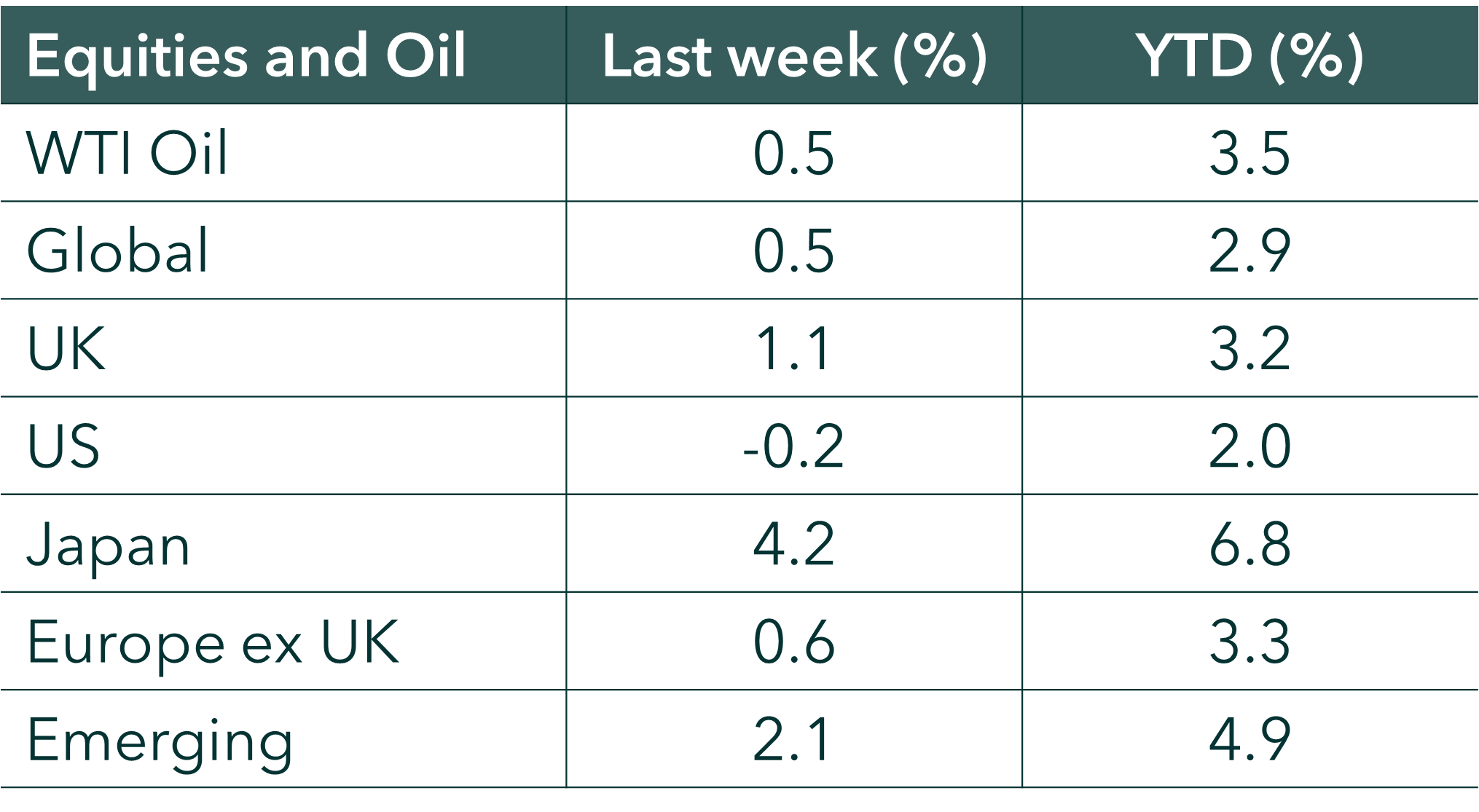

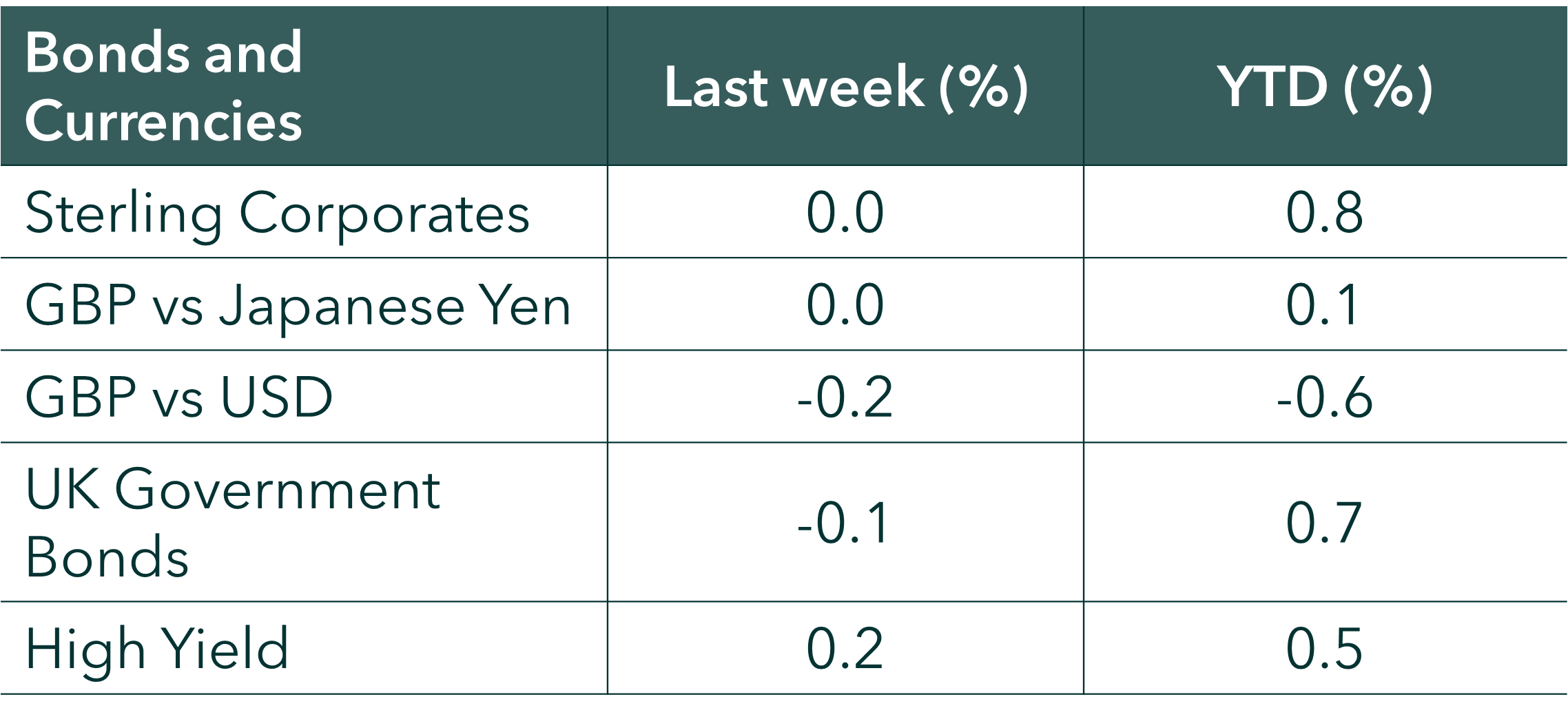

Markets were broadly positive over the week, with most equity regions delivering gains and oil prices edging higher.

Last week

- Japan was the standout performer, surging 4.2 per cent over the week and up 6.8 per cent for the year, Emerging Markets also performed strongly, gaining 2.1 per cent on the week and 4.9 per cent for the year to date, indicating improving investor sentiment.

- Europe delivered steady but more modest advances up just 0.6 per cent whilst the UK equities posted solid gains up 1.1 per cent. In contrast, US equities were the laggard, slipping 0.2 per cent over the week due to weak fourth quarter earnings from major lenders along with calls for credit card interest rates to be capped.

- WTI crude oil futures rose 0.4 per cent to settle at US$59.44 per barrel on Friday, wrapping up a volatile week with over 1 per cent gain, as traders weighed lingering geopolitical risks against easing fears of an immediate US strike on Iran.

- Finally, US inflation held steady in December, with core prices cooling to their lowest since 2021, reinforcing expectations that the Fed will keep rates on hold in January.

This week

- In the United States, the spotlight will be PCE price along with leading indicators including S&P PMIs and the other consumer survey.

- In Asia, the focus will shift to China’s final GDP print for the year, while the Bank of Japan will decide on its monetary policy

- PMIs will also be released for the Eurozone, UK, Japan, Australia, and India. At the same time, the UK will post its inflation rate, unemployment, and retail sales.

- On the earnings front we are expecting results from Netflix, 3M, J&J, Visa, Intel and P&G.

Source: Bloomberg. Currency GBP.

More detail:

Japan’s stock market surged to a record high, on Prime Minister Takaichi’s decision to dissolve parliament for an early election. The has fuelled the “Takaichi trade” where equities are up and both the yen and Japanese bonds are down. The ten-year JGB yields hit 2.185 per cent , which is the highest in 27 years and increased concerns over the debt-to-GDP ratio which is over currently over 230 per cent.

