Stock markets had a choppy week, giving up some gains on the year. US shares bore the brunt of the selling with Financials and Tech weighing on the index. This came on the back of a barrage of geopolitical headlines, with President Trump threatening to raise tariffs on a host of European trade partners. Fortunately, this flare up was short lived and we’d expect markets to turn their attention back to earnings reports – with some key ones to look forward to this week.

Last week

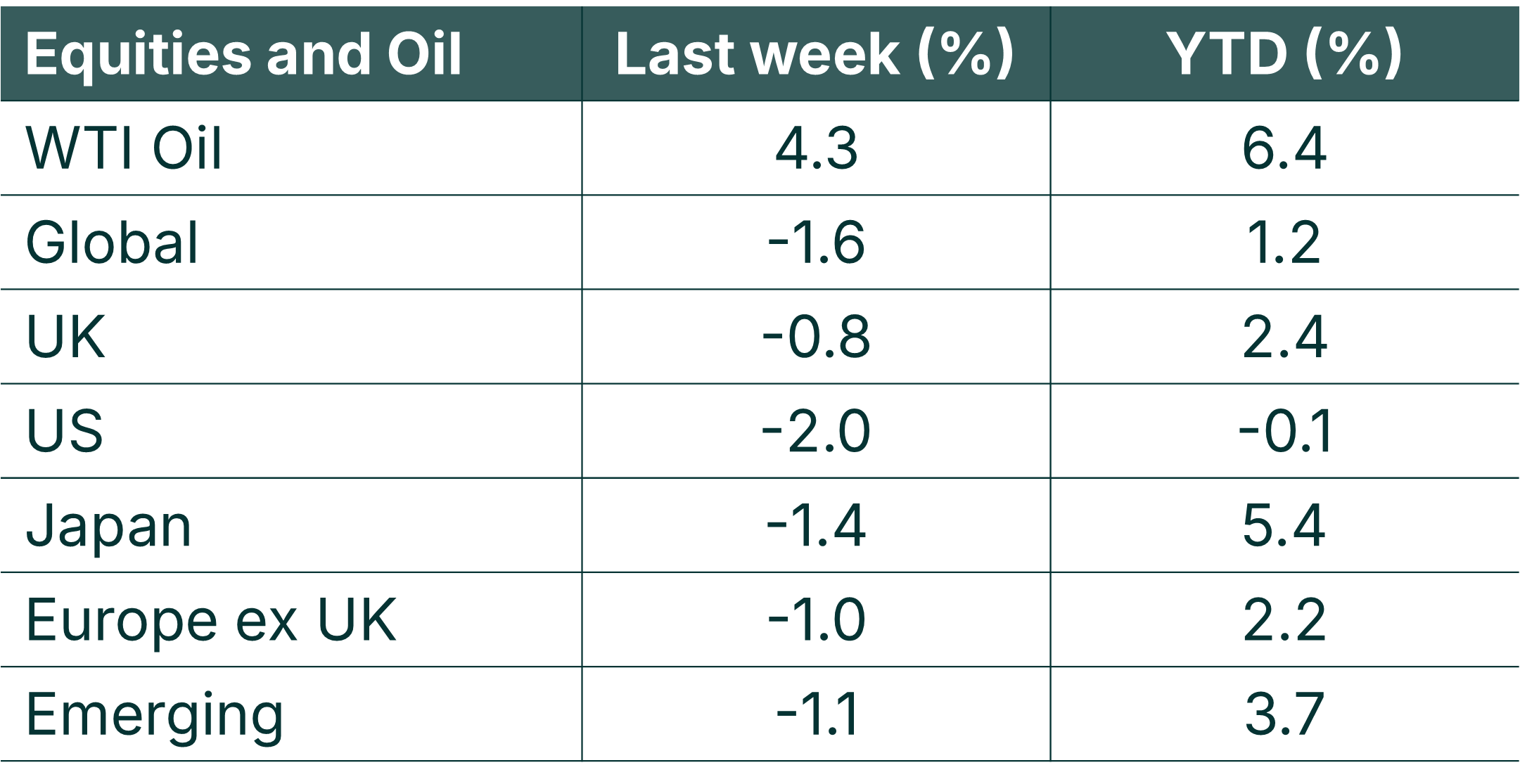

- Stock markets fell back last week, with the US index (and the Dollar) weighing most heavy

