Don’t worry, titling this article ‘The X Factor’ isn’t the start of a campaign to bring back the so-named reality TV show, nor is it a platform for showcasing my (one and only) 2023 Christmas board game triumph!

The “X” symbolises the ballot box entry of the forty countries next year that will be participating in national elections. Our view is that in the race to get elected, politicians will look to turn a blind eye to the burgeoning debt piles accumulated in the last few years. Tackling the debt burden (through higher taxes and decreased spending, or austerity) would not be a vote winner.

In a year of elections, it may well be that inflation turns from “sinner” to “saint”; gently chipping away at the debt pile over time. To us, this makes the case of a vote for investments over cash; which we see struggling should interest rates be cut to support growth and stoke up the economy.

Politics is something of a popularity contest and capturing the most votes is the name of the game. With much of the world still in the midst of a cost-of-living-crisis, it seems unlikely that we’ll be putting an “X” in favour of higher taxes and decreased government spending! This makes perfect sense but creates a problem for the politicians who need the tax revenues to chip away at the debt mountains that have been built up over the last few years. The answer, in our view, is to let inflation do the dirty work for them (the politicians) and let the debt piles and deficits be gradually eroded away by inflation. This will put pressure on savers, but should generally be good news for investment markets whose returns can outpace inflation.

Before we unpack this in greater detail, we should first re-cap on the events of last year. 2023 saw a slew of negative news headlines. From “war in Israel and Gaza” (2023’s most Googled term) to fears of a global banking crises and global recession.

Bad news clearly sells best in the media, but, atrocious and tragic though it was on a humanitarian level, much of it was less bad than feared in terms of its impact on investments. Inflation came down faster than expected, growth was better than expected and the global recession never came.

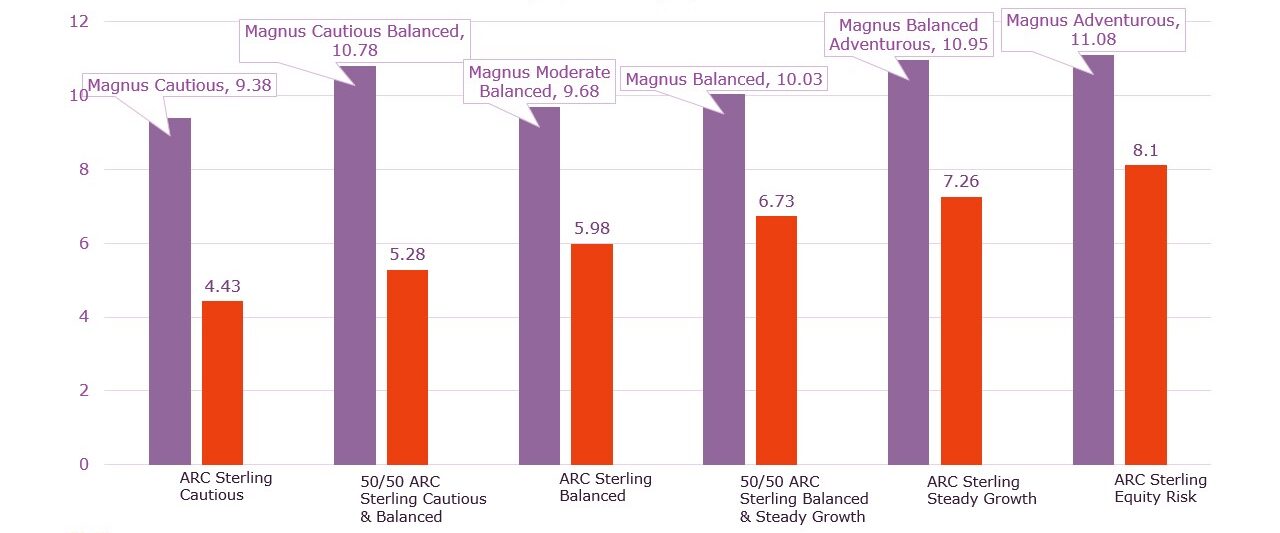

Strong Magnus MPS Performance in 2023 Relative to ARC Comparators

Total Return, %, Net of Weighted Underlying Fund Charges

31/12/2022 – 31/12/2023

Source: FE Analytics/ARC. The Moderate Balanced Portfolio relies on simulated performance data due to the model having recently launched on 27/02/2023. Performance is based on 50% Magnus Cautious Balanced and 50% Magnus Balanced portfolio performance. Data is gross of DFM, platform and adviser charges. Past performance is not a reliable indicator of future performance. The value of an investment can go down as well as up and your client may get back less than they’ve paid in.

This set the tone for some excellent performance for investment markets and the Magnus portfolios in particular. In fact, returns for the Magnus Portfolios ranged from 9.4% to 11.1%, with all of our portfolios being strongly ahead of their respective peer groups.

Much of our outperformance last year came from not “voting with our feet” and resisting the temptation to jump in and out of different investments and a preference to stick to our long-term plan.

