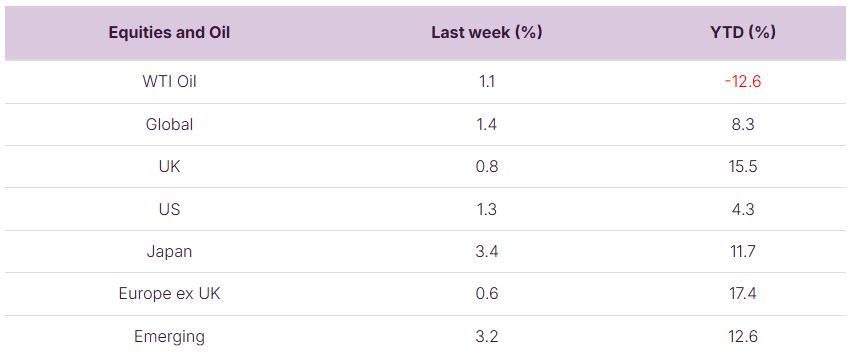

Global stock markets had a solid week, with Emerging Markets continuing their strong performance. The Nasdaq reached another all-time high, though sterling weakness dampened US returns for British investors. Japanese markets also had a strong week, pushing the region’s year-to-date returns into double-digit territory.

US inflation and the European Central Bank’s (ECB) interest rate decision were the key macroeconomic events last week, though neither surprised the market. The real surprises came from corporate earnings updates: Oracle’s stock surged 36%, while Synopsys dropped 36%.

Looking ahead, this week will be pivotal for monetary policy, with four major central banks expected to announce interest rate decisions.

Last week

- Equity markets: Global stock markets had another good week, led by Japan and Emerging Markets. UK and Europe remain the regional highlights year-to-date

- Corporate Earnings Surprises: Oracle shocked markets with a 36% jump in its share price following strong earnings, while Synopsys saw a 36% drop after disappointing results.

- US Inflation Data: The CPI data, released Thursday, came in at +2.9%, as expected, offering little surprise ahead of the Federal Reserve’s meeting.

- ECB Decision: The European Central Bank kept its key interest rate unchanged at 2%, aligning with market expectations.

- UK Economic Data: UK GDP growth for the 3 months to July was flat at 0.2%, matching market consensus.

This week

- Central Bank Decisions: The US, Canada, UK, and Japan will all announce interest rate decisions this week, making it a critical time for global monetary policy.

- UK Data: Key data points include the unemployment rate (expected at 4.7%) on Tuesday, August inflation (expected to rise slightly to 3.9%) on Wednesday, and retail sales on Friday.

- US Data: A busy week for the US, with retail sales for August on Tuesday, followed by housing data on Wednesday and the Fed’s interest rate decision.

- Earnings to Watch: Next (UK) and FedEx (US) will be in focus this week for their earnings updates.