- Smaller and cheaper companies held up best

- Bond yields moved higher as timing for the next interest rate cuts got pushed out further into the future

- Geopolitical risk remained elevated but less pronounced, with a deal emerging around US security interests in Greenland

This week

- US earnings will be in focus this week with 4 of the Magnificent 7 reporting in the US (Meta, Microsoft, Tesla and Apple).

- In the UK, we have trading statements from Lloyds, St James’s Place and Fresnillo (amongst others).

- The Federal Reserve conclude their meeting on Wednesday night (UK time). Rates are expected to be left unchanged at 3.75%.

Source: Bloomberg. Currency GBP.

More detail:

- Global stock markets fell by 1.6% last week, with the US market (which accounts for c70% of the global index) and US dollar weighing heavily on returns. The US Dollar fell by about 2% vs the Pound on the week: underlining its sensitivity to policy volatility. This came on the back of a week where President Trump pushed to acquire Greenland and threatened to raise tariffs on 8 European trading partners. An emergence of a deal to address US security interests in Greenland helped stem some of these losses towards the end of the week.

- Within equity markets, it was the smaller and cheaper companies which fared best. This has been the trend so far this year, with Small Cap outperforming Large Cap by about 5% and Value outperforming Growth by about 2%. At a sector level, Energy and Materials continued to lead the way. These sectors are under-represented within the US market-cap-weighted indices (with a combined weight of c7%) and, in our view, make a case for diversifying into markets like the UK and US equal weight indices where they carry significantly larger weights: 15% and 10% respectively.

- Although the broad UK market (FTSE All Share) fell by 0.8% on the week, there was some good performance from the smaller companies: following the global trend this year of smaller companies doing better than larger companies. Smaller companies, as a cohort, rose modestly on the week, helped by bid activity (Beazley) and better profits outlooks (Currys). UK markets were also helped by continued strong performance from the basic materials sector: now up 13.5% year-to-date.