As we look forward to 2024, it’s impossible to not talk about those 40 National elections. If we narrow our focus to the UK (our home market) and the US (the world’s biggest economy), we observe some common characteristics or “problems” for our Politicians:

Record high debt levels

-

-

- US total public debt is running at over $33 trillion

- UK government debt is running at over £2.7 trillion

-

Big Budget deficits

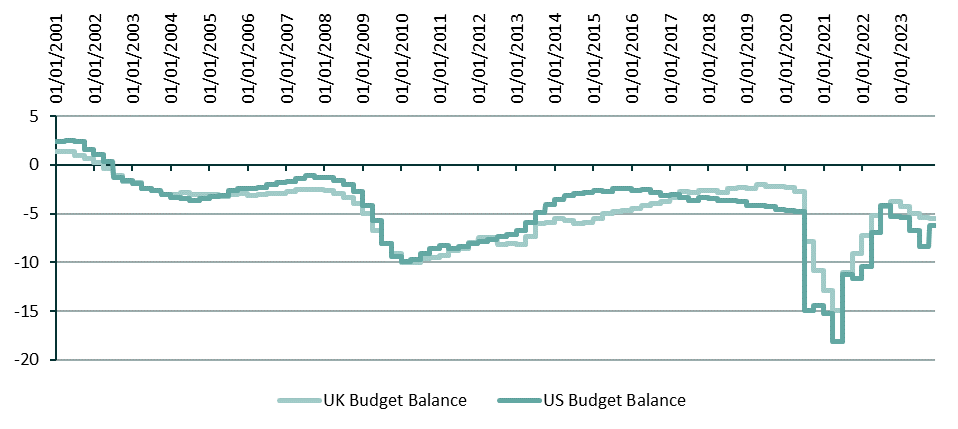

Both these countries are running budget deficits: i.e. they are spending more than they are earning (through taxes).

Unfavourable demographics

Put very simply, people are living too long and not being replaced fast enough. UK life expectancy is 82 and less children are being born each year (1.75 births per woman).. UK life expectancy is 82 and less children are being born each year (1.75 births per woman). This makes for a smaller working population which means less tax-take to fund the deficit (which itself grows cos of the higher pension burden of the larger share of older people in the population).

I should point out, that this is in no way a swipe at older people! It is more an acknowledgement of the situation the politicians face in a year that is set to be particularly political. They also need to balance the reality that older people are more politically active too.

Budget Deficits need to be funded (or inflated away)

As the chart above shows, budget deficits are a common feature of many developed countries: with the UK and US shown below. This is economics 101: try not to spend more than you’re earning! The challenge for the Politicians is that earning more (higher taxes) or spending less (less public services like pensions/schools etc) are not vote winning strategies.

The idea of budget deficits is not new. Deficits were being tackled by austerity, which was the “go-to” solution in a world without inflation (UK inflation averaged 1.6% in the 8-year period running up to the COVID-19 pandemic).

The pandemic then saw spending like we’d never seen before. Globally, there was c.$16 trillion of stimulus money created and injected into economies to help “fight the war” on Covid, with the US economy seeing the biggest jump (27% in 1 year) in its money supply ever. These numbers probably sound big but they might get lost under the banner of technical mumbo-jumbo. In perhaps more relatable terms, $16 trillion is equivalent to 4.5 towers of US dollar bills stacked up from the earth to the moon! A massive stack of money!!

This idea of creating money to fight a war chimes with prior periods in history. Often, the answer has been using inflation as a chisel to work away at the debt pile. Inflation at 11% (as it was in October 2022) is politically unacceptable, whereas inflation at 3% is much more palatable. Politicians and Central Bankers talk down inflation when it is high, but our view is their tone will quieten as inflation softens. Targeting a balance where cash rates are lower than inflation (which itself is also lower) will mean that debt servicing costs (for governments) reduce whilst the debt pile is simultaneously being whittled away by inflation. It has worked before and it may well work again!

Our view is that inflation will remain sticky and will remain above the Bank of England’s target. Granted it has come down markedly in the last year (from 11.1% in October 2022 to 3.9% today), but our view is that the path down to 2% will be long and lumpy. At the same time, we don’t believe we’re out of the woods yet on recession; the “piggy banks” built up during Covid have been well and truly spent down and the consumer is now feeling the pinch of higher rates. This paints a gloomy picture, but it doesn’t need to be. The key points here are:

1. Interest rates are at levels from which they can quickly be cut.

This sounds an obvious thing to say, but with interest rates being at their highest level in 15 years and having been hiked at the fastest rate in over 30 years, there is now plenty of room to cut them if the economy stalls.

2. Companies have already priced a recession in.

Stock markets are forward looking and are (in many cases) trading at valuations which reflect a mild recession. Furthermore, many of them have prepared for recession by cutting back on staff or ordering less stock. Companies are leaner and meaner.

3. Consumers are generally in good shape.

UK consumers are feeling the pain of high taxation and high mortgage rates. This affects spending and confidence. The good news for us is that the US consumer is in much better shape! The US is the world’s largest economy and comprises nearly 70% of the global stock market, with the US consumer making up c70% of US economic growth. The ability to transfer in and out of mortgages (so long as one doesn’t move house) means that over 95% of US mortgages have been “locked in” at lower rates, such that the effective rate of interest on US mortgages (at 3.7%) is significantly lower than the 20-year average rate (4.3%).

Lower interest rates are also great news for companies (it’s like an oxygen mask dropping from the ceiling) as they can borrow to grow, but bad news for savers; especially when combined with above-target inflation.

The news in 2024 will have some surprises, but one thing for sure is that there will be considerable focus and attention on which box the X is being placed in each of the 40 countries hosting elections.

The pollsters will get very excited about where sentiment is swinging, (cynically we’d say that every winner inherits the same problem and there isn’t much scope for differentiation). When it comes to investments, having the X factor will mean owning those assets that can grow over and above inflation and benefit from the lower interest rates we expect to see. These sorts of investments form the backbone of the Magnus portfolios we’ve chosen on behalf of our clients, so we believe we’re well equipped to weather election season in 2024.