Global share markets fell by about 1.2% last week after a strong recent run. Negative sentiment around US tariffs combined with some weak US jobs data to drag markets lower on Friday. In turn, this saw bond markets rally, with bond yields falling to price in lower interest rates.

July was an excellent one for stocks, with the global market rising by about 5.2%. The US market has been the biggest contributor to this return, with US technology shares leading the way. This was further evidenced last week with some strong earnings numbers from Meta and Microsoft.

This week sees the Bank of England meet (where they’re expected to cut interest rates) along with a host of companies reporting their Q2 profits (more details below!).

Last week

- Global stock market fell by c1.2%: ending a strong recent run

- The Pound fell by c1.1% vs the US Dollar: helping to limit overseas’ losses

- Bond markets rose, with bond yields falling (to reflect more imminent interest rate cuts)

- Corporate earnings continued to be strong (notably within the US technology sector) in the US whilst UK Banks continued their theme of growing profits and buying back shares

- The US Federal Reserve kept interest rates on hold at 4.5% (upper bound)

- US jobs data came in weaker than expected

This week

- The Bank of England meet on Thursday: where they’re expected to cut interest rates to 4%.

- It’s a busy week for corporate earnings, with the likes of Palantir and Berkshire Hathaway reporting on Monday, AMD, Super Micro Computer and Caterpillar on Tuesday, 3i, L&G and McDonald’s on Thursday and Eli Lilly and Flutter on Friday.

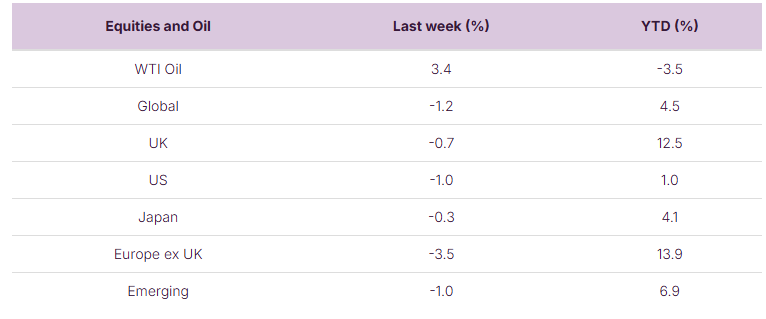

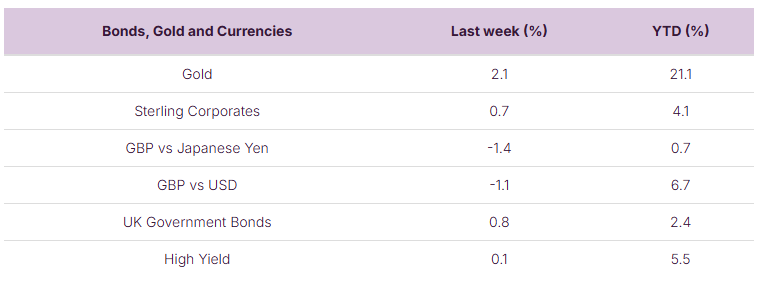

Source: Bloomberg. Currency GBP.

More details:

- Global stock markets fell by about 1.2% last week in GBP terms. This ended a run of 6 consecutive positive weeks, which saw them return 5.2% in July (in GBP terms). Most of last week’s fall came on Friday, which coincided with President Trump’s August 1st tariff deadline and monthly US jobs data which came in weaker than expected.

- A key reason that stock markets have been so strong in July has been the resilience of corporate profits – as has been evidenced in the recent earnings season: notably in the US. 66% of S&P 500 companies have now reported their Q2 earnings (as per Factset data) and the blended growth rate is 10.3%. This is MUCH better than the 4.9% growth rate that was expected on 30th June (i.e. before the companies started reporting) and it puts the US on track for 9.9% earnings growth this calendar year.

- Notably, the US technology sector, which accounts for approximately 34% of the US stock market, posted very strong growth in Q2, with earnings up around 21%. Over the past two weeks, companies such as Meta, Microsoft, and Alphabet have all reported results that beat expectations for both revenue and earnings, while also raising their capital expenditure plans, most of which is being directed toward artificial intelligence infrastructure. This trend is significant, as these three companies alone represent nearly 14% of the US equity market and contribute roughly 34% of Nvidia’s total revenues. Nvidia, now the largest company in the US by market capitalisation, produces the processing chips powering much of this AI infrastructure buildout.

- UK companies have also demonstrated good earnings growth, with companies growing their earnings at just shy of 6%. UK listed Banks have continued their theme of generating strong earnings growth and of buying back their stock. Last week saw Barclays announce a £1bn share buyback, HSBC announce a further $3bn buyback and Standard Chartered announce a new $1.3bn share buyback.

- Last week saw bond markets perform well in the face of falling bond yields (bond yields move inversely to bond prices). UK Gilts rose by 0.8% on the week, with UK corporate bonds rising by 0.7%. Bond markets are heavily pricing in an interest rate cut from the Bank of England this week and have also moved to increase the likelihood of an interest rate cut by the US Federal Reserve when they next meet in September. This comes on the back of weaker than expected US economic data on Friday of last week.

- US monthly jobs data came out weaker than expected on Friday last week. Just 73,000 jobs were shown to be created by the US economy in July which was less than the 104,000 that had been expected (by economists as surveyed by Bloomberg). The unemployment rate also ticked up to 4.2%. Friday also saw the release of US manufacturing survey data (ISM manufacturing) which came in below expectations and in “contractionary” territory: adding to the negative market direction on the day. It’s worth reminding ourselves that this data set is less important than it once was (manufacturing accounts for just under 10% of US GDP these days) and it has been in “contractionary” territory for 31 of the last 34 months!

- The US Federal Reserve met last week and held interest rates steady at 4.5% (upper bound). Notably, two of the eleven voting members dissented, favouring a 0.25% rate cut. This marks the first time since 1993 that two Governors have dissented, adding to growing speculation around who might succeed Jerome Powell as Fed Chair when his term ends in May next year. President Trump (who has been highly critical of Chair Powell) took to Truth Social on Friday calling Powell “a stubborn MORON” who should “substantially lower interest rates, NOW.”