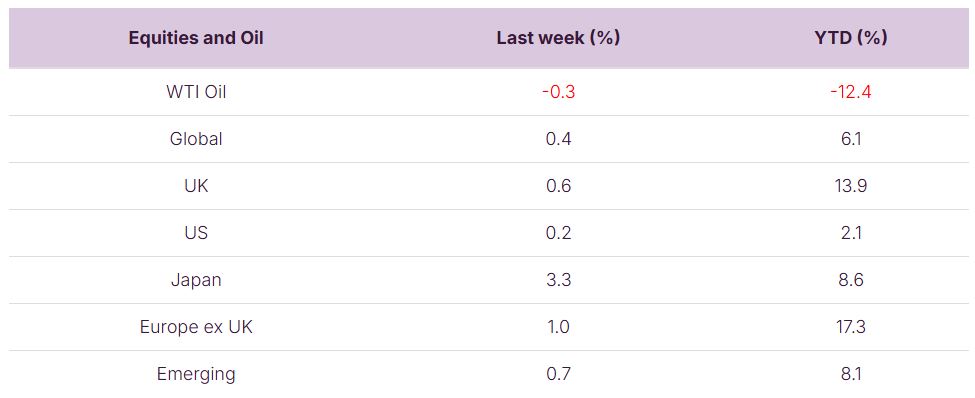

Equity markets enjoyed another positive week, with the global index up 0.4%. Japan led the way after stronger than expected economic and export growth gave investors confidence. The UK was up by 0.6%, and reached a 52-week high, buoyed by the strength of the insurance sector with strong earnings announcements from Admiral (ADM) and Aviva (AV). NatWest (NWG), as investor confidence continues to build on its earnings strength.

This week’s global economic calendar has UK inflation figures, the minutes of the July US Federal Reserve meeting, interest rate decisions in China and Sweden and a slew of composite PMI readings.

Last Week:

- Global equities: Another positive week, with the global index up 0.4%. Japan outperformed on strong growth and exports.

- US CPI inflation held steady at 2.7%, below forecasts, thanks to cheaper energy. Core inflation ticked up to 3.1%, but markets remained calm.

- However, producer inflation (PPI) was higher than expected at 3.3% YoY, the sharpest rise in over three years. Services and margin expansion drove the increase, raising the risk of higher consumer prices ahead.

- Fed outlook: Despite hot PPI, markets still price in a 90%+ chance of a September rate cut. Jerome Powell’s upcoming speech could sway sentiment.

- US consumers: Retail sales growth slowed to 0.5% in July (from 0.9% in June), while confidence dipped in early August on inflation and jobs concerns. Spending remains positive but softening.

- UK economy: Q2 GDP growth slowed to 0.3% (from 0.7%) but beat expectations. June saw a stronger 0.4% monthly gain. Growth came largely from government spending, while business investment fell. GDP per head is improving, and the UK is on track to be the fastest-growing G7 economy in H1.

- Intel & US industrial policy: The White House struck a deal letting Nvidia/AMD sell chips to China with a 15% government cut. Rumours of a direct US stake in Intel pushed its shares up 7%. This marks a shift toward more hands-on, state-influenced capitalism.

This Week:

- Looking ahead we have several of the US consumer products companies announcing their half yearly earnings, with notable reports from Home Depot (HD), TJX Companies (TJX), Lowe’s Companies (LOW) and Walmart (WMT). These companies are often considered by analysts to be a bellwether stocks for the average American household’s financial circumstances.

- Economic data due this week includes July’s building permits and housing starts as well as existing home sales, and minutes of the US Federal Reserve’s July 29th -30th meeting. The week will also see the beginning of the Fed’s Jackson Hole Symposium. This is a congregation of global central bankers which will be watched even more closely as the Federal Reserve Chair Jerome Powell could use the podium to signal the restart of monetary policy easing in September.

More details:

- In the US, the latest inflation numbers showed headline inflation holding steady at 2.7%, slightly below forecasts thanks to cheaper energy costs—particularly lower gasoline prices. Core inflation, which strips out food and energy, nudged up to 3.1% but remained within expectations. However, the producer side of the economy painted a different picture. The Producer Price Index (PPI), which tracks what businesses pay for goods and services, jumped sharply—up 3.3% year-on-year, well above forecasts. Services were the main driver, with companies widening margins at the fastest pace since 2022. This suggests that while businesses had previously absorbed higher costs, more of these are now being passed on to consumers, echoing forecasts that households will eventually carry a greater share of tariff-related price increases.

- Despite all this, the markets still expect the Federal Reserve to cut rates in September, with odds of a quarter-point move above 90%. Fed Chair Jerome Powell’s upcoming speech will be closely watched for any change in tone, as a hint of hesitation could unsettle markets. On the consumer side, July retail sales growth slowed to 0.5% from 0.9% in June, while consumer confidence dipped in early August on concerns about inflation and job prospects. For now, spending is holding up, but signs of caution are beginning to emerge.

- Closer to home, UK GDP growth slowed to 0.3% in the second quarter, down from 0.7% in Q1, but was still better than forecasts. June delivered a stronger 0.4% monthly expansion, suggesting some momentum is returning. The challenge is that growth came for the “wrong” reasons—government spending was the main driver, while business investment fell sharply. Encouragingly, GDP per head is finally improving, but household consumption barely grew. For all the mixed signals, the UK is still on track to be the fastest-growing economy in the G7 during the first half of the year. One hand clapping, perhaps—but at least it’s clapping in the right direction.

- Meanwhile in the US, Washington is rethinking what capitalism looks like in practice. The White House struck a deal allowing chipmakers like Nvidia and AMD to sell certain AI processors to China, with the government taking a 15% slice of revenues. On top of that, rumours are swirling about a direct government stake in Intel to bolster domestic chipmaking. Intel’s share price jumped 7% on the chatter, highlighting just how seriously investors take this shift. With tariffs, revenue-sharing, and potential state equity stakes, the US is moving away from pure free-market principles and toward something more hands-on.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.