Global stock markets posted modest gains in a choppy week. Positive momentum early on—driven by the end of the US government shutdown—faded as concerns grew over a slower pace of US interest rate cuts and a reported shift in UK tax policy.

The week ahead centers on Nvidia’s earnings and UK inflation data, both due Wednesday.

Last week

Stock markets posted modest gains, with plenty of rotation beneath the surface!

Bond markets gave up some ground – particularly longer-dated UK Government bonds

The US Shutdown ended – after a record breaking 43 days!

This week

Wednesday is the key day in the week ahead. Nvidia (the world’s most valuable company) report their earnings numbers on Wednesday night. Analysts are expecting to see earnings and revenue growth of c55% year-over-year. Guidance on future quarters will be key.

UK inflation data is released on Wednesday, with the headline CPI rate expected to fall to 3.5% from 3.8%.

US jobs data for September is due to be released on Thursday.

UK retail sales are released on Friday.

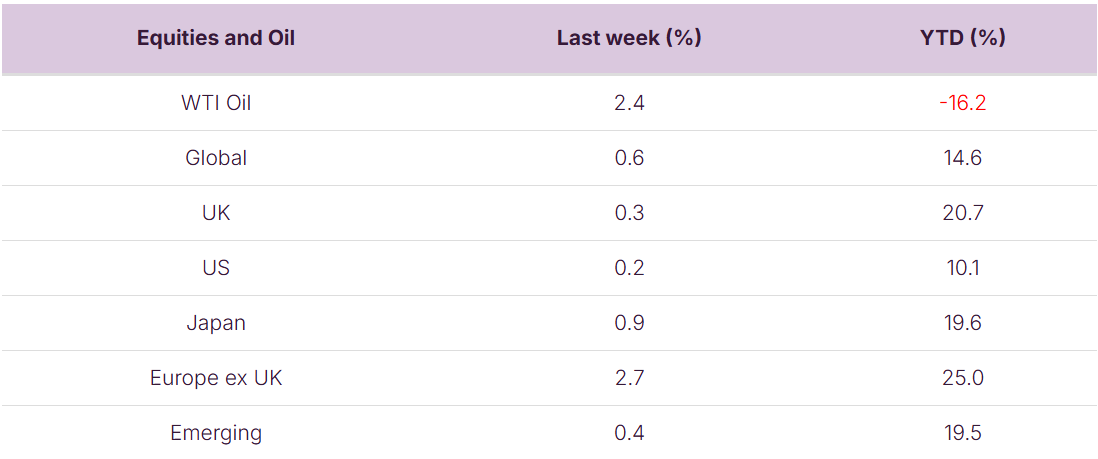

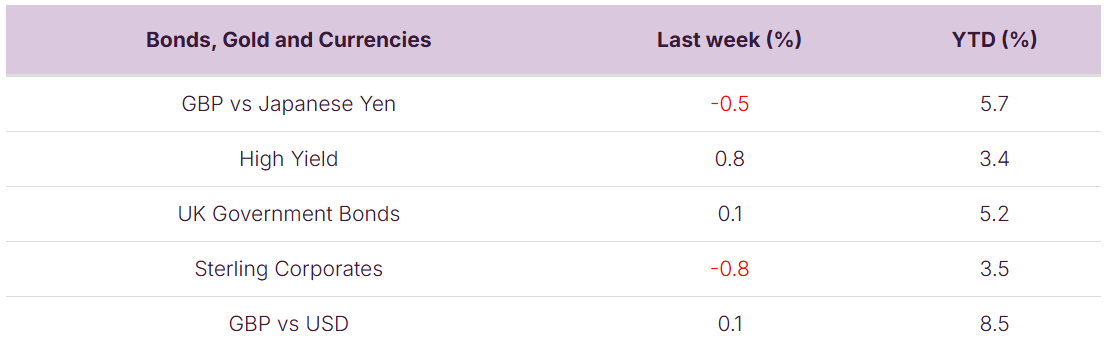

Source: Bloomberg. Currency GBP.

More details:

Global stock markets posted modest gains last week, rising by about 0.6%. European stocks (+2.7% on the week) led the way, whilst US stocks (+0.2%), though positive, lagged. Within the US market, there was a rotation out of AI names into more defensive sectors such as Healthcare and Energy.

After 43 days, the longest US Government shutdown came to an end on November 14th as the White House signed a Congressional Bill to fund Government through to 30th January 2026. This will mean:

-

Roughly 1.4m federal workers who have gone without pay, about half of whom were furloughed, are now eligible for backpay.

-

US economic data (which was halted during the shutdown) will be released. However, this will be lagged and, in some cases, incomplete. For instance, the jobs data for September is expected to be released this week but it will not include the unemployment rate.

-

US economic growth is lower than was previously forecast. Estimates, as per Bloomberg, are that Q4 US economic growth will be 1.1%: pre-shutdown readings were in the 2.5% to 3% range. We’d note that much of this hit to growth will be temporary and the fact that expectations have been sensibly lowered is encouraging for stock markets. Furthermore, we’d note that next quarter’s corporate earnings have also been revised lower: expected earnings growth for the next quarter is essentially flat for the US (and negative if we strip out the technology sector): suggesting that realism is baked into expectations and that the hurdle for surprising to the upside has been lowered.

Rising bond yields was a key theme last week, driven by comments from US Fed Presidents and reports of a “U-turn” in proposed tax policy from Chancellor Rachel Reeves. This made for losses of c0.8% on the week for UK Government bonds, with 10-year Gilt yields closing the week at 4.57%. UK public sector debt is c£3trn, with debt service costs (as per OBR estimates) at c£111bn for 2025/26 – hence the yield on UK Government debt is a key factor, especially in the face of large issuance to fund spending.

Rising bond yields – the 2 key drivers last week:

-

Conservative “Fedspeak” – last week saw several US Fed Presidents urge caution as regards lowering interest rates. This led to bond futures markets pricing in just a 50% chance of a further US interest rate cut at the Fed’s 10th December meeting. This is a marked change from 1 month ago, when bond futures markets had priced a 95% chance of a rate cut and served to put upwards pressure on Sovereign bond yields.

-

Reports (in the Financial Times) of Chancellor Reeves looking to drop previous proposals to raise the basic and higher rates of income tax. UK bond yields moved higher on these reports, on the concern that targeting a broader base of smaller tax bases will have unintended consequences which inhibit economic growth.

Where next for UK interest rates?

Bond futures markets have moved to price an 80% chance of an interest rate cut when the Bank of England meet on 18th December. This follows some weaker-than-expected recent readings for jobs, wages and economic growth.

This week’s inflation reading is key: Consensus (as per Bloomberg) expects it to fall to 3.5% (from 3.8%), this would give the Bank of England a pathway to cut interest rates to 3.75% – subject of course to whatever is revealed at the 26th November Budget!

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.