Despite its glorious start, it’s hard to rely on the British summer!

Many of you will no doubt be jetting off to warmer climes where wall-to-wall sunshine is more of a certainty.

Even with meticulous planning and forensic analysis of the various weather apps, you might be the unlucky punter who gets the freak cold snap in Greece or flash flood in Dubai! Go for a quick weekend and your holiday might be spoilt. Relocate there – and you’ll almost certainly enjoy better weather.

The same logic applies to investing.

If you own the right mix of investments for you (as agreed with your Financial Planner), then you’re more likely to meet your goals and outpace inflation. Emphasis on own: this means holding these investments for a long time. Contrast that with “renting” your investments – jumping in and out – and you’re playing the holidaymaker’s lottery: you might land in paradise, but you could just as easily get rained out and panic-sell at the worst time.

We’ve seen this play out in investment markets recently. President Trump’s “Liberation Day” tariffs saw sharp falls in stock markets, followed by an equally sharp recovery. The proposed 2nd April tariffs triggered the fifth-worst two-day drop in US stocks since WWII – only for them to stage the fastest recovery of its size since 1982. Bravo to anyone who spent April blissfully on a remote desert island; markets ended the month largely unchanged after a rollercoaster ride.

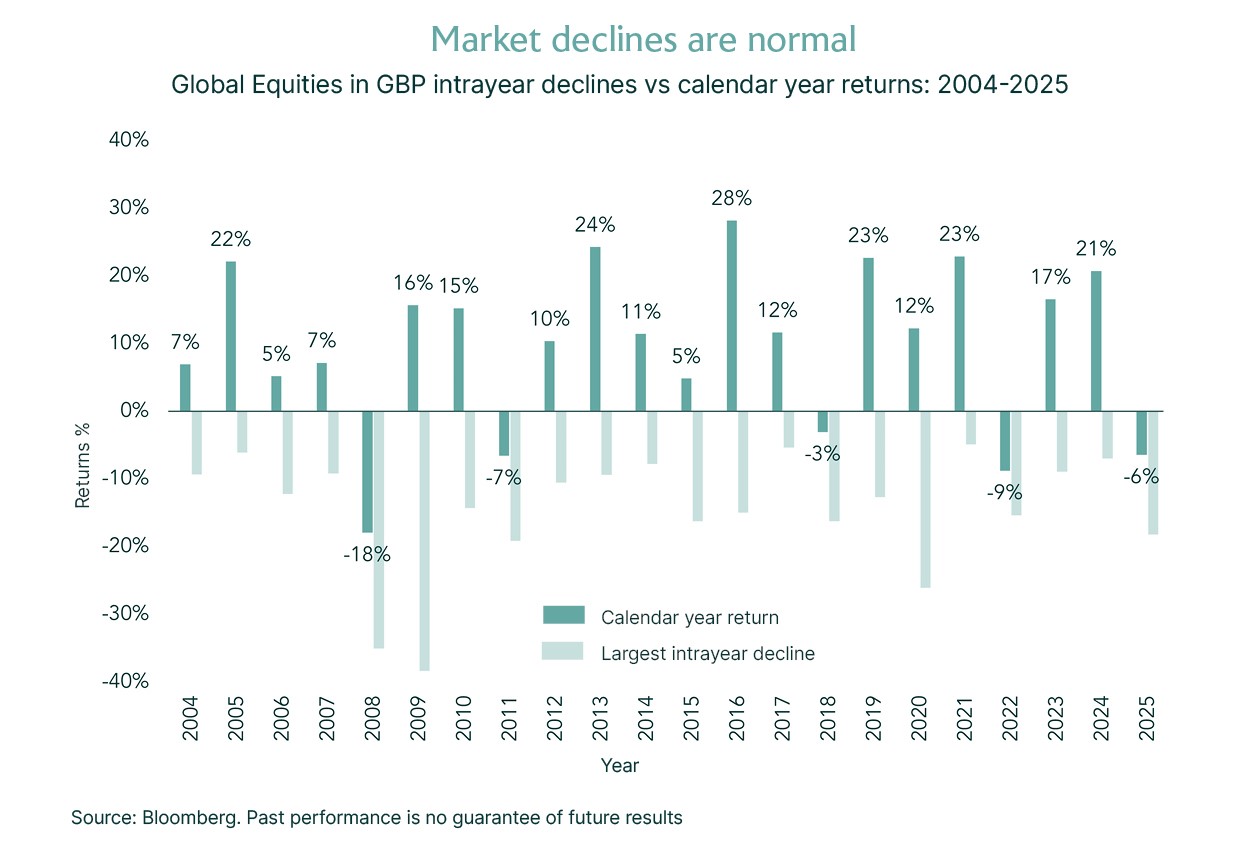

It’s times like these when stepping back to take a long view really pays off. Whilst not pleasant, these sorts of falls are not uncommon for markets as the chart below shows.

Market drops of over 10% (like the –18.2% fall earlier this year) tend to happen roughly every 18 months. Since 2004, on average, global stock markets fall around 14.4% within a year – even when they could go on to deliver strong annual returns of around 9%.

Hence the holiday analogy

If you “relocate” (i.e. stay invested long term), you’ll have a higher likelihood of better returns – just as you’d average better weather living abroad. Try to time the market like a short break, and you’re more exposed to bad timing and a flurry of smug messages from friends telling you how lovely it is back home!

Another part of good holiday planning is building in a “buffer”. Miss your flight, and the whole trip’s in jeopardy. In investing, the equivalent of consulting TripAdvisor is checking whether the companies you own are growing their earnings.

That’s what really drives long-term market returns – far more than day-to-day politics.

Market Fundamentals remain intact

