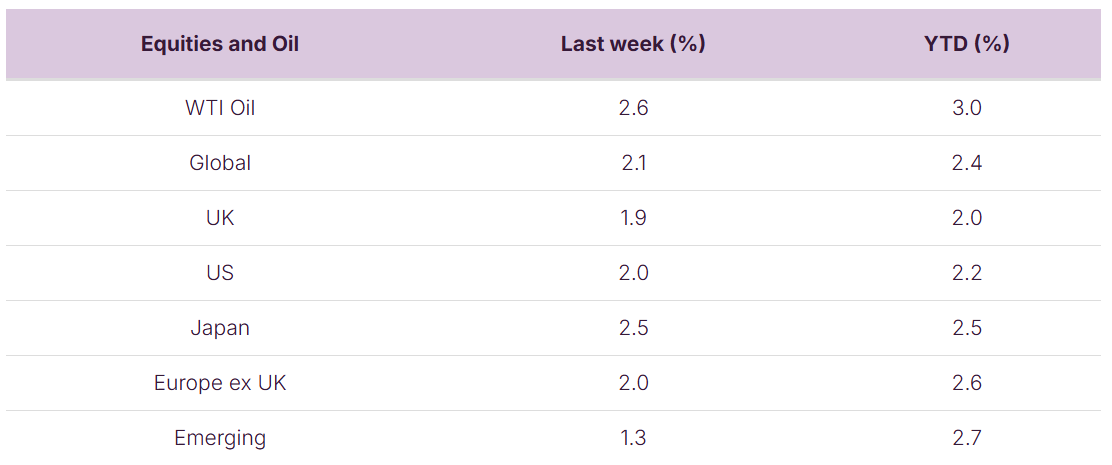

Global stock posted a strong week, rising by about 2.1%. This gain was broad based across equity markets, with smaller, cheaper companies doing best. Last week also saw decent gains for bond markets, particularly within the UK market.

This week sees the corporate data flow pick up, with earnings reports from the big US banks – JP Morgan kicks things off here on Tuesday. On the economic data front, we have US inflation data along with UK growth data to look forward to.

Last week

- Global stock markets had a strong week, rising by 2.1%.

- UK stocks enjoyed a strong week, with domestic companies doing best.

- US military intervention in Venezuela served to dial up geopolitical risk.

- US economic data was a mixed bag: slightly weaker than expected jobs data, but the big economic picture remains robust

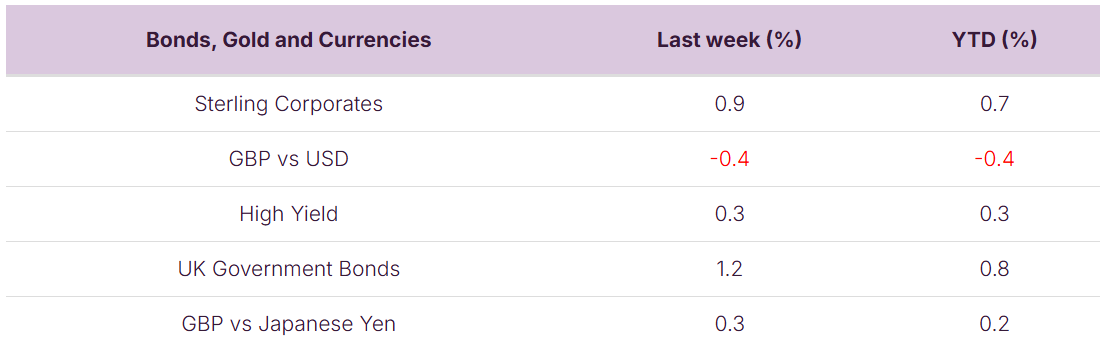

- UK bond markets posted good returns, with UK bond yields falling in response to slowing housing data (which increased the chances of further interest rate cuts this year).

This week

- It’s a busy week, with the start of Q4 reporting season as well as the release of US inflation data.

- Tuesday sees the JP Morgan report their Q4 numbers, with Bank of America, Wells Fargo and Citigroup reporting on Wednesday. Goldman Sachs and Blackrock report on Thursday.

- US inflation data is released on Tuesday, with Bloomberg economists expecting US CPI to remain at 2.7%.

- UK economic growth data (GDP) is released on Thursday. The 3-month average (through to November) is expected to slip to -0.2% (per Bloomberg economists).

Source: Bloomberg. Currency GBP.

More detail:

- Global stock markets kicked off their first full week of 2026 in good fashion, rising by about 2.1%. This gain was broad based, but led by the cheaper companies within the market, with sectors such as materials and industrials faring best.

- The UK FTSE 100 market closed above the 10,000 level for the first time ever last week. This came alongside gains of 1.9% for the broader market and 2.8% for the domestic market (which lagged significantly last year). Whilst the 10,000 price level helps drum up some nice support for the UK market, we’d note that it is fairly meaningless in and of itself and also note that only 30% of the total return within the FTSE 100 in the last 30 years has come from price appreciation – i.e. the overwhelming majority has come from reinvesting dividends!

- US military action in Venezuela grabbed most of the headlines last week. Venezuela is a relatively small player, with an economy making up less than 1% of global GDP and representing less than 1% of US and global trade. The motives behind the action remain unclear and debatable, with possible reasons ranging from clamping down on narco-terrorism, freeing up oil reserves (Venezuela has about 17% of global oil reserves, yet only deliver about 1% of global production) or, perhaps, President Trump wanting to shift attention away from faltering approval ratings ahead of mid-term elections. Whatever the reasons are, such action serves to dial up geo-political risk globally.

- US jobs data for December was released last week and although the numbers disappointed, they did help bond markets maintain their expectations for future interest rate cuts this year – which, combined with a strong economy, should support stock market growth (via lower borrowing costs for companies). Nonfarm payrolls numbers from the US Labor Department showed that 50,000 jobs had been created in December: less than Bloomberg estimates of 70,000. However, the data also showed that unemployment ticked down to 4.4% (from 4.6%) which supports the narrative of a strong US economy. This narrative is supported further still by data such as the Atlanta Fed GDPNow forecast which shows the US economy growing at over 5% in the 4th

- Bond markets posted modest gains last week, with UK bond markets being a particular bright spot. UK bond yields fell (meaning bond prices rose) in response to housing data (from Halifax) which showed a drop in house prices. This, combined with Bank of England data showing a slowdown in mortgage approval data, helped UK bond markets increase their pricing for UK interest rate cuts. UK bond futures markets are pricing in 2 interest rate cuts this year, with the first cut coming at the 30th April Bank of England meeting.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.