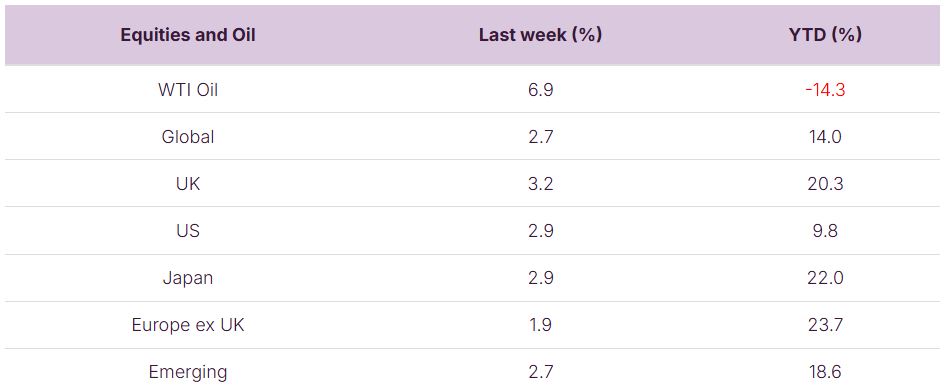

Global equity markets had a strong week in GBP-terms, up around 2.7%, supported by strong Q3 corporate earnings and softer US inflation data. Investor sentiment remains buoyant despite ongoing political and economic uncertainty in the US, as focus stayed on resilient company profits and the potential for a further interest rate cut this week.

This week, we are set for the biggest series of earnings updates, including 5 of the Mag 7 due to report. Focus will be on corporate earnings and central bank meetings, with US macroeconomic data unavailable due to the ongoing US government shutdown. Trump remains out of town, journeying around Asia, and is due to meet with Chinese President, Xi, towards the end of the week.

Last week

- Global stock markets had a strong week, up c2.7%, with multiple regional equity markets (including the UK) hitting all-time highs, boosted by the delayed US inflation data and solid Q3 corporate earnings.

- Earnings season continued to ramp up, with nearly 90% of companies reporting earnings ahead of expectations. Intel was a highlight, while both Tesla and Netflix disappointed.

- Major macroeconomic data releases generally surprised to the benefit of markets, including US inflation, Chinese industrial production, UK retail sales and UK PMIs.

This week

- We are set for the biggest Q3 earnings season update week, including earnings from 5 of the Mag 7.

- The US shutdown is set to continue to drag on and could cause further delays to US macroeconomic data releases.

- Multiple major central banks will meet to review interest rates policy – the biggest focus will be on the Federal Reserve, with a decision due out Wednesday, with a 25bps cut expected.

- GDP and inflation data is expected out of the Eurozone towards the end of the week.

- Trump (US) and President Xi (China) are due to meet this week which is hoped to ease US-China trade tensions.

Source: Bloomberg. Currency GBP.

More details:

- Global equities performed well last week, generally up around 2-3% in GBP-terms. Positive returns were supported by continued strong Q3 corporate earnings and softer US inflation data which helped offset the ongoing US political and economic uncertainty. Investors continued to focus on the resilience of company profits and the prospect of US interest rate cuts in the coming months.

- The current bull market has entered its third year, with significant gains so far. While it is natural for investors to consider the potential for a correction at this stage, continued strength in corporate earnings remains a supportive factor.

- The Q3 earnings season accelerated last week, with the majority of companies exceeding expectations. Notable outperformers included Intel, Coca-Cola, IBM, Procter & Gamble, and Thermo Fisher, while Tesla and Netflix disappointed. Tesla delivered solid revenue growth following two weaker quarters, but profits missed expectations due to higher capital expenditure. Netflix fell short of Q3 earnings expectations, citing a Brazilian tax dispute. Overall, US earnings growth remains robust at high single digits, led by technology, industrials, and financials, while energy and consumer goods are expected to lag.

- As earnings season reaches its peak, results from major US technology, financial, and healthcare companies are expected to be key market drivers. While we remain constructive on equities, we are mindful of concentration within mega-cap technology stocks and favour a more balanced approach.

- Economic data was broadly supportive last week. US inflation was softer than forecast, China’s GDP matched expectations but was accompanied by stronger industrial output, and UK business surveys and retail sales surprised positively.

- Central banks are in focus this week, with policy meetings at the Federal Reserve, ECB, Bank of Canada, and Bank of Japan. Markets are anticipating a 25bps rate cut from the Federal Reserve and a similar cut from the Bank of Canada, while other major central banks are expected to hold rates steady.

- Geopolitical developments remain on watch, with renewed US–China trade discussions expected to feature prominently. President Trump and President Xi are due to meet in South Korea later this week, in talks that may help ease trade tensions. Last week also saw the US and Malaysia sign a reciprocal trade agreement, a US tariff increase on Canadian goods, and Russia at risk of more sanctions over the Ukraine war.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.