Real Change, real opportunity, a handful of really exspensive valuations – really important to diversify!

AI remained the defining theme of 2025 — and, unlike past technology crazes, it is genuinely reshaping the world.

Businesses across logistics, healthcare, finance, retail and engineering used AI to cut costs, speed up decisions and boost productivity. J.P. Morgan estimates that AI-related investment contributed around 1.1 percentage points to U.S. GDP growth in the first half of the year — over half of all growth during that period.

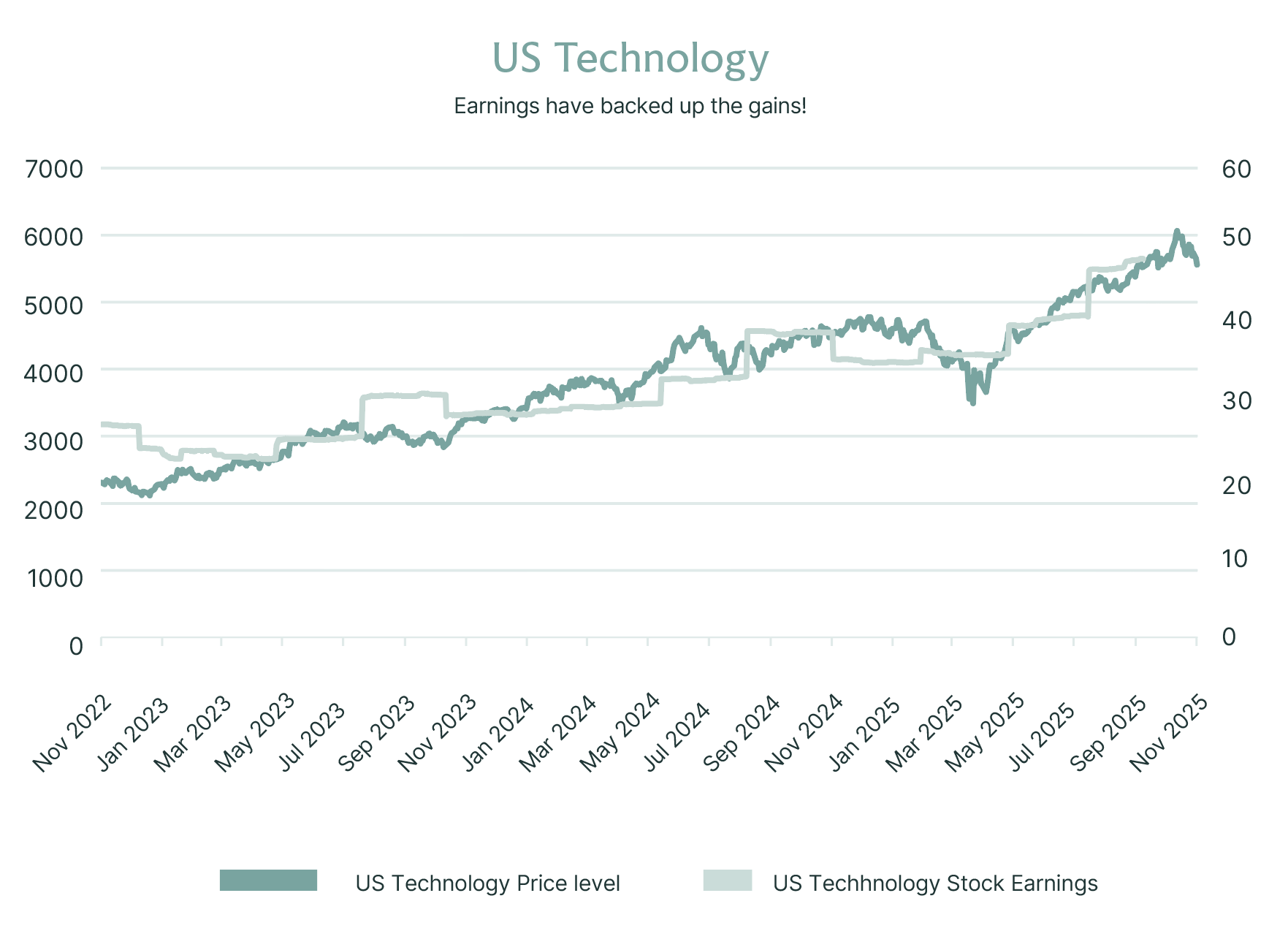

Exceptional levels of investment created exceptional returns — and unlike in previous hype cycles, these returns were backed by exceptional profits.

