Global equities rose last week, led by the US and Emerging markets. In the US the main indexes were trading at record highs bolstered by upbeat corporate earnings the Fed’s first rate cut of 2025, and signs of progress in US-China relations.

In the US, FedEx climbed nearly 3% after posting stronger than expected results, while Apple jumped 2.8% on a price target hike and the launch of its new iPhone whilst Tesla advanced 1.5% following a broker upgrade.

The UK market fell on Friday, lagging European markets, as investors digested the Bank of England’s decision to hold interest rates and a larger than expected £18bn budget deficit in August which raised further concerns over government borrowing. Market pressures also hit financial stocks, with LSE dropping over 5% after US peer FactSet issued a weak 2026 forecast, NatWest down 2.5%, and Lloyds around 1.7%.

Last week

-

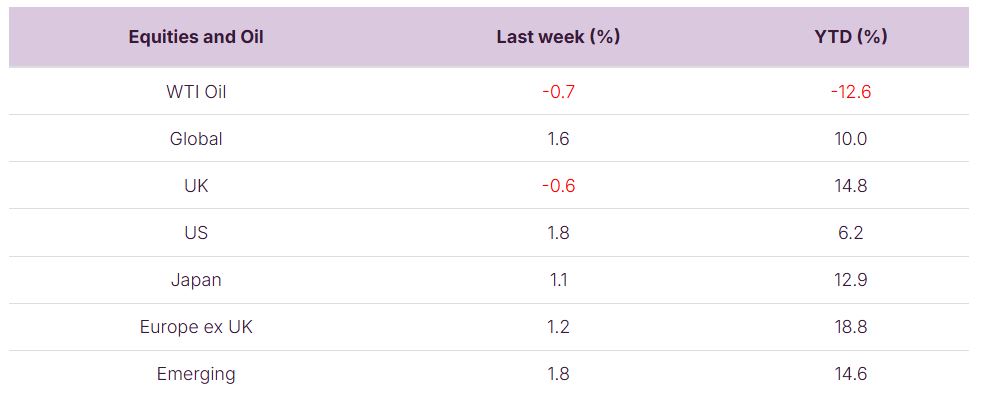

Equity markets: Global equities rose last week, led by the US and Emerging markets. The UK, Japan, and Europe also posted gains, while oil slipped lower. For the year-to-date, Europe, the UK, and Emerging markets remain the strongest performers,

-

Fixed Income markets: Bonds slipped slightly last week, with UK government debt and corporates both weaker. High yield and sterling corporates are leading gains this year, while government bonds have risen more modestly.

-

US: The Federal reserve cut rates by 25 bps to 4% from 4.25% (vote 11-1) Chairman Powell cited “two-sided risk”: slowing jobs but sticky inflation potential leading to stagflation.

-

UK: The Bank of England held rates at 4% (vote 7-2) the MPC highlighted further inflationary pressures partly blamed on government policy (taxes, NI contributions, wages).

-

US Tech: Nvidia invested $5bn for 5% Intel stake in new tech-sharing deal. Intel shares rose 30 per cent, their highest level in more than a year.

This week

-

Central Bank Decisions: The outlook on global rates will remain the focus next week, with key speeches from FOMC members, including Chairman Powell, to follow up on the Fed’s recent rate cut.

-

Purchasing Managers’ Index: These will also be the focus in India, Australia, Japan, the United Kingdom, Germany, France, and the aggregate for the Eurozone. PMI are key economic indicators that assess the health of a sector by surveying purchasing managers.

-

Earnings to Watch: Costco and Accenture will be in focus this week for their earnings updates.

Source: Bloomberg. Currency GBP.

More details:

Last week was dominated by the central banks, with key interest rate decisions from the Fed and the Bank of England keeping markets on edge.

-

In the U.S., the Fed cut rates by 25 basis points to 4 % from 4.25% in a largely unanimous vote, citing a cooling labour market and moderating inflation, though one dissenter, Stephen Miran, pushed for a larger 50-basis-point cut. The meeting was complicated by political interference, including attempts by the Trump administration to influence committee membership, yet most Fed officials resisted political pressure. The Fed signalled two more rate cuts this year, but one anonymous member forecasted far deeper reductions, highlighting ongoing uncertainty amid inflation, tariffs, and slowing hiring. Jerome Powell emphasized the unusual situation of simultaneous labour weakness and inflationary pressure, warning of a potential stagflation risk.

-

In the UK, the Bank of England kept rates at 4% and reduced its quantitative tightening target from £100 billion to £70 billion to stabilize the gilt market. However, fewer maturing gilts mean the BoE will need to sell more actively, raising concerns about borrowing costs, especially for long-dated gilts. BoE Governor Andrew Bailey attributed stubborn inflation partly to government policies, including higher National Insurance contributions and administered price increases.

Overall, both central banks face delicate balancing acts between managing inflation, supporting markets, and navigating political pressures. In both cases, the ultimate impact on markets will depend on how investors respond, leaving the final act still uncertain.

-

Nvidia has strengthened its position in the semiconductor industry by taking a just under 5% stake in struggling competitor Intel, alongside a $5 billion investment and a technology-sharing agreement. The deal follows the White House converting a $9 billion grant into an equity investment and comes amid a political fallout between President Trump and Intel’s new CEO, Lip-Bu Tan. The collaboration aims to integrate Nvidia’s AI and GPU technologies with Intel’s CPU expertise, including building Nvidia-custom x86 CPUs for data centres. Nvidia’s rapid growth, fueled by AI-driven GPU demand, has seen its annual revenue soar from $27 billion in FY2023 to a projected $207 billion by January 2026, eclipsing Intel in market value since 2020. The announcement boosted Intel shares by 30% pre-market, marking their highest level in over a year.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.