It was another choppy week for stock markets to close out the month of January. Markets closed out January up by about 1%, despite all the choppiness and geopolitical uncertainty. We’re in the midst of US earnings season and profit growth continues to be strong: which helps underpin stock market returns. That said, we’d also note that the market has become much more discerning around companies’ ability to generate future profits, particularly as pertains to spending on Artificial Intelligence.

This week, the focus remains on corporate earnings, with some big names reporting. We’ve also got the much-watched monthly US jobs data: due out on Friday lunchtime.

Last week

-

Stock markets were broadly flat last week, with US shares (and the US Dollar) weighing on returns

-

US corporate earnings came in strong, although the market was discerning over Companies’ ability to monetise AI spending

-

UK banks continued to trade well, with Lloyds announcing a £1.75bn share buyback

-

The US Fed kept interest rates on hold (at 3.75%)

-

President Trump announced Kevin Warsh as his nomination for Chair of the Federal Reserve

This week

-

It is another big week of earnings! In the US, we have AMD and SuperMicro Computer reporting on Wednesday, Alphabet, Qualcomm and Eli Lilly on Thursday and Amazon on Friday.

-

In the UK, we have GSK reporting on Wednesday and Shell on Thursday. These 2 companies account for c8.5% of the UK share index, so their results will be closely watched.

-

The Bank of England meet on Thursday: they’re widely expected to hold rates at 3.75%.

-

US monthly jobs data (nonfarm payrolls) is released on Friday.

