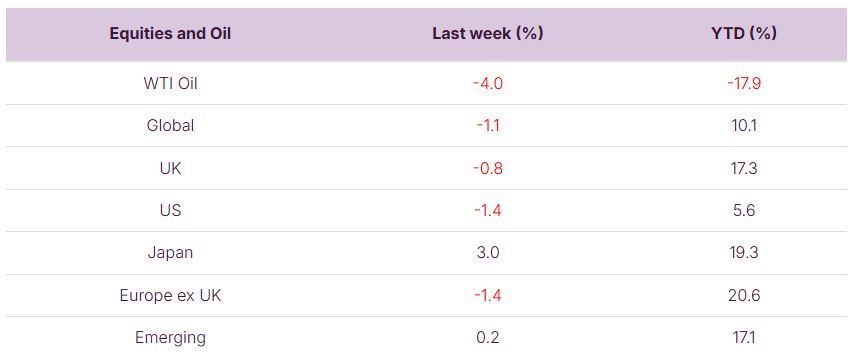

Global equity markets saw a mix of returns last week, with US equities under pressure amid US-China trade tensions and the ongoing US government shutdown. Despite this, Japanese equities continued their strong run, up around 3%. Oil prices remained under pressure.

Last week

- US equity markets declined, weighted down by US-China trade tensions, most notably the concern that President Trump may impose additional tariffs on Chinese goods.

- The ongoing US government shutdown added to investor caution. In modern times, extended shutdowns are rare, but markets appear to remain more focussed on the fundamentals of monetary policy and corporate earnings.

- Japanese equities did well, up around 3%, supported by yen weakness and optimism around the country’s new leadership.

- In commodities, oil extended its year-to-date weakness, pressured by concerns over softening demand and rising investories. Conversely, gold and silver continued their surge, supported by geopolitical uncertainty and safe-haven demand, with both metals reaching record highs.

This week

- Q3 earnings season begins to gather momentum, led by a series of major US financials reporting on Tuesday.

- As the week progresses, additional financial heavyweights will report, providing insight not only into sector performance, but also into broader macro conditions.

- In the UK, focus will turn to macro data, with August unemployment data due Tuesday and monthly GDP due Thursday. Both are expected to show little change from July but will be closely watched for signs of economic resilience or softening.

- In the US, aside from earnings, attention will remain on progress towards ending the government shutdown, trends in more minor economic data releases, and Fed Chair Powell’s speech on Tuesday, which could provide further guidance on the Fed’s future interest rate path.

Source: Bloomberg. Currency GBP.

More details:

- Despite the drag from US markets, most global equities remained relatively resilient. In the short-term, investors seem to be looking through the US domestic political noise and focussing more on the US-China trade tensions, as well as core fundamentals, like earnings and monetary policy. Japanese equities bucked the broader trend and continued their outperformance, benefitting from a weaker yen and a positive outlook following recent political developments.

- In commodities, oil remained under pressure amid demand concerns, and rising global inventories. Meanwhile, precious metals outperformed, with both gold and silver hitting record highs. This reflects growing investor concern over geopolitical tensions and the search for safe-haven assets.

- Q3 earnings will be closely followed this week. Financials are not only a major market sector, so they are important in their own right, they can be an early indicator of broader earnings season trends. Major financials releasing updates on Tuesday will include JP Morgan, Goldman Sachs, Wells Fargo, and Citi. This will be quickly followed by Bank of America and Morgan Stanley on Wednesday.

- This week will also see earnings updates from ASML & TSMC, both major players in the global chip supply chain, with key roles in the AI revolution. For ASML, we won’t just be looking at order levels and revenue growth but also signals of semiconductor demand and market conditions. For TSMC, we will be looking for similar sector indicators, as well as focus on the company’s continued momentum and pricing power.

- On the macro front, China released mixed trading data this morning, with a mixed trade balance update. Exports exceeded expectations, while imports rose more sharply than anticipated. Chinese inflation data is on Wednesday.

- UK unemployment and GBP data released this week will be closely monitored for any signs of deceleration in the labour market or broader economy, particularly in the context of ongoing inflationary pressures and Bank of England base rate expectations.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.