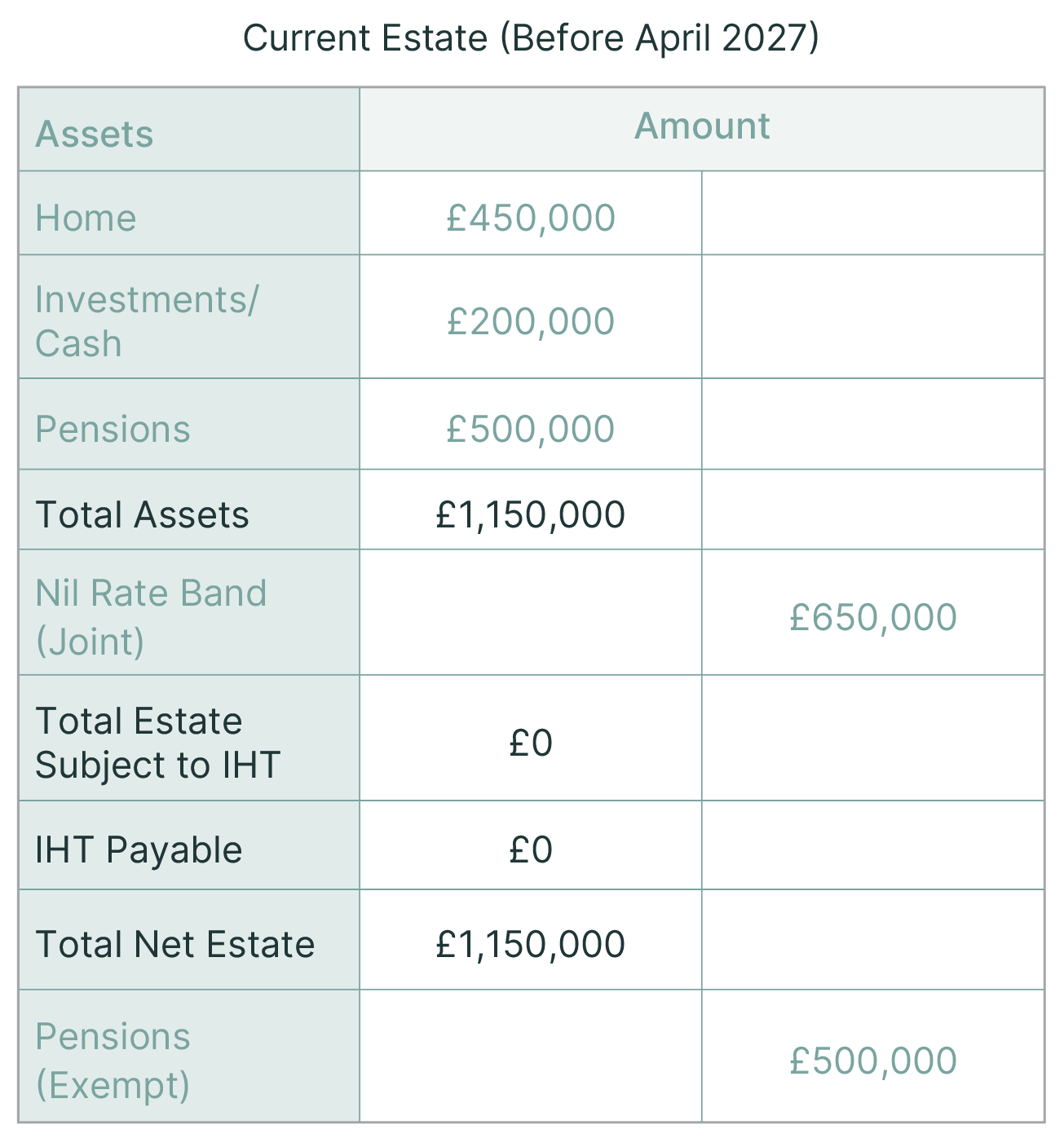

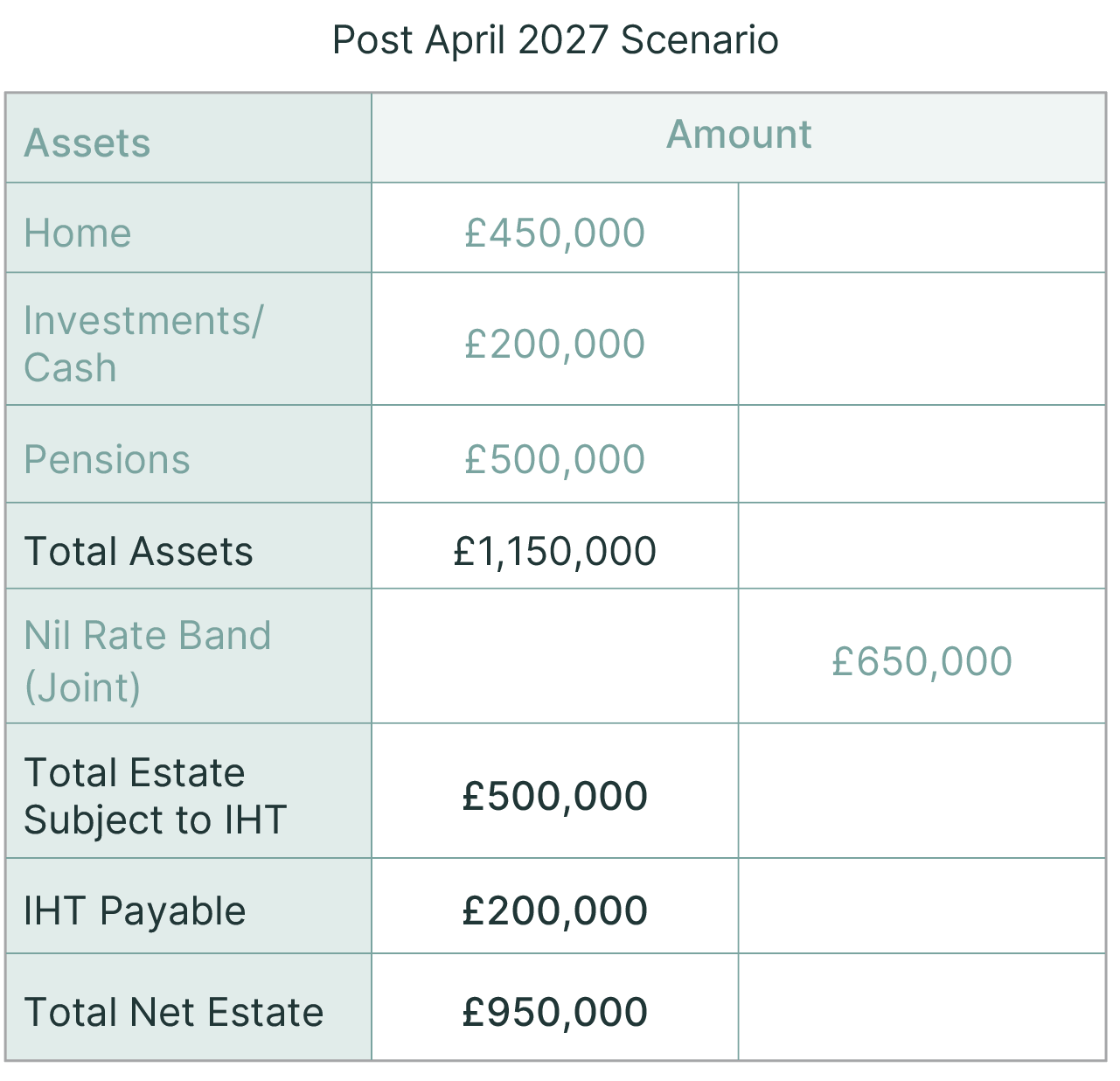

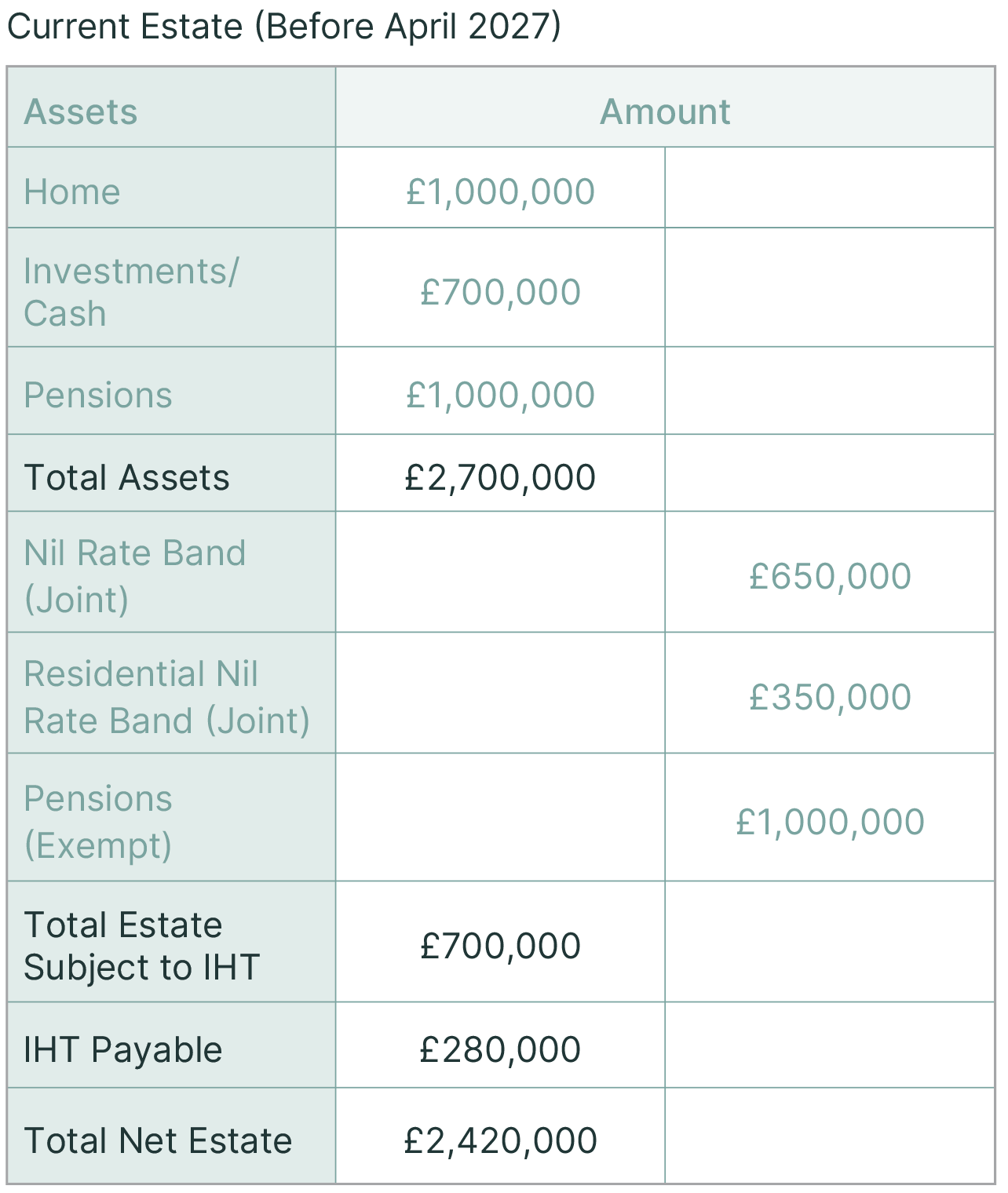

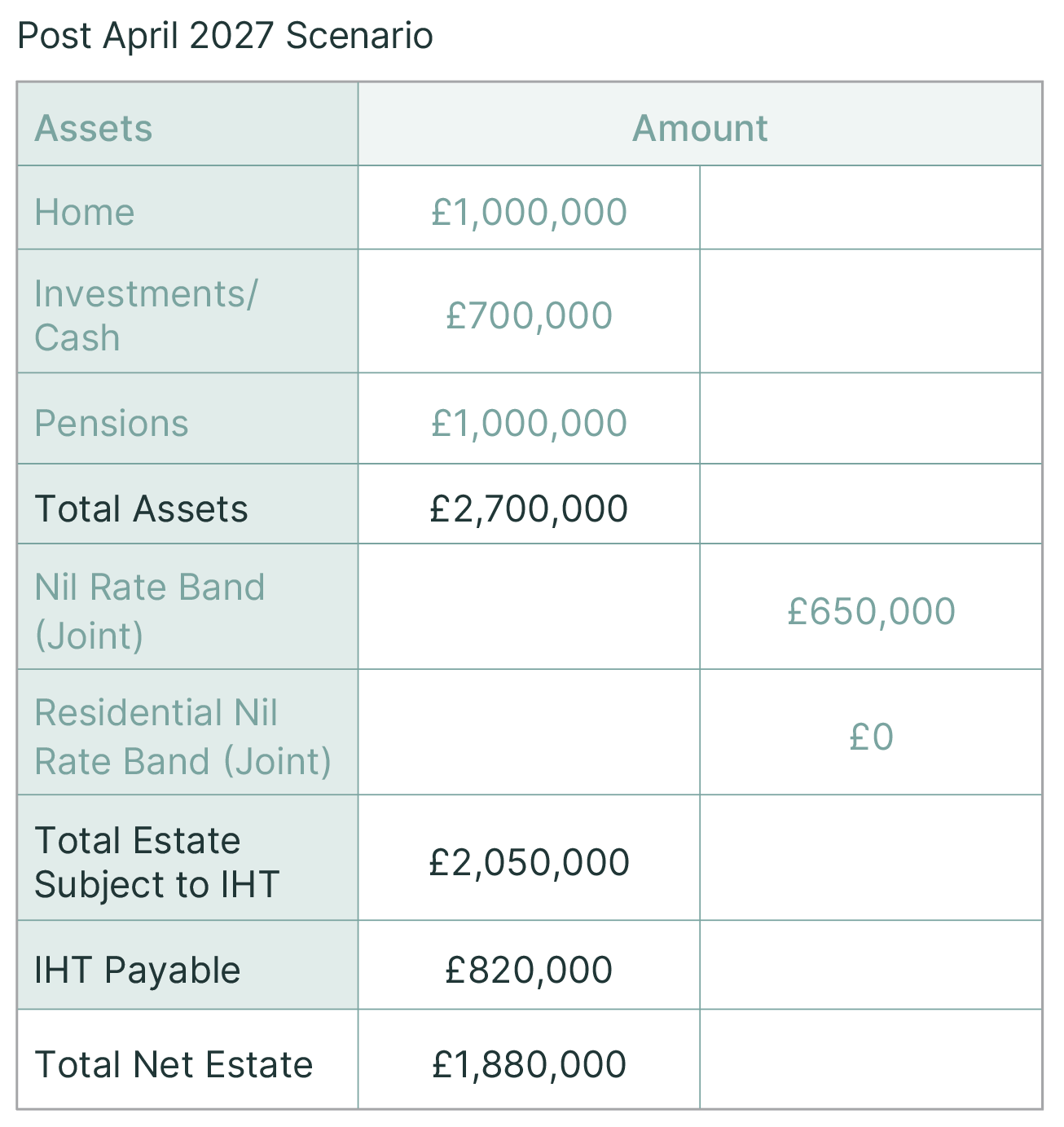

In the last edition of Money Matters, my colleague Gareth Edwards highlighted the upcoming changes to inheritance tax (IHT) and their impact on our clients. Six months on — and six months closer to April 2027, when new rules on including pensions within estates are due to take effect — we want to ensure all clients fully understand the potential implications and have the opportunity to respond appropriately.

Inheritance planning is something many of us tend to delay, but with recent government proposals set to change the way pensions are treated for IHT, now is an important moment to review your arrangements. These changes could materially influence the value of what you pass on, making it more crucial than ever to revisit your financial plans.