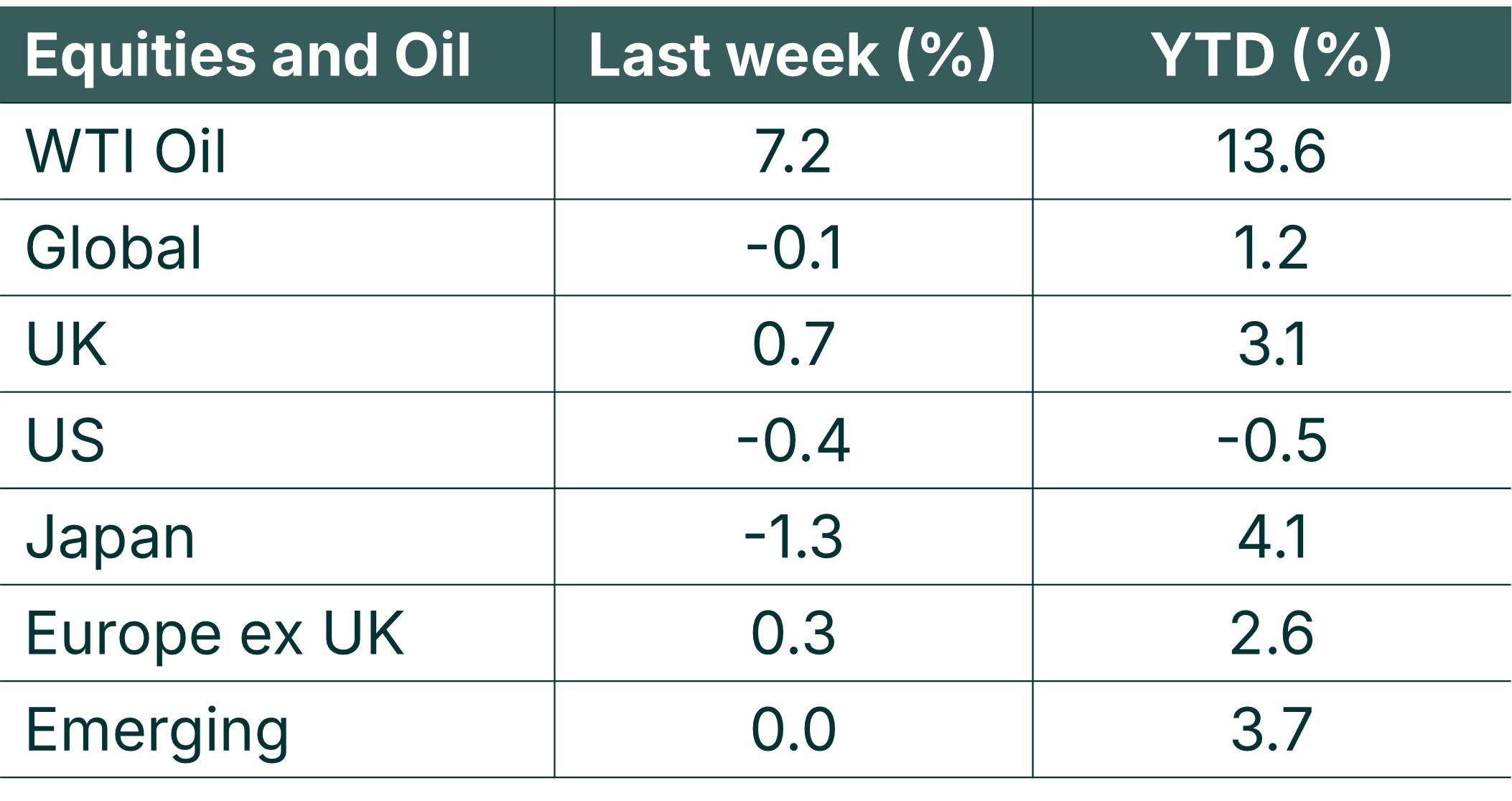

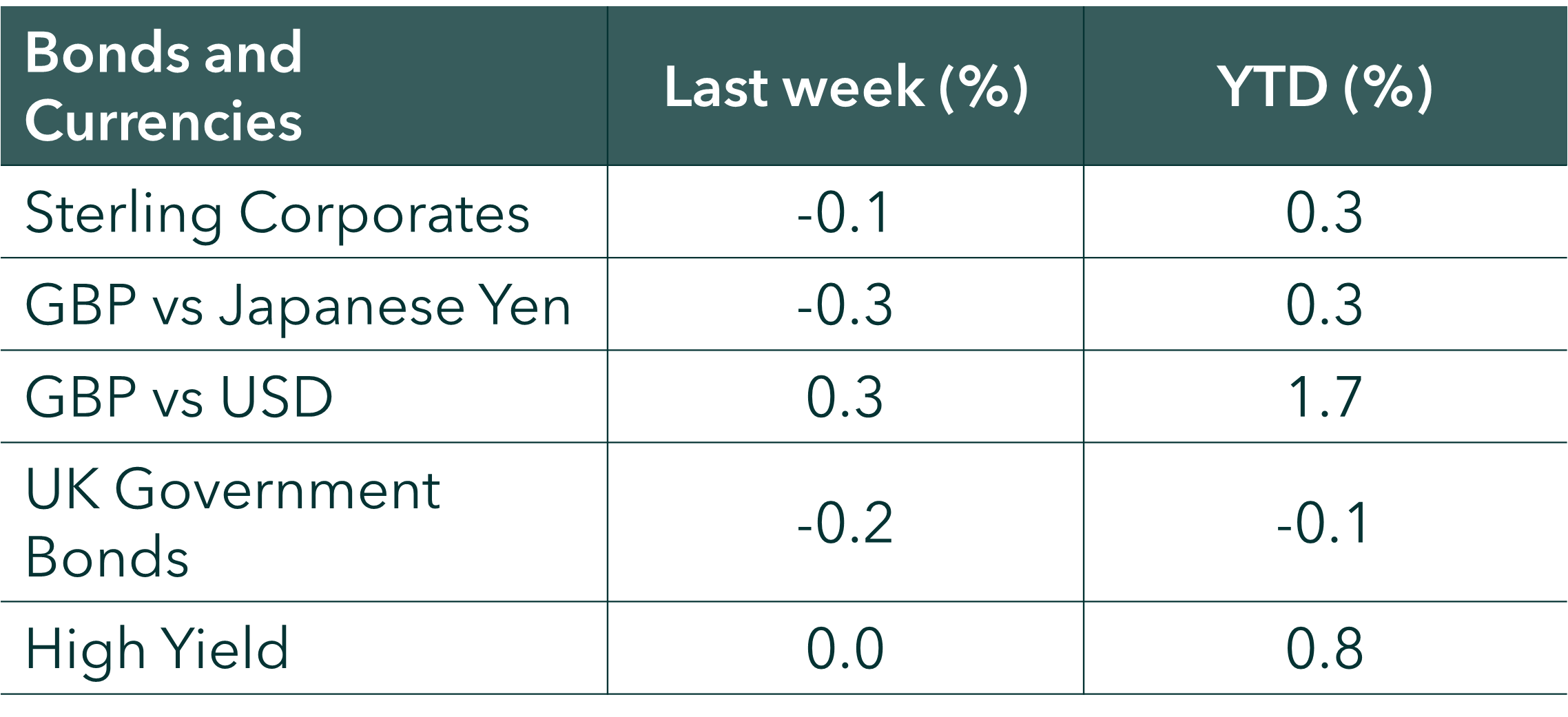

Source: Bloomberg. Currency GBP.

More detail:

-

Global stock markets went sideways last week, but there was a lot going on beneath the surface! US companies weighed on global stock returns last week, whilst UK and European companies posted positive gains. On a sector basis, Consumer Discretionary and Tech (which carry large weights in US indices) weighed, whilst Energy and Financials (more prevalent in UK indices) rallied.

-

Corporate earnings were a key driver for markets last week. We’re now just over 1/3 of the way through reporting for US companies and the headline growth rate is c11.9% year-over-year. This is better than the 8.3% growth rate that had been expected at end December 2025 (source Factset) and, if it holds, would represent the 5th consecutive quarter of double-digit earnings growth for the index. Earnings are the single biggest driver of long-term stock returns; hence we view this as a positive signal!

-

This earnings season has seen the market be more discriminating on Artificial Intelligence (“AI”) spending. Last week saw 4 of the Magnificent 7 companies (Apple, Meta Platforms, Microsoft, and Tesla) report result that all beat estimates. However, the stock price reaction was very varied, with the market becoming increasingly discerning over companies’ abilities to monetise AI spend. Meta rose by 8% on the week as its advertising revenue came in better than expected. Conversely, Microsoft fell by 8% on the week, as growth in Azure (cloud computing) was slower than expected.

-

