The opening weeks of February have been marked by heightened volatility, with earnings announcements, evolving AI narratives, valuation concerns, and shifting interest rate expectations all contributing to choppy market conditions. The period has also offered investors an opportunity to absorb and reassess the renewed risk appetite that characterised global equity markets in January.

Market leadership has broadened meaningfully in the US as investors have rotated toward cyclical sectors and away from the concentrated strength of mega‑cap names. In January this shift was evident in the Russell 2000’s performance, which outpaced the S&P 500 by nearly 400 basis points. This trend has continued in the first two weeks of February. We have also seen a continuation of strong performance in Japanese and emerging markets equities.

Last week

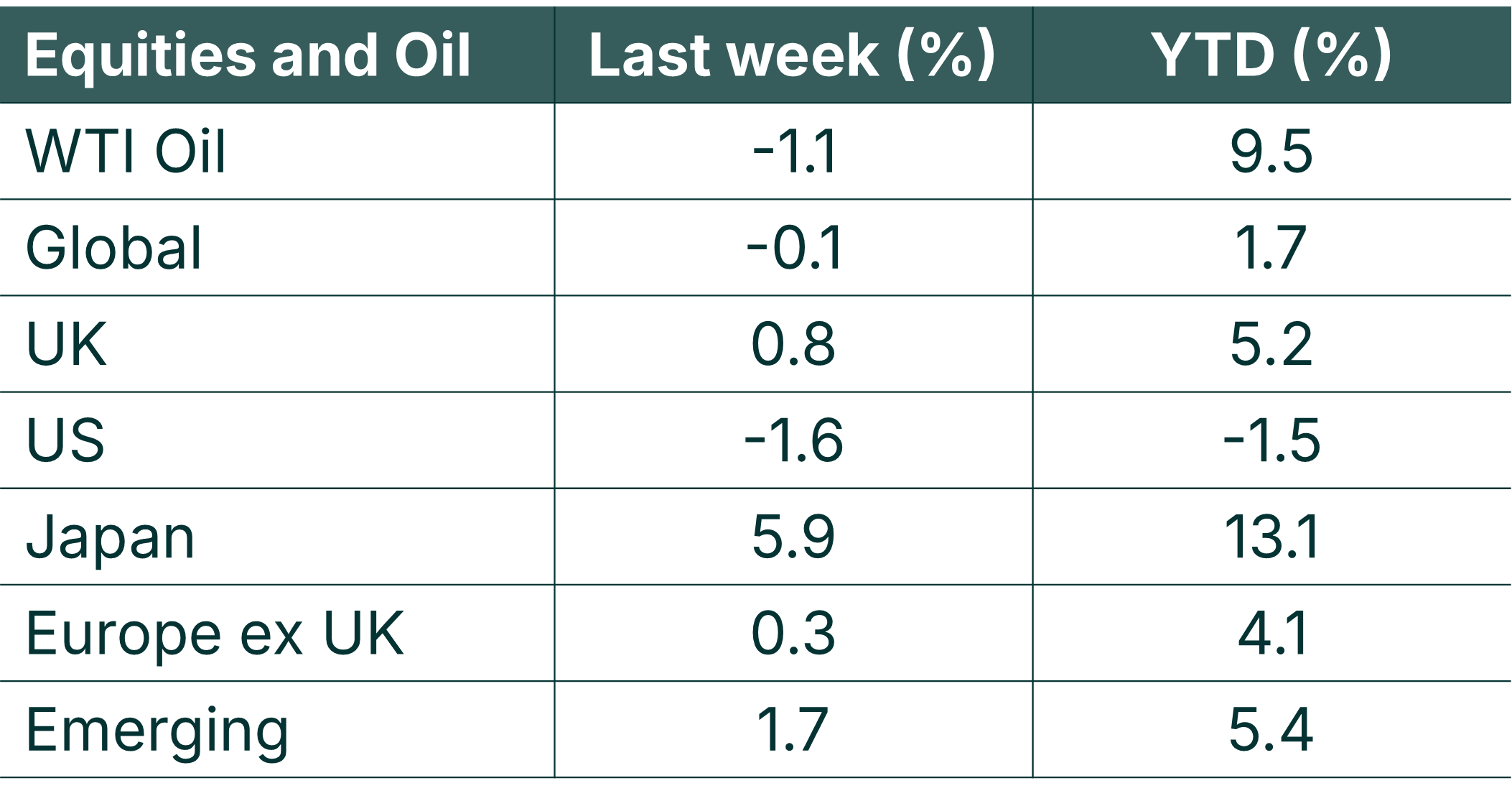

- Global stock markets were broadly flat at –0.10% reflecting dispersion among regional market returns.

