Global equity markets posted decent gains last week, rising by around 0.8% despite a more volatile backdrop.

Solid U.S. corporate earnings and indications of forthcoming interest-rate cuts from the Federal Reserve outweighed concerns over U.S.–China tensions and credit quality in parts of the regional-bank sector.

This week, attention remains on the U.S., with several major companies due to report and a key data point — U.S. inflation — coming ahead of next week’s Fed meeting.

Last week

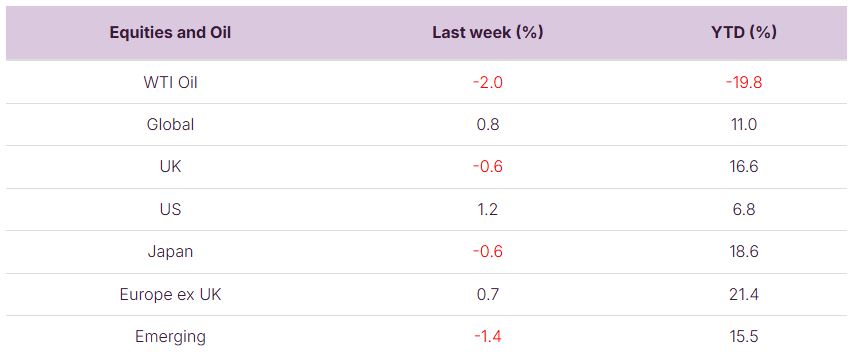

- Global stock markets rose by c0.8%, with the US leading.

- Defensive equity sectors held up best.

- US Corporate earnings came in strong, but guidance was cautious.

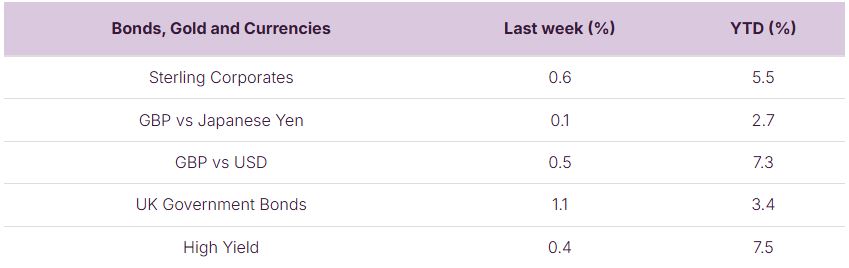

- Bond markets rallied as UK economic data came in weaker than expected and Central Bankers in the US guided towards rate cuts.

This week

- Q3 US earnings season heats up with some of the big technology and consumer companies reporting. Netflix, General Motors and Coca Cola report on Tuesday, Tesla and IBM on Wednesday and then we have Intel, Ford and American Airlines on Thursday.

- UK inflation data is due out on Wednesday. UK CPI is expected to rise to 4% (as per Bloomberg survey data).

- UK retail sales is due out on Friday along with US CPI data: ahead of the Federal Reserve’s meeting on 29th October (where they are widely expected to cut interest rates).

Source: Bloomberg. Currency GBP.

More details:

-

Global stock markets rose by about 0.8% last week despite a backdrop of increased choppiness. Within the global market it was the more defensive sectors such as Consumer Staples and Utilities which held up best: these 2 sectors both trade at a valuation discount to the broader market.

-

US shares (c70% of the global share market) drove the positive gains last week. US stocks were buoyed by a combination of reduced trade tensions between the US and China, dovish comments from the US Central Bank and positive earnings growth from US companies which reported their numbers.

-

US earnings season is now fully underway, with 12% of Companies having reported and the blended rate of earnings growth is running at 8.5% (which is higher than the 7.9% rate which had been estimated – by Factset analysts – at the start of the reporting period). Much of the focus thusfar has been on US banks. US banks, as a cohort, have delivered very strong earnings growth (running at over 14% YoY according to Bloomberg data) but future guidance has been cautious.

-

Fed Chair Jerome Powell spoke last week and noted that the “downside risks to employment” have shifted the balance of risks in the economy. This comment, was also echoed by other Fed officials (e.g. Christopher Waller and Stephen Miran) and combined with concerns around the Government shutdown and concerns around the US regional banking sector to drive bond yields lower – and to increase the market pricing of a US interest rate cut at the 29th October Federal Reserve meeting.

-

Bond markets delivered positive returns last week as yields fell, with Government bonds performing better than Corporate bonds. UK Gilts were amongst the best performers on the week (within the Sovereign space), with the 10-year yield closing the week at 4.53%. UK Government bonds rose by 1.1% on the week, with UK Corporate bonds rising by about 0.6%.

-

UK economic data last week showed the unemployment rate ticking up to 4.8% (from 4.7%) and the 3-month growth figure (GDP) come in at 0.3%. This, combined with somewhat weaker than-expected growth in wages helped the bond market move to price in a faster pace of interest rate cuts than had been priced previously. This resulted in lower bond yields and higher bond prices.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.