Welcome back to our first market update of 2026. From all of us at Magnus, we wish you a Happy New Year!

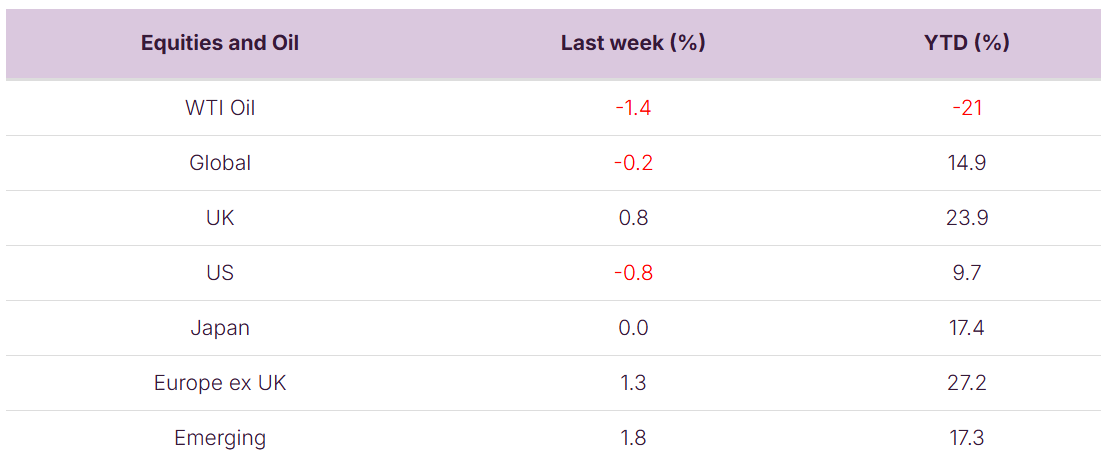

Global stock markets were relatively quiet over the final weeks of 2025. UK and European stocks finished the year strongly, once again leading returns. With many investors only just returning to their desks, the coming week is expected to remain quiet, with limited data due to be released, and markets taking stock of the outlook for the year ahead.

Last week

- With many off enjoying the festive period, macroeconomic and corporate news flow was light.

- Global markets ended 2025 broadly flat. UK and Europe equities finished the year up over 20%, while US markets delivered returns closer to 10%.

- Oil continued its 2025 trend, ending the year around 20% lower, whereas precious metals had one of their best years on record.

- Minutes from the US Federal Reserve’s December meeting were released, offering further insight into the December rate cut and the potential future path of interest rates.

- Chinese manufacturing PMI data, released on New Year’s Eve, came in broadly as expected.

- UK house price data for December showed price contraction, reinforcing observed weakness in the housing market.

- On the geopolitical front, developments involving Venezuela drew attention, with potential implications for energy markets.