- US markets fell –1.6%, whilst UK and European equities made modest gains of 0.8% and 0.3% respectively. It is notable that UK markets edged higher despite political turmoil.

- Japanese equities gained 5.9% in Sterling terms, a strong week after Sanae Takaichi’s decisive election victory on February 8th.

- It was another strong week for emerging markets, powered by Asia Pacific stocks in particular; Indian and Latin American equities made a strong start but faded over the week.

- The WTI Oil price fell over the week, which was supportive for equities.

This week

- The release of US Q4 GDP on Friday is highly anticipated and will be influential on markets.

- US markets will be closed for Washington’s Birthday on Monday 16th.

- It will also be a shorter trading week in parts of Asia Pacific with most markets closed for their New Year celebrations for several days. Additionally, in Latin America, Brazil is closed for carnival on 16th February

Source: Bloomberg. Currency GBP.

More detail:

- U.S. equities declined –1.6% over the week in Sterling terms, influenced by NASDAQ stocks, as concerns about AI-related disruptions pressured a wide range of sectors. Microsoft, Nvidia and Meta all fell at the beginning of the week. Mid-caps held up better, while value stocks outperformed growth for a seventh consecutive week. Bright spots in the S&P 500 included some retail brands such as Wal-Mart and selected industrials, for example, Caterpillar.

- Stronger‑than‑expected US January jobs data lowered expectations for near‑term Fed rate cuts. Employers added 130,000 jobs, the biggest gain in over a year, and unemployment ticked down to 4.3%. Despite significant downward revisions to prior-year job figures, markets pushed out expectations for rate cuts.

- US inflation cooled in January: headline CPI rose 0.2% month over month and 2.4% year over year, helped by lower energy prices. However, core inflation firmed slightly to 0.3%. Retail sales disappointed, coming in flat as eight of 13 major categories fell, suggesting softer consumer momentum.

- Japan’s Liberal Democratic Party secured a sweeping victory in the February 8th legislative elections, under Prime Minister Sanae Takaichi, an outcome that is unusually decisive in Japan’s political landscape. The result provides Takaichi with a strong mandate to advance her policy agenda, particularly expansionary fiscal measures designed to stimulate growth through higher government spending, more accommodative borrowing conditions, and targeted tax cuts, including reductions on food items. These developments are supportive for Japanese equities.

- There will be a lull in Asia Pacific equities next week due to New Year celebrations. There are however, reasons to be optimistic looking beyond the short term. For instance, China is experiencing a series of encouraging developments. The one‑year trade détente with the United States continues to hold, supported by a constructive presidential call in early February and a planned diplomatic visit in April. At the same time, an AI‑driven industrial upgrade cycle is gathering momentum, with accelerating progress across semiconductors, cloud infrastructure, data centres, robotics, and wider automation technologies.

- Korean equities posted strong gains, with the Kospi rising c.10% in Sterling terms last week and c.22% in Sterling terms in January. The market was fuelled by a surge in memory chip prices amid supply shortages. Samsung Electronics and SK Hynix continue to benefit from exemptions to the more punitive US tariffs. Although AI‑related demand is supporting the sector’s upcycle, conditions in this market can shift rapidly and we will continue to discuss inventory trends and procurement sentiment with managers who invest in this area.

- The UK economy expanded by just 0.1% in the fourth quarter of 2025, falling short of expectations for 0.2% growth and matching the modest 0.1% increase recorded in the previous quarter. The release adds pressure on embattled Prime Minister Keir Starmer, for whom revitalising economic performance remains a central government priority.

