Global stock markets fell around 2% last week, led lower by US technology and consumer stocks. The pullback follows an almost uninterrupted 25% rally since the April lows. We expect markets to remain choppy in the near term as investors reassess the outlook for companies tied to Artificial Intelligence. That, along with Wednesday’s UK Budget, will be the key market focus this week.

Last week

- Global equities fell ~ 2%

- Bond markets held up well

- Nvidia delivered very strong earnings

- UK inflation dropped to 3.6%

- Japan announced a major fiscal package

This week

- 12.30pm Wednesday sees Chancellor Reeves deliver the UK budget

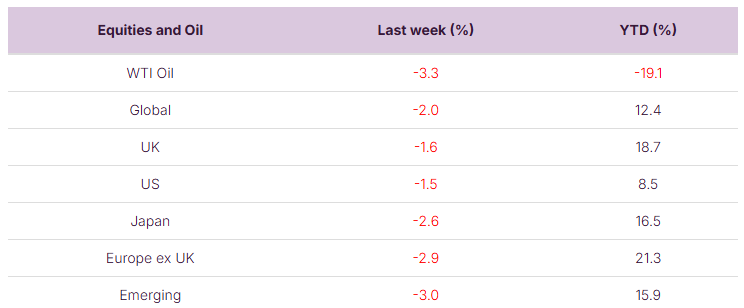

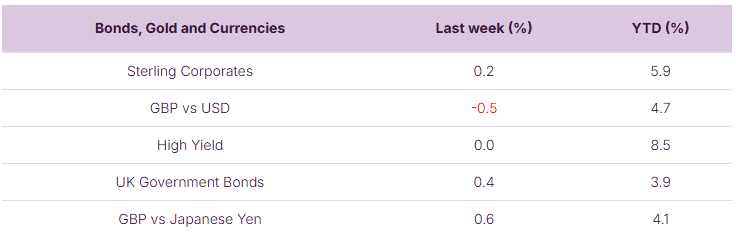

Source: Bloomberg. Currency GBP.

More details:

Global stock markets declined by about 2% despite a standout earnings report from index heavyweight Nvidia. Even with strong results, the stock fell 5.5% on the week and 3% on the day of the announcement — a reminder of how elevated expectations have become in the AI sector.

- For context, Nvidia remains up 25% year-to-date and over 85% from its April lows (GBP terms).

- The broader Q3 US earnings season has surprised positively:

- 95% of companies have now reported

- Blended earnings growth: 13.4% (vs. 7.9% expected at end-September)

- Highest level of earnings and revenue beats in over four years

- Despite this strength, global equities have effectively flatlined for six weeks and sit about 3.5% below recent highs. Most selling has come from the technology sector amid concerns over AI monetisation and stretched valuations. Given the sector’s heavy ~35% weight in the US market, these moves can meaningfully influence global indices. This underscores the case for diversification across equity markets.

Bond markets acted as a stabiliser, with UK and US government bond prices rising. Yields fell after:

- UK inflation fell to 3.6% (from 3.8%)

- NY Fed President Williams said there is “room for further adjustment in the near term”

Rate markets now price:

- 75% chance of a US rate cut to 3.75% at the 10 December Fed meeting

- 88% chance of a UK rate cut to 3.75% at the 18 December Bank of England meeting

Japan unveiled a sizeable $135bn fiscal stimulus package under new Prime Minister Sanae Takaichi. The plan includes tax breaks, spending programs, and targeted investment in strategic sectors such as shipbuilding and AI.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.