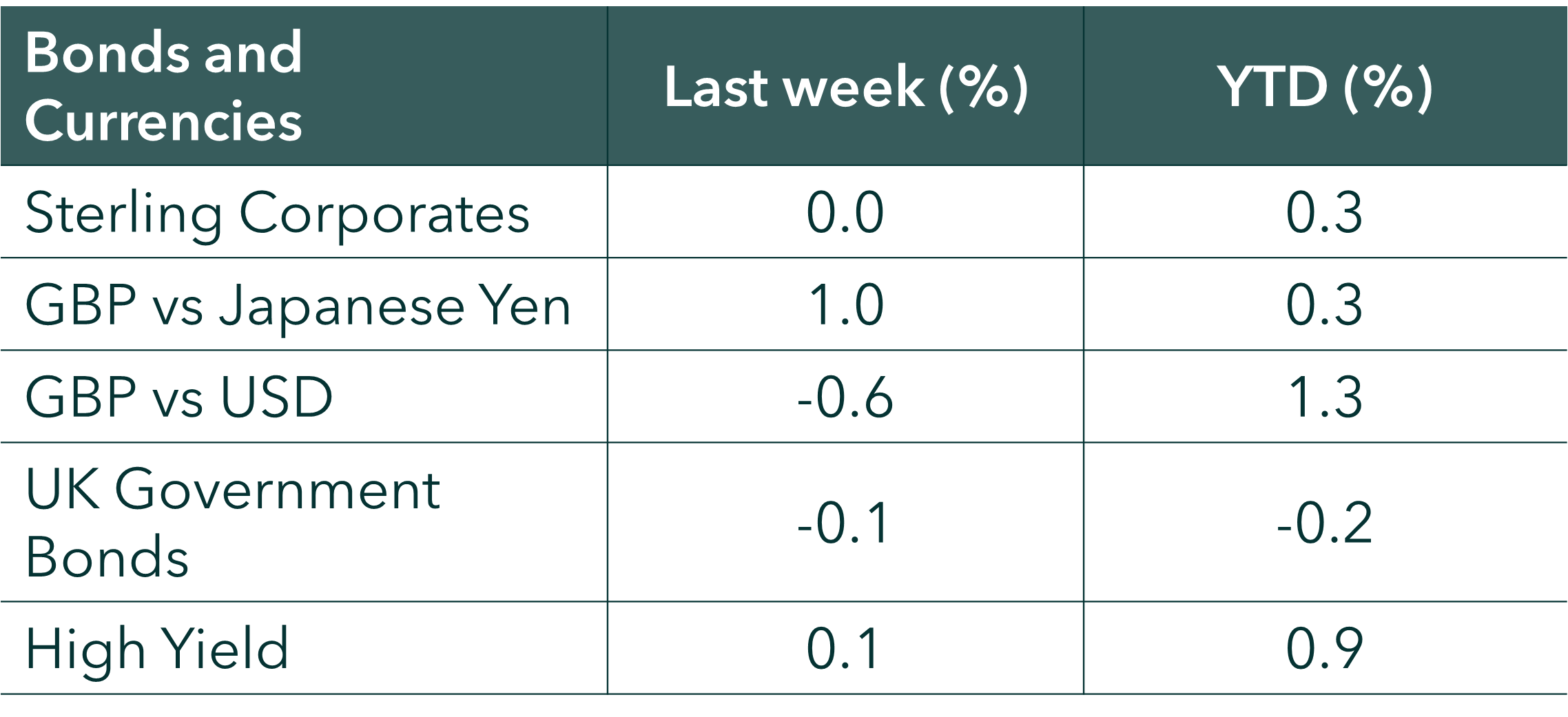

- Bond markets were largely unchanged, as the Bank of England, European Central Bank and Reserve Bank of Australia all held policy rates steady, in line with expectations.

- Earnings season remained broadly constructive, though investors showed increased sensitivity to forward guidance and capital expenditure plans. Alphabet, Amazon, Eli Lilly and Novo Nordisk all reported results at or above analyst expectations.

- Broader investment markets were weaker, with oil prices falling c.3%, while precious metals experienced another volatile week. Silver and platinum both saw further spot price declines.

This week

- Investor attention remains firmly on earnings, with Coca-Cola, AstraZeneca, McDonald’s and NatWest among the notable companies reporting.

- Japanese equity markets have opened strongly following the election landslide, with focus now turning to Takaichi’s policy agenda and the scope for tax cuts.

- A busy US macro calendar lies ahead, including retail sales (Tuesday), labour market data (Wednesday) and inflation figures (Friday).

- In the UK, following last week’s Bank of England rate decision, attention will turn to GDP growth and production data, due on Thursday.

Source: Bloomberg. Currency GBP.

More detail:

- Global equity markets have continued their upward trajectory, supported by generally robust Q4 earnings and political developments in Japan. Results have now been reported by six of the “Magnificent Seven”. While earnings have largely exceeded expectations, investor reaction has been more nuanced, particularly around the pace of AI monetisation and rising capital expenditure forecasts. By way of context, the five major hyper-scalers — Alphabet, Amazon, Meta, Microsoft and Oracle — are expected to spend over $600bn on capital expenditure in 2026 alone.

- In the US, Q4 earnings season remains busy, with consumer-facing names in focus this week, including Coca-Cola, McDonald’s, Shopify and Airbnb.

- In the UK, GSK reported strong earnings last week, providing support to the market, while Shell disappointed amid weaker oil prices. This week, results are expected from AstraZeneca — one of the FTSE 100’s largest constituents — alongside Barclays and NatWest. Ahead of its earnings release, NatWest announced the acquisition of Evelyn Partners, which had been put up for sale late last year.

- Three major central banks met last week — the BoE, ECB and RBA — all holding interest rates as expected. The BoE maintained rates at 3.75%, the ECB at 2.15% and the RBA at 3.85%.

- This week, macroeconomic data will take centre stage in both the US and UK. In the US, data releases are beginning to normalise following the government shutdown, with key indicators including retail sales, employment and inflation spread across the week. In the UK, GDP growth and production figures will be closely watched for further signals on the underlying health of the economy.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.