Global stock markets kicked off October in strong fashion, despite the US government moving into shutdown. Moves higher in markets were driven by positive news in the healthcare sector (tariffs less bad than feared) and expectations of lower US interest rates (on the back of weak jobs data). This week is light on economic data, and we’d expect market attention to be focused on the US Government and progress around the shutdown.

Last week

- Global stock markets rose on the week, boosted by the healthcare sector

- UK stock markets outperformed (thanks to their high allocation to the healthcare sector)

- The US Government went into shutdown: which made for an absence of the monthly non-farm payrolls jobs numbers produced by the US Bureau of Labor Statistics

- US jobs data from a private payroll processing firm (ADP) came in lower than expected for the month of September

- Bond yields fell on expectations of lower interest rates: this boosted bond markets and stock markets.

This week

- Developments around the US Government shutdown will be closely watched

- Wednesday sees the release of the Federal Reserve’s minutes from their recent rate setting meeting (they next meet at end October)

- Tuesday sees trading updates from Imperial Brands and Shell, with Delta Airlines reporting on Thursday and Blackrock on Friday

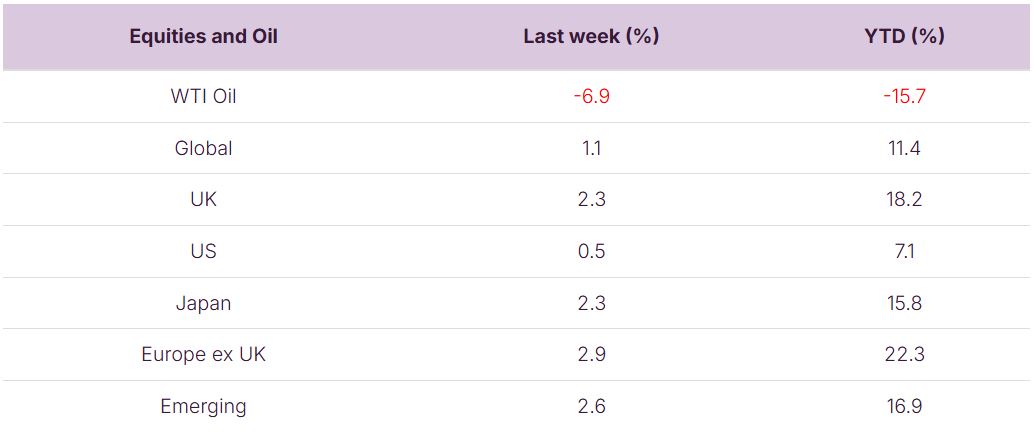

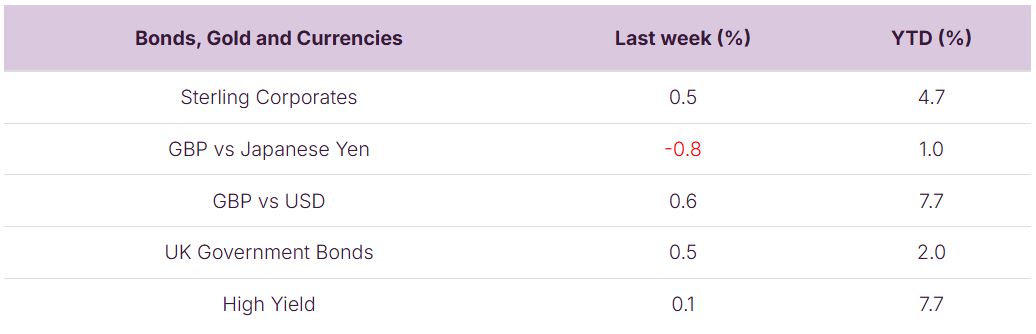

Source: Bloomberg. Currency GBP.

More details:

- Global stock markets kicked off October in positive fashion, rising by 1.1% on the week. This rise came despite the US government being in shutdown. Healthcare was the stand-out sector in the global share market last week, pushed higher by a deal between Pfizer and President Trump to lower prescription drug prices in the Medicaid program in exchange for tariff relief.

- UK shares had a strong week, powered by the healthcare sector. Healthcare constitutes around 11% of the UK equity index, due largely to Astrazeneca (around 6.5% of the index) and GlaxoSmithKline (around 2%) of the index. These shares were up 15% and 9.6% respectively on the week. Both shares rallied on the news around the “Most Favoured Nation” deal that Pfizer had struck with President Trump. Last week also saw a new CEO succession plan announced for GlaxoSmithKline, with Chief Commercial Officer Luke Miels set to take over the helm from CEO Emma Walmsley.

- European stock markets also had a strong week, up by c2.9% (boosted by tech and healthcare), whilst Emerging market stocks continued their strong run; benefiting from a 3.5% rise in the Chinese share market.

- Last week saw the US Government go into shutdown – at the stroke of midnight on 30th September as lawmakers failed to reach a funding agreement. This sparks a halt to nonessential government operations, widespread furloughs and a pause in some public services. Perhaps the most consequential impact for investors last week was the delay (and absence) of the US monthly jobs print (non farm payrolls). We did get the September private payrolls report from ADP which showed the economy had lost 32,000 jobs as opposed to expectations (going into the report) for 51,000 jobs to be added.

- Although US Government shutdowns are rare, there have been several occurrences in recent decades: 3 since 2013 and 20 since 1976. The last shutdown occurred in December 2018 (under President Trump) and was the longest on record at 34 days. Shutdowns can cause a distortion to economic data but have generally had little impact on equity markets. The last shutdown (in 2018) saw US equity markets rise by some 10% over the period, but it is worth noting that with c750,000 Federal employees currently being furloughed (as per the Congressional Budget Office), there will doubtless be an impact onto near-term economic data.

- Investors took bad news (around the US shutdown) as good news; in so far as it would prompt further interest rate cuts to support the economy. This helped boost stock markets and saw bond yields fall. This movement lower in bond yields reverberated across the Atlantic and saw UK gilts rise in price by about 0.5% on the week, with 10-year bond yields closing out the week at 4.69%. Credit spreads tightened over the course of the week (reflecting underlying investor confidence in corporates).

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.