The comparison with the dot-com era is natural, but 1999/2000 was marked by far higher valuations, far weaker profits and six Federal Reserve interest rate hikes totalling 1.75% in just a year. Today’s environment is very different. Adoption is real, demand is broad, interest rates are being cut, and productivity gains are proving durable. The use cases stretch far beyond giving me inspiration for Elf-on-the-Shelf ideas! Where we see risk, however, is index concentration. A “passive” investment in 500 US stocks today gives you exposure where the top 10 names represent around 40% of the index — nearly all tied to AI-related activity. That is not true diversification. Our approach is to offer clients some exposure to these leaders, but within a broader, more diversified allocation to US companies.

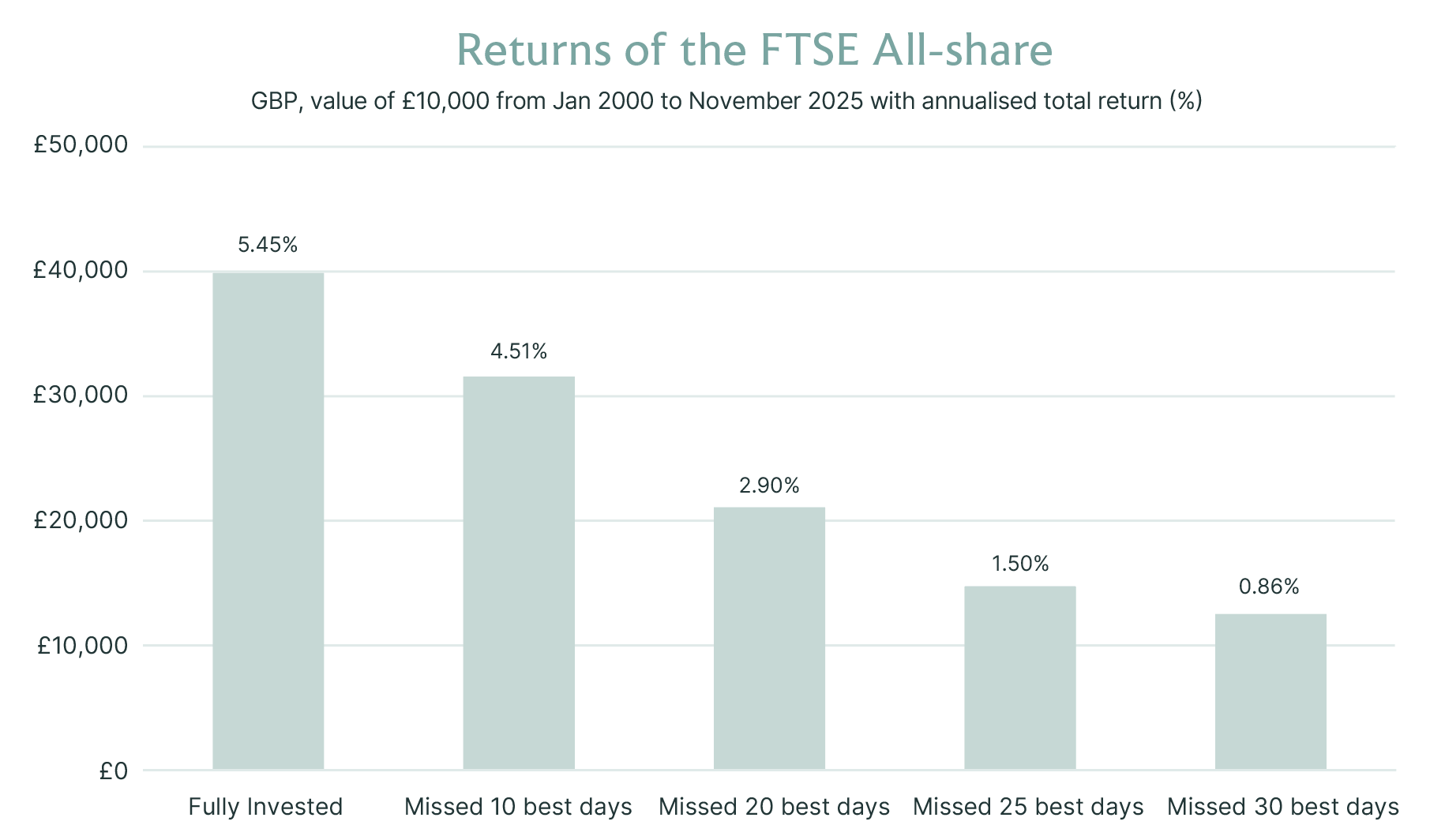

Lesson: participate selectively. Diversification doesn’t come from owning the index when the index is so top-heavy.