- Looking under the bonnet of the FTSE 100: it was a strong week for miners and basic materials. Financial services stocks had mixed fortunes with insurers generally gaining and banks sliding on interest rate expectations. M&A was a theme: Natwest announced a 25% increase in pre-tax profits and a deal to buy Evelyn wealth management. and US firm Nuveen announced a £9.9 bn purchase of Schroders. Healthcare was generally strong and GSK paid a larger dividend than in 2025. Most energy stocks gained, despite a softer oil price, but BP fell over the week as markets digested news of a new incoming CEO and a suspension of share buybacks for the time being.

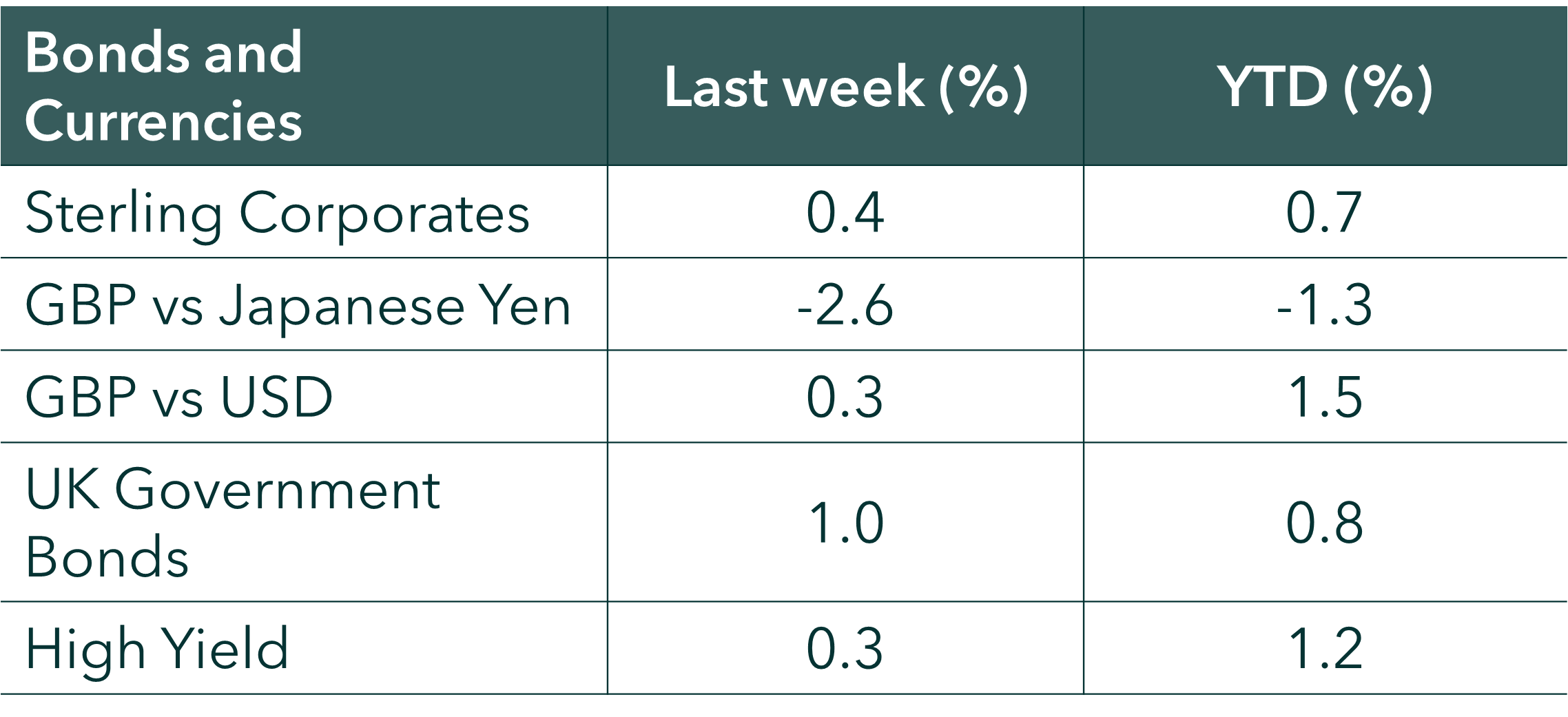

- Broad UK Gilt indices gained 1% last week as yields softened slightly over the week, reflecting stable macro expectations, cautious sentiment, and ongoing interpretation of UK inflation data and Bank of England policy signals.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.