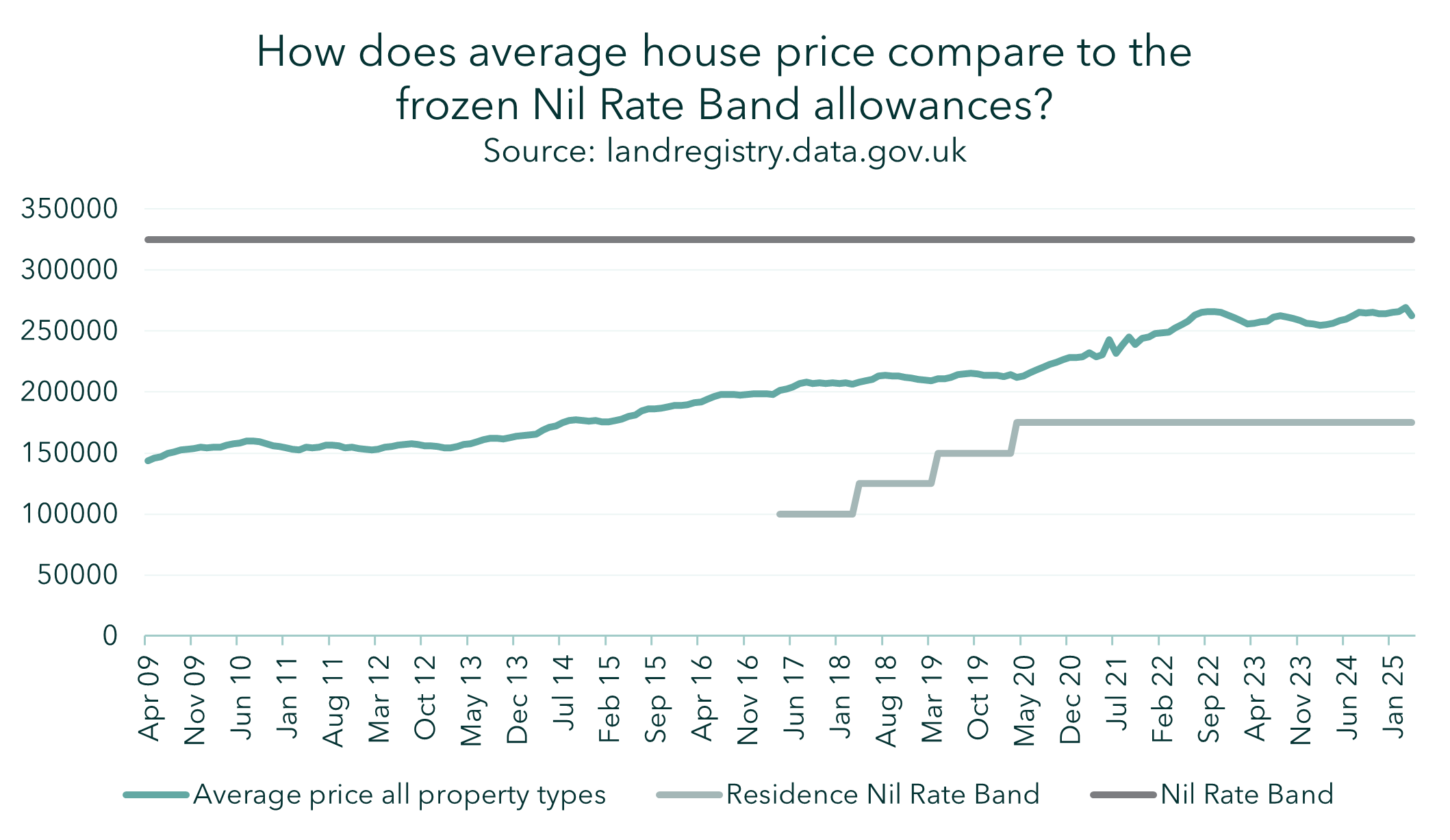

The Nil Rate Band and Residence Nil Rate Band have been frozen since April 2009 and 2020 respectively, and aren’t set to change until 2031 (as announced in the November 2025 Budget). For many, this freeze will see more of their estate being inherited by the tax man, rather than their loved ones. Over the three-years of additional freezing the Exchequer expects an additional £575m in inheritance tax receipts to the tax year 2030/31.

Independent Financial Adviser, Andrew Mence, shared a story of a recent case. “I met with some clients recently, a couple aged 70 and 75, who wanted to get their affairs in order. We found that their IHT bill would be nearly 15% of their estate. As per their wishes, we considered a variety of solutions, ensured their Will was up to date, and enabled them to pass down as much of their estate to their children as possible. I was delighted to be able to support this and give them peace of mind about their children’s future.”

-

What is the Nil Rate Band?

Inheritance Tax (IHT) often represents one of the most significant financial considerations in estate planning within the UK. As a tax levied on the estate (including property, money, and possessions) of someone who has passed away, understanding the mechanisms available to mitigate its impact is crucial for effective financial planning.

The Nil Rate Band is the amount of an individual’s estate that is exempt for inheritance tax purposes. This is currently £325,000 (as of tax year 2025/26 and frozen until 2031) and anything above this threshold is taxed at 40%.

-

What is the Residence Nil Rate Band?