Emerging market equities have shown positive returns so far in January, with the index up roughly +5 per cent year to date. Within the index there has been some regional dispersion, Latin America has performed very strongly this year whilst Asia Pacific has been softer and India relatively flat around +0.2 per cent month-to-date.

In the US, the Bank stocks led a sell-off on Wall Street as fourth-quarter earnings season kicked off with disappointing results from some of the biggest US lenders. Wells Fargo and Citigroup were among the worst performers, losing 4.6 per cent and 3.3 per cent respectively. Citi reported a 13 per cent profit decline in the fourth quarter even as revenue rose 2 per cent year on year. Wells Fargo reported lower than expected net income. JPMorgan Chase on Tuesday reported a 7 per cent profit decline in the final quarter of 2025 because of an unexpected drop in investment banking revenues and an increase in the reserves set aside for possible loan losses.

In December, the US headline Inflation, the total increase in prices for all goods and service, remained steady at 2.7 per cent year-on-year. While the overall rate didn’t move from November, there was a notable shift in underlying price pressures. Food Inflation (the rate at which grocery and restaurant prices rise) hit its fastest monthly growth since August 2022. Rents, which make up more than one-third of the Consumer Price Index (CPI also saw a sharp increase this month. This was largely because November’s data was artificially low due to temporary government shutdown effects. Because inflation is showing signs of stabilizing, financial markets now see a 95 per cent probability that the Federal Reserve (the US central bank) will keep Interest Rates unchanged at its upcoming January meeting.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.