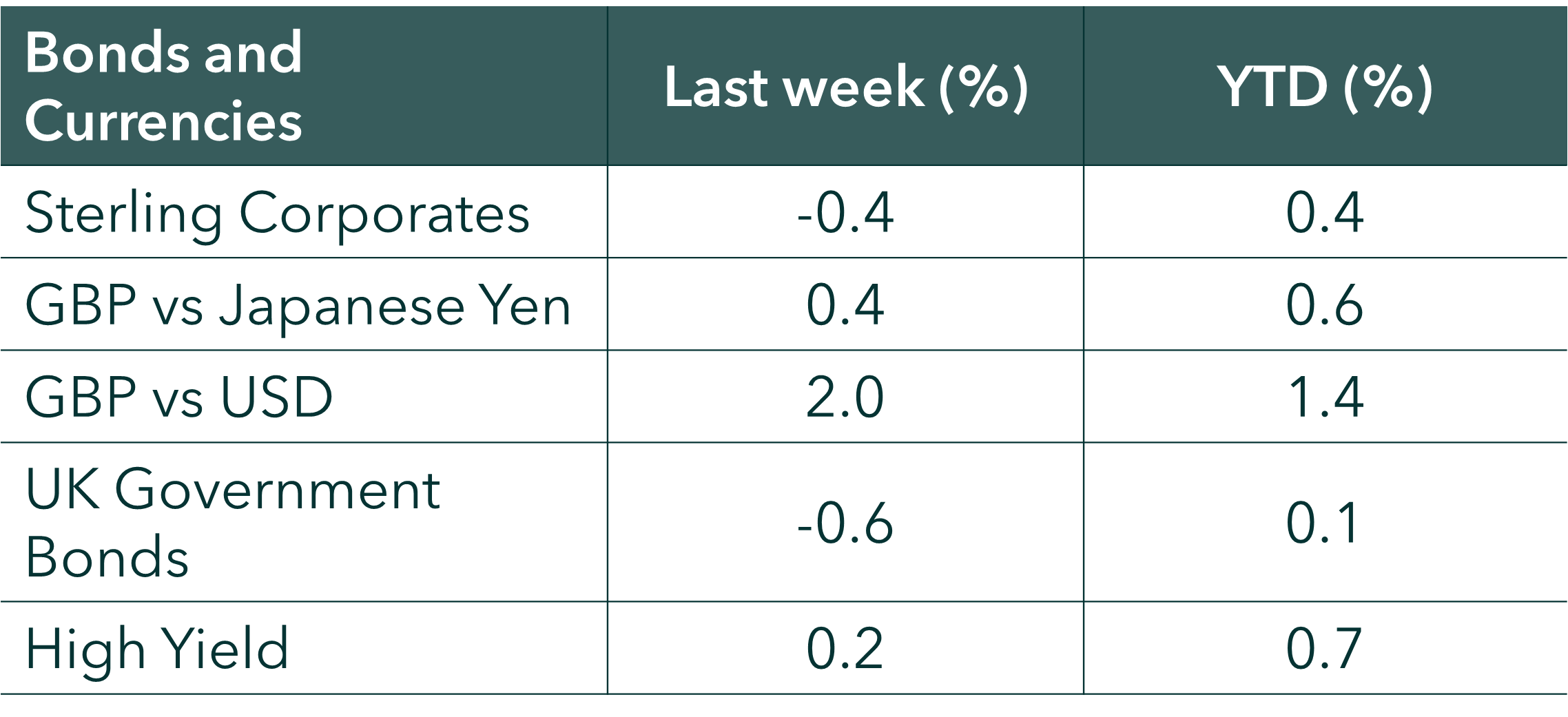

- Bond markets were mixed last week, with longer-dated UK government bond yields rising, whilst credit spreads tightened. UK Gilts sold off by 0.6% last week as yields rose on the back of stronger-than-expected UK economic data. UK average weekly earnings came in at 4.7% YoY, inflation came in at 3.4% (from 3.2%), retail sales came in at 2.5% YoY (from 0.6%) and business survey data (PMIs) came in better than expected. This led the bond futures market to reduce the pace of pricing for UK interest rate cuts, with the first cut of 2026 expected to be in June.

- Last week’s move in bond yields followed a theme we have seen over the course of the last 18 months, with longer-dated yields (which affect government debt service costs) struggling to come down. Despite seeing 1.5% of interest rate cuts from the Bank of England since August 2024 and 1.75% of rate cuts from the US Federal Reserve, longer-dated bond yields have risen. US 10-year yields are 0.57% higher since the Fed started cutting rates, whilst UK 10-year yields are 0.63% higher since the BoE started cutting rates. This negatively impacts Governments ability to service their debt and is one of the key reasons we have seen mounting pressure on policy makers (from Governments) to lower interest rates. This feeds into our preference for shorter-dated bonds within our clients’ portfolios.

- Japanese bond yields were also in focus last week, with the 10-year JGB closing the week at 2.24%: the highest level since 1997, on investor concerns about Prime Minister Takaichi’s proposed temporary consumption tax cut. This followed the announcement last week of an early Parliamentary election on 8th

- US earnings season continued to tick along last week, with a blended growth rate of 8.2% YoY for the companies that have reported so far (13% of the S&P 500). This earnings season is on course to mark the 10th consecutive quarter of positive earnings growth for the index, with the bulk of the earnings this quarter expected to come from the Magnificent 7. This week sees 4 of the Mag 7 report with Meta, Apple, Tesla and Microsoft all due to report.

- US technology shares will be in focus this earnings season and the bar of expectation is highest for this cohort for 2026, with c29% earnings growth expected over the course of the year. Analysts (as per Factset) are looking at c26% YoY earnings growth for US tech in the 4th quarter of 2025 (being reported in the next few weeks) and we’d note that earnings so far have backed up the stock prices: with the sector getting a hair cheaper (on a PE basis) over the course of 2025.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.