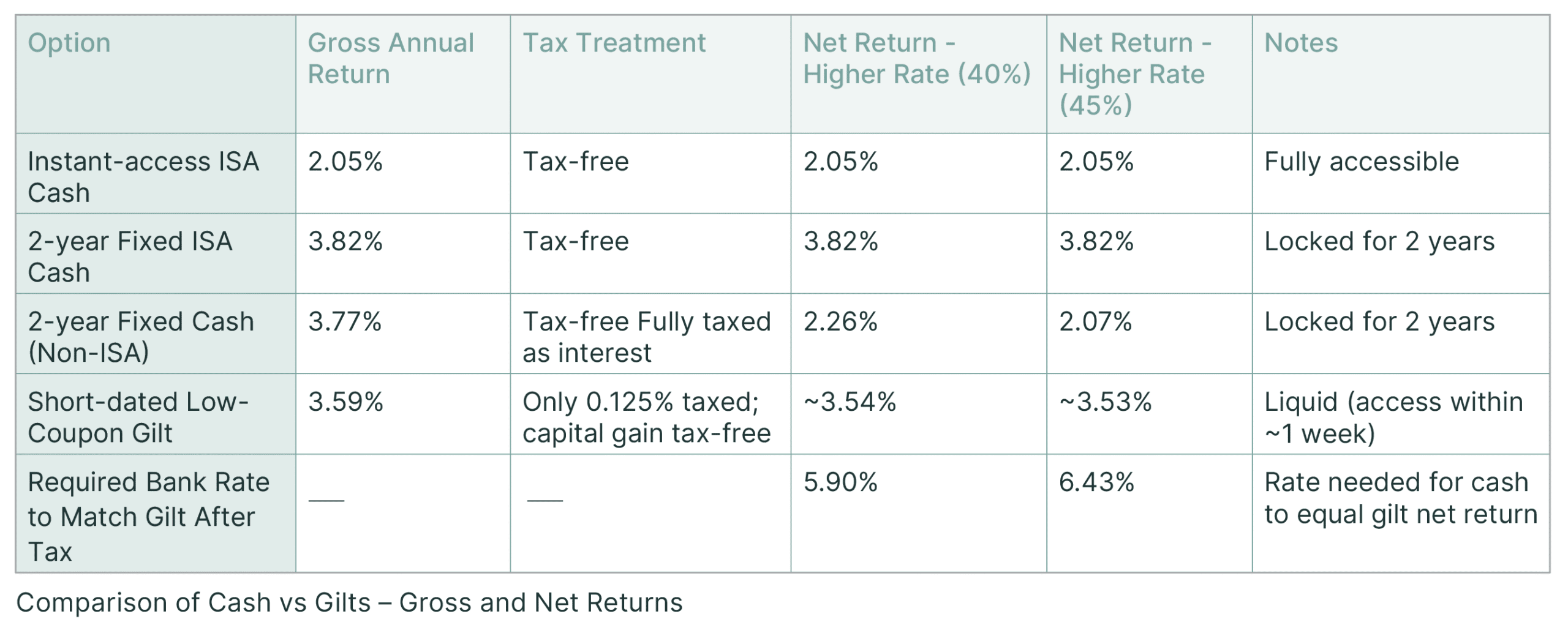

Our clients who hold longer term investments also typically retain an element of cash, usually in a bank account or savings account. Whilst having some cash savings is sensible, low-risk alternatives products do exist that can offer better returns.

One area we’re increasingly talking to clients about is using direct gilts – a low-risk investment that can have valuable tax advantages, giving the potential to meaningfully boost the return received.

As a consequence of the UK’s Bank of England interest rates coming down gradually, we have all seen savings rates falling on bank accounts. Plus, for many of our clients, some or all of the return on the cash is taxed, as income.

Gilts can provide returns ahead of cash whilst keeping risk factors to a minimum and utilising the financial backing of HM Treasury to provide valuable financial guarantees.