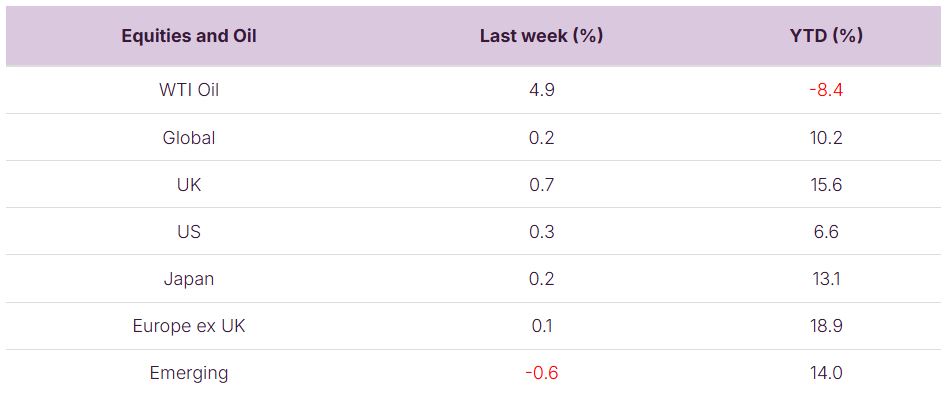

Global stock markets flatlined last week after a strong run which has seen them rise by over 3% during September. Although only a mere 3.5% weighting in the Global share index, the UK share market put in a good showing last week: rising by 0.7%, with Kingfisher providing evidence of a UK consumer that is still willing to spend (despite being low on confidence!). This week the focus will be squarely on US jobs data (due out Friday). Investment markets will be looking for numbers that still show resilience in the underlying economy, but also ones that give the Federal Reserve an opportunity to cut interest rates when they next meet on 29th October.

Last week

- Global stock markets ticked higher with the UK stock market performing best

- US economic data showed signs of stable inflation and rebounding growth

- Bond markets were largely flat on the week

This week

- US monthly jobs data (non-farm payrolls) is due out on Friday.

- The final reading for 2nd Quarter UK economic growth is due out tomorrow (Tuesday).

- Nike report their latest quarterly earnings on Tuesday, with Tesco reporting on Thursday, and JD Wetherspoon reporting numbers on Friday

Source: Bloomberg. Currency GBP.

More details:

- Global stock markets ticked higher last week, rising by 0.2% in GBP terms. The UK stock market performed strongly, rising by 0.7% on the week, taking its gains for the year to 15.6%. Last week saw strong gains in the UK for the Materials sector (+6%) and the Energy sector (+5%); these sectors constitute about 16% of the UK equity market and hence have a significant impact on returns.

- Kingfisher was the best performing stock in the UK large cap index, up by 19.8% on the week on the back of corporate results which saw profits beat expectations, improved cost controls and the announcement of an acceleration of its share buy back programme. This is another example of the UK consumer continuing to spend despite being low on confidence: Next Plc, which has raised its profit guidance 3 times this year, would be another.

- US economic data last week showed signs of stable inflation and better than expected economic growth.

- PCE (Personal Consumption Expenditure) inflation for August came in at a 2.7% year-over-year rate, with core inflation coming in at 2.9%. Whilst these numbers are above the Federal Reserve’s 2% target, they are below the Fed’s recent estimates for 2025 and reflect a cooling in services inflation which is offsetting the expected increase (via tariffs) in goods inflation.

- US economic growth came in strong, with the final estimate for 2nd quarter GDP growth being revised higher to 3.8%: the highest reading since Q3 2023. We’d note that Consumption, which drives about 70% of US economic growth, came in above expectations at 2.5%, beating forecasts of 1.7%. Furthermore, it’s worth noting that forecasts for Q3 GDP (as per the Atlanta Fed GDP-Now model) are pointing towards GDP growth of 3.9%, with consumption continuing to run at a strong clip.

- Bond markets were largely flat on the week, with 10-year Government bond yields in the UK closing the week at 4.74%. Credit spreads (the extra yield demanded for corporate debt over Government debt) continued to tighten on the week, with Global Investment grade spreads closing the week at 0.78% and US high yield spreads closing the week at 2.66%: the lowest levels, in both cases, since 2007. These tight spreads reflect the attractiveness of the high absolute yields (4.3% and 6.7% respectively), the confidence in Corporates over Governments and the relatively good trading environment that Corporates are enjoying.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.