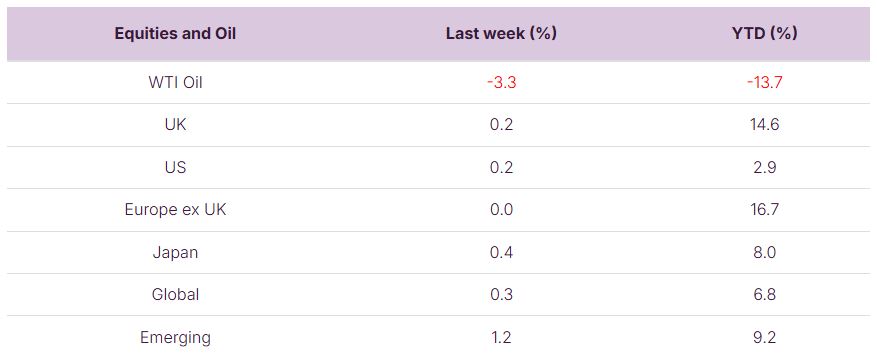

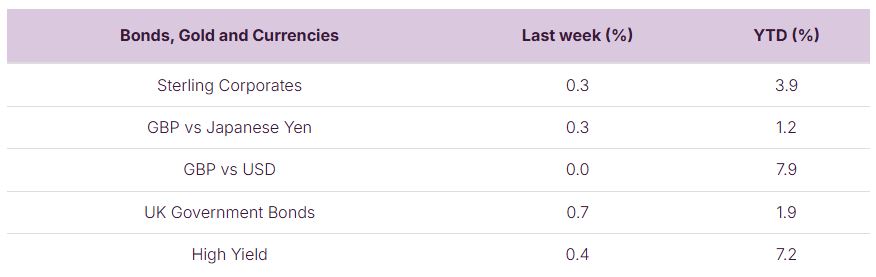

Global stock posted modest gains last week, with Emerging market stocks faring best. Bond markets had a bumpy week but ultimately generated positive returns – enjoying a bumper day on Friday as yields fell on the back of weak US jobs data and the Cabinet reshuffle in the UK.

US jobs data was the key event last week and it surprised to the downside. This prompted a rally in bond markets as bond yields fell, with a faster pace of interest rate cuts being priced into markets. This was welcome news for bond investors and the UK Government, with UK Gilt yields also falling on the day (Friday) of their Cabinet reshuffle.

This week is light on corporate data, with Thursday’s US inflation print the key one for markets: the last big data point ahead of the Federal Reserve’s interest rate meeting next week.

Last week

- Global stock markets eked out modest gains

- Emerging markets posted good gains: buoyed by Chinese equities

- US jobs data came in weak but boosted the likelihood of interest rate cuts

- Bond yields came down which benefited bond markets

This week

- UK growth data is released on Friday for the 3 months to July

- US inflation data is due out on Thursday (expected to come in at 2.9%)

- European Interest Rates are announced on Thursday (expected to hold steady at 2%)

Source: Bloomberg. Currency GBP.

More details:

- Global stock markets rose by 0.3% last week, buoyed by a 10% rise on the week in Google parent Alphabet. Alphabet (which carries a c3% weight in the global share index) rose strongly on the back of an antitrust ruling that was less severe than expected.

- Emerging market shares were the star performer last week, rising by 1.2%. China (which makes up about 1/3rd of the emerging market share index) rose by 1.8% last week and has been the key driver of emerging market gains so far this year: rising by c22%.

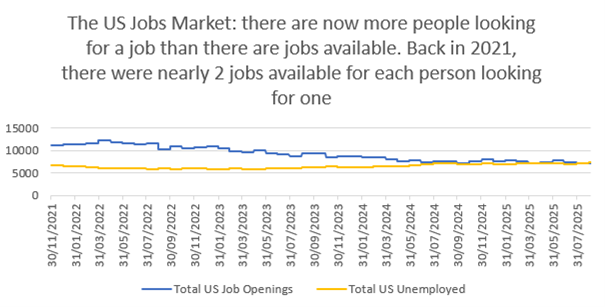

- US jobs data was the big news last week and the numbers came in worse than expected. Although negative at face value, this helps pave the way for a faster pace of interest rate cuts which could be welcome news for stock markets.

- US Unemployment rose to 4.3% (as expected and still low by historical standards) and just 22,000 new jobs were shown to have been created in the month of August. This figure was less than the 75,000 that had been expected (by economists surveyed by Bloomberg). These numbers chime with the recent view from Fed Chair Jerome Powell (in his Jackson Hole speech in August) that the “downside risks to employment are rising”.

- Weaker US jobs data may well prompt the US Federal Reserve into cutting interest rates. Historically, this has been good news for markets, so long as the economy avoids a recession: which was the view taken from the bond markets and smaller companies in the stock market which rose on Friday as more imminent interest rate cuts got priced into markets.

- Bond futures markets are now pricing in a 100% likelihood of a US interest rate cut at the 17th September Federal Reserve meeting and are pricing in a total of 6 interest rate cuts over the course of the next year!

- The chart below shows the change in path of the US jobs market. Back in 2021, there were roughly 2 jobs available for every person that was looking for a job. Now, the total number of job openings is less than the number of those seeking a job. This implies that employers are pulling back on hiring. Although employers aren’t hiring, they aren’t yet firing, with the data showing little change in the number of workers being laid off.

Source: Bloomberg

- Friday’s move lower in bond yields provided welcome relief to bond investors and saw gains on the week of 0.7% for UK Government bonds (10-year Gilts) and 0.3% for UK Corporate bonds. Lower bond yields help take the pressure off Governments who are having to service large amounts of Government debt (c$37trn in the US and c£3trn in the UK) and these costs have been rising in the face of increased debt issuance and investors demanding a higher premium to lend their money to Governments!

- For the UK last week, much of the focus was on politics rather than economics. Friday’s cabinet re-shuffle coincided with the US jobs data which saw a move lower in Gilt yields. This was welcome news as Tuesday had seen the 30-year UK Gilt reach its highest level since 1998. Changes in gilt yields have big ramifications for UK debt service costs, with the OBR (Office of Budget Responsibility) forecasting UK debt service costs to be £111.2bn in 2025-26.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.