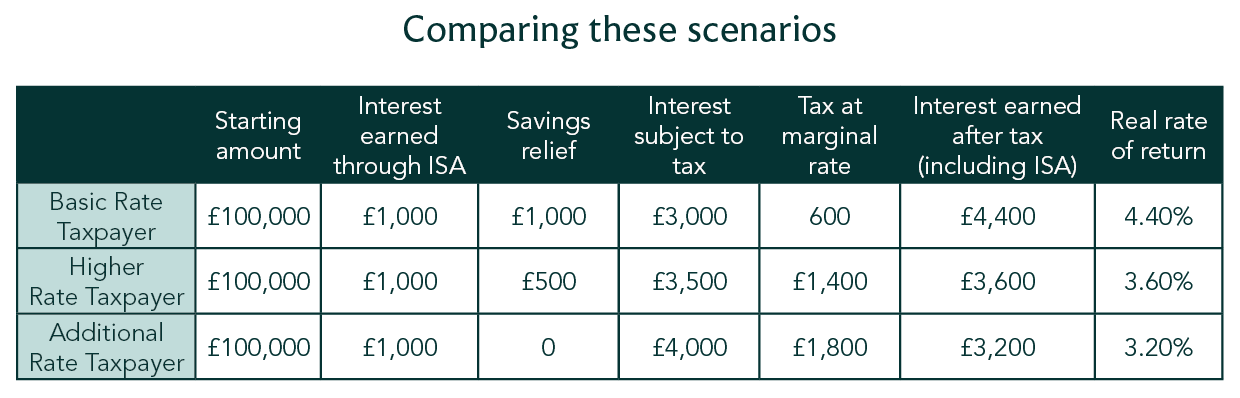

If you put £100,000 in a savings account paying 5%, you’ll make £5,000, right?

As usual in the UK tax system, the answer is “it depends”.

What we need to consider is the marginal rate of tax paid by the person paying it into an account. Let’s break it down.

1. A basic rate taxpayer

Let’s assume they use their ISA allowance and put £20,000 in a Cash ISA, earning 5%. That would earn them £1,000 tax-free.

Of the remaining £80,000, they qualify for £1,000 of interest before taxation is applied, so that’s no tax on a further £20,000 taken care of.

Now we’re down to £60,000. No more ISA allowance and tax-free interest, so the 5% on the remaining £60,000 is taxed at 20%, their marginal rate of tax. This is £3,000, so the saver owes HMRC £600, which will need to be part of their self-assessed tax return, leaving them with a real rate of return of 4.4%

2. A higher rate taxpayer

Again, let’s assume this taxpayer also utilises their ISA allowance to earn £1,000 on their first £20,000. From there, things start to change. They are eligible for a further £500 of interest paid on savings taking care of another £10,000, so there’s now £70,000 to work with.

5% on £70,000 is £3,500, but now, they’re taxed at 40%, so that’s £1,400 due to HMRC through their tax return.

Instead of £5,000, this taxpayer is left with £3,600, a real rate of return of 3.6%

3. An additional rate taxpayer

This person also fills their ISA from this pot, but the difference this time is that the taxpayer gets no relief on savings, so there’s £80,000 to work with. They’re also taxed at their marginal rate of tax, which is 45%.

£4,000 of interest needs to be taxed at 45%, leaving a bill of £1,800 and a real rate of return of 3.2%.

Other options

Putting the £100,000 into investments instead means that share disposals can be managed by a Financial Planner and structured in a way to minimise tax liabilities. For example, gains can be offset against losses, there is a slightly more favourable capital gains tax allowance of £3,000 and if there are no disposals, there’s no tax to pay, so a portfolio has the space to grow over time.

There’s also the tax rate, basic rate taxpayers only pay tax on gains at a rate of 10%. Higher and additional rate taxpayers still only pay tax on gains are a rate of 20%. So while investments carry some degree of risk, they are much more efficient from a tax perspective.

For higher and additional rate taxpayers, Gilts can also be of significant benefit. A Gilt maturing on 30 January 2026 can currently be purchased for £93.74 (correct at June 26 2024). Assuming our government doesn’t default, then £100 will be repaid. That uplift in value is free of tax and represents a 4.2% annualised return. A higher rate taxpayer would have to achieve a gross interest rate of 7% in the bank to equal the gilt. An additional rate taxpayer would have to achieve a 7.6% interest rate in the bank to equal the Gilt.

A Financial Planner can also ensure that the right vehicles are used to hold the cash or investments, including pensions, ISAs or even offshore accounts.

There are other allowances to consider. Married couples could utilise their spouse’s allowances, while Junior ISAs allow £9,000 in a single year.

Put simply, there are a lot of different ways to beat cash with financial planning and always look hard at the quoted rate to work out what the real rate of return is!

IMPORTANT: Financial Conduct Authority does not regulate tax planning. This is for information only and does not constitute advice.

The information contained within this article is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.

Unlike a deposit account or a Cash ISA, the value of your investments can go down as well as up, so you could get back less than you invested. Past performance is not a reliable indicator of future performance.