The UK share market was boosted by its relatively high allocations to sectors such as Energy and Financials. The energy sector rose strongly on the back of the rising oil price, whilst the Financials sector was pushed higher by the Banking sector. Specifically, Lloyds Bank announced some strong results last week which saw its share price rise by 7.2% on the week. This came on the back of a £1.75bn share buyback program which started on Friday last week.

-

The Federal Reserve met last week and maintained the federal funds rate at 3.75% (upper bound). This was widely anticipated by the market.

-

President Donald Trump announced that he had nominated Kevin Warsh, a former Fed Governor, to be the next Fed Chair. This nomination needs to be confirmed by the Senate. If confirmed, Warsh would become Fed Chair in May when current Chair Powell’s term ends.

-

Kevin Warsh – Warsh was a Federal Reserve Board Member from 2006 to 2011. He is more dovish (i.e. in favour of lower rates) than the current Fed Chair Powell. However, he is likely less aggressively focussed on lower rates than the other Fed Chair candidates (e.g. Kevin Hassett and Rick Reider). As such, the market reaction was positive, with the Dollar firming and longer-dated Treasury yields rising a touch: signally less rate cuts further out in time. The confirmation process should happen, but it will take time and needs a positive vote from the Senate Banking Committee. The Republicans have a majority on this committee, but one member, Thom Tillis, has indicated that he will oppose confirmation of any Fed nominees until the DOJ investigation into Fed Chair Powell is resolved.

-

Bond markets finished the week flat, with short-dated sovereign yields in the US faring best. This came on the back of the Fed Chair nomination from President Trump, with markets pricing in interest rate cuts for later this year. The first cut is priced for June which is when Kevin Warsh is expected to be in situ as Fed Chair.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.