The Residence Nil Rate Band (RNRB) is an additional allowance of £175,000 (tax year 2025/26 also frozen until 2031) which allows the deceased to pass their homes on to their children, grandchildren or other ‘direct descendants’.

This changes when an estate is worth over £2 million. In these cases the RNRB is tapered to reduce by £1 for every £2 that exceeds £2 million. This means that estates eligible for only one Nil Rate Band worth more than £2.35 million may not benefit from the RNRB at all (£2.7 million where two Residence Nil Rate Bands are available).

The crucial part of the Residence Nil Rate Band for landlords is that only the value of one property can receive the RNRB, the RNRB cannot be divided between properties, and the deceased must have been a resident of the chosen property – so this relief cannot be applied to buy-to-let properties. The RNRB will also not apply to properties gifted in certain trusts – and therefore we recommend that landlords regularly review their existing estate plans.

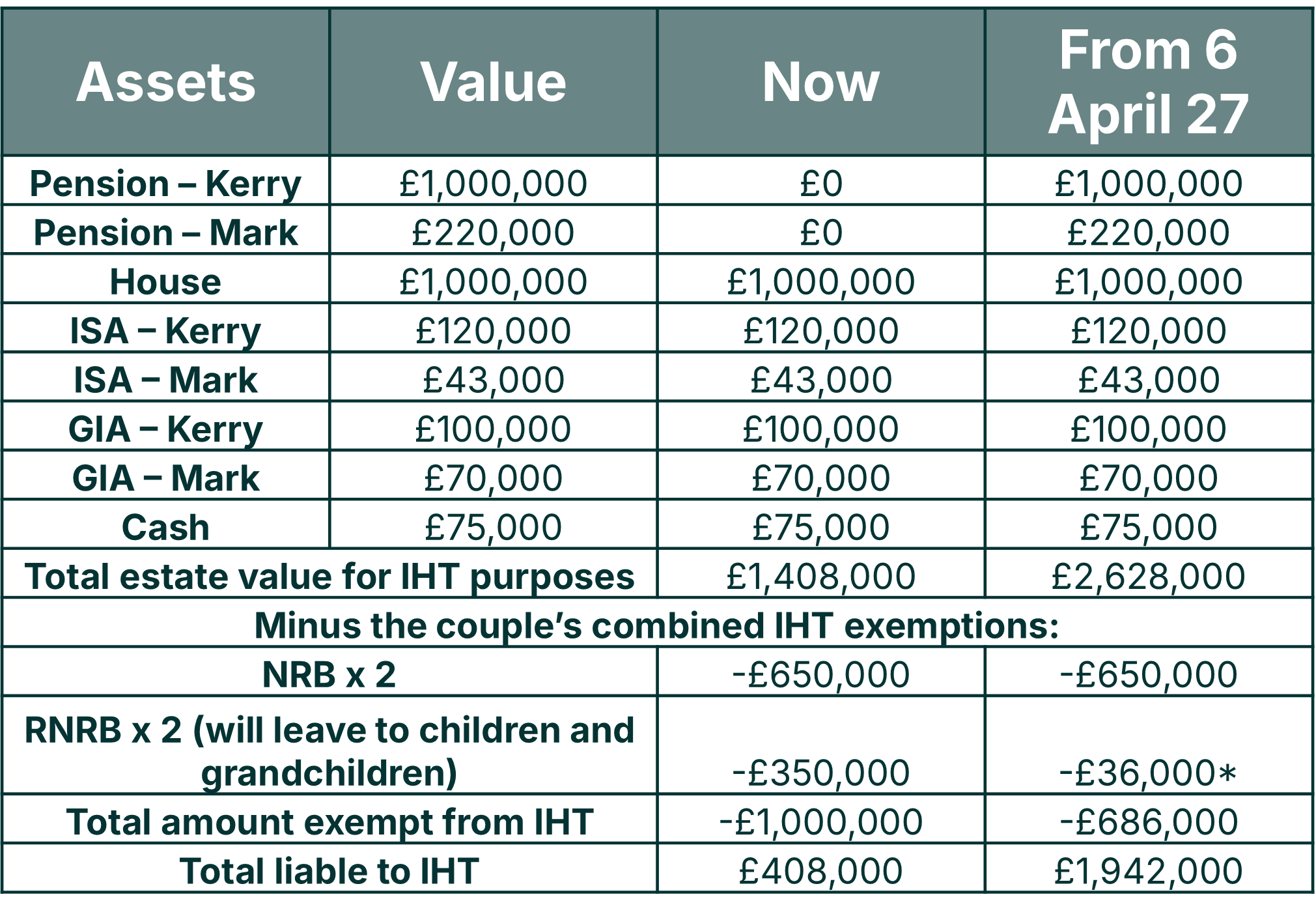

Impact of pension changes for IHT calculations

From the 6 April 2027 unused pension funds will become potentially liable for inheritance tax as part of the person’s estate. This change is designed to discourage the use of pensions as a wealth transfer tool and encourage individuals to save for their retirement. As our homes and pensions are likely to be our highest value assets – it is particularly important for homeowners and landlords to consider how this change will affect their estate planning.

Let’s look at an example. Here we see a fictional example of this affecting a couple (Kerry and Mark) and increasing their taxable estate value by over £1.2m.