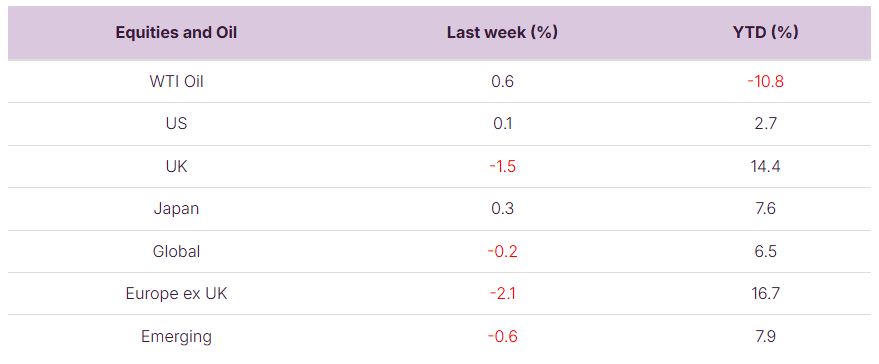

Global stock markets fell modestly in the last week of August but did manage to post small gains for the month: rising by 0.4%. UK stock markets had a weak end to the month but rose by 0.9% in the month of August, with index heavyweights in sectors such as Healthcare and Oil & Gas boosting gains.

Last week the focus was very much on the US and Nvidia in particular, with the world’s largest company posting decent earnings numbers. There were also some strong US economic growth numbers last week amidst ratcheting pressure from President Trump to push the US Federal Reserve to lower interest rates: with the President moving to fire one of the Fed Governors!

This week the focus remains on the US, with the much-watched monthly jobs data due out on Friday. The UK economic calendar is quiet, with Friday’s retail sales numbers being the highlight.

Last week

- Global equities sold off modestly, but posted small gains for the month of August

- Nvidia’s much anticipated corporate results were solid but not spectacular

- US Corporate earnings season is mostly done, with very positive overall growth numbers

- US growth data came in strong, whilst inflation was in line with expectations

- President Trump put downward pressure on US interest rates: announcing he would be firing Fed Governor Lisa Cook

This week

- The focus remains on the US, with the much-watched monthly jobs numbers (non-farm payrolls) due out on Friday

- UK retail sales are also released on Friday

- Eurozone inflation data is out on Tuesday