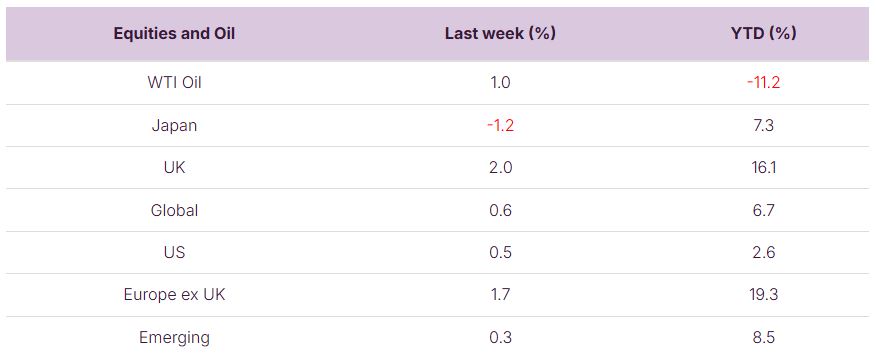

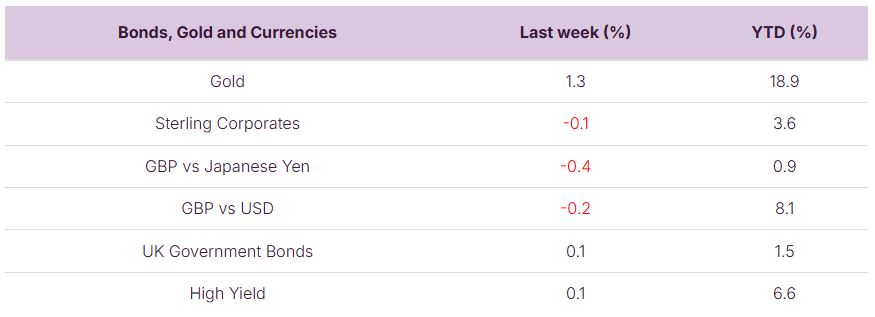

Global equity markets posted another positive week, rising around 0.6%, with the exception of Japan, which saw a modest pullback from recent highs. UK equities led the way, gaining approximately 2%, followed closely by European markets. Oil prices saw a slight rebound, though they remain down for the year, while gold continued to perform strongly.

Over the weekend, investors have been digesting key speeches from the Jackson Hole Symposium, while UK markets took a pause for the bank holiday on Monday.

Looking ahead, this week brings a flurry of U.S. economic data, including Durable Goods Orders and revised Q2 GDP estimates. On Wednesday, attention will turn to Nvidia’s highly anticipated earnings report.

Last week

- Global equities continued to perform well, gaining 0.6%.

- It was the final major week of U.S. earnings season, though several high-profile names still reported, including Walmart, Home Depot, and Intuit.

- UK inflation came in slightly above expectations at 3.8% year-on-year.

- PMI data in Germany surprised to the upside, coming in ahead of consensus. In contrast, the UK showed a mixed picture: manufacturing was weaker than expected, while services outperformed. Notably, composite PMIs remained in expansion territory.

- Late on Friday and over the weekend, markets digested key speeches from ECB President Christine Lagarde and Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium.

This week

- Nvidia reports earnings on Wednesday, marking the final update from the “Magnificent 7”. In a slightly unusual move, the company will report its Q2 2026 results.

- Investor attention will be shifting away from the U.S., towards China and Canada, with a wave of earnings expected from China and banking earnings from both countries.

- Economic data will be in focus, starting with a batch of U.S. releases today, including Durable Goods Orders. This will be followed by Q2 GDP estimates on Thursday.

Source: Bloomberg. Currency GBP.

More details:

Overall, earnings have been strong, though results from Walmart, Home Depot, and Intuit were mixed. Last week marked the final major week of the U.S. earnings season, with these key companies drawing significant investor attention. This week is expected to be quieter in the U.S., with focus shifting to Nvidia’s upcoming earnings.

- Walmart, often seen as a bellwether for the U.S. economy, experienced a share price decline following a Q2 earnings miss despite sales beating expectations. While forward guidance reflected confidence, it was tempered by margin challenges and tariff-related cost pressures.

- Home Depot demonstrated market resilience with solid Q2 results and strong share performance, buoyed by broader optimism after Fed Chair Powell’s remarks hinting at potential interest rate cuts.

- Intuit disappointed investors with weaker guidance, prompting several brokers to cut their price targets.

The Jackson Hole Symposium once again drew global attention over the weekend. Investors digested key speeches from ECB President Christine Lagarde and Federal Reserve Chair Jerome Powell, both emphasizing labour market dynamics:

- Powell highlighted the risks posed by a weakening U.S. jobs market and its implications for the Fed’s interest rate outlook.

- Lagarde stressed the growing importance of foreign labour in sustaining Europe’s ageing workforce.

Looking ahead, attention will shift to China’s earnings season and several key macroeconomic data releases:

- Alibaba (U.S.-listed) will report alongside major Chinese financial institutions, including all of the Big Four banks — ICBC, CCB, ABC, and BOC.

- Earnings are also expected from a broad range of Chinese companies, spanning airlines, automakers such as BYD, and miners.

- Other notable earnings include Prudential in the UK and Pernod Ricard in Europe.

It will be a busy week for economic data, featuring:

- S. Durable Goods Orders on Tuesday

- S. Q2 GDP estimates on Thursday

- Japan’s consumer confidence data on Thursday

- Inflation data from key European economies, including France and Germany, due on Friday

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.