- On the whole, companies have been growing their earnings at a healthy pace

- Profit expectations this year have only been revised down by around 3%, in line with long-term norms. This is in stark contrast to COVID or the Global Financial Crisis, which saw cuts of 25%.

- Earnings drive markets. See below: a powerful (if imperfect) correlation between corporate profits and market performance.

Returning to the theme of margin of working within a buffer I’ve convinced my wife Suzie (who’s missed 2 flights in her life to my zero!) to arrive at the airport with time to spare (my campaign to win control of the TV remote continues!). For portfolios, this means diversifying: assets that have growing earnings, blend equities with bonds, and pay a low enough price so there’s room for bad news without wiping out your returns.

To that end, the chart below helps frame how we favour structuring the Equity section of our Clients’ Portfolios at Magnus.

Despite being in the cross hairs of President Trump’s trade policy, the US remains the highest quality equity market with companies growing their earnings at the fastest rate globally. Earnings are robust, and the big tech firms—Meta, Alphabet, Amazon, Microsoft—have all recently committed to ramping up investment, a sign of growing confidence.

Still, we balance this with exposure to attractively valued regions like the UK and Emerging Markets where there is a greater “margin of safety”. We’ve increased our UK exposure recently, and clients have benefited as earnings have come through.

On the bond side, we prefer shorter-dated, high-quality corporate bonds. It would take a COVID-style credit shock, lasting a year, for these to generate capital losses. That’s akin to relaxing in the airport lounge with a cold drink in hand. This will come as no surprise to those of you that know us: we pride our bond investments on being boring and predictable!

Apologies for wringing every last drop from the holiday metaphor – but I’ll indulge one final time: I’ll be spending my summer in the UK, enjoying the beaches of North Devon and Cornwall. I’m a long-time staycation convert, and the UK is finally starting to shine – economically as well as meteorologically:

The UK has seen:

- Stronger than expected economic growth

- Stronger-than-expected retail sales, with real wages growing at over 2%

- A household savings rate of 12% – the highest (ex-COVID) since 2010

All this adds up to a compelling postcard for UK investments!

We remain excited about what lies ahead for markets, and we thank you, as always, for your continued support. Wishing you all a relaxing and enjoyable summer—however and wherever you choose to spend it.