Global equity markets rose approximately 1.1% last week, recovering from a modest pullback the week prior. Following a strong July, global markets are now broadly flat month-to-date in sterling terms. U.S. tariffs officially came into effect last week (August 7) and have been referenced in several corporate earnings reports. With Q2 2025 earnings season well underway, overall results have remained solid.

Key developments last week included the Bank of England delivering a widely expected rate cut to 4.0%, strong performance from Apple, and a decline in oil prices amid speculation about a possible resolution to the war in Ukraine.

Looking ahead, this week marks the final busy stretch of Q2 earnings, with notable reports still due from names like Cisco and Deere. Monday is expected to be quiet on the macroeconomic front, but attention will shift to U.S. inflation and UK unemployment data on Tuesday. Later in the week, markets will digest UK and Japanese GDP figures, along with U.S. retail sales and Michigan Consumer Sentiment data.

Last Week:

- Global markets gained around 1.1%, recovering much of the prior week’s losses. All major regional equity indices ended the week in positive territory.

- Earnings season remained strong, though headlines were tempered by ongoing geopolitical uncertainty and U.S. tariffs. Major pharmaceutical names underperformed.

- Apple had its best week in over five years, driven by increased commitments to invest domestically in the U.S.

- The Bank of England delivered an anticipated rate cut, lowering the base rate from 4.25% to 4.0%.

- Oil prices softened, reflecting reduced geopolitical tensions and expectations of easing supply risks.

This Week:

- This marks the final major week of Q2 earnings, after which the pace of corporate updates is expected to slow.

- A busy macroeconomic calendar lies ahead, including GDP releases from both the UK and Japan.

- Investors are already focused on the upcoming September Federal Reserve rate decision, with heightened attention on Fed communications and the potential implications of Stephen Miron’s nomination to the Fed Board amid broader debates over central bank independence.

- Geopolitical developments will remain in focus, particularly around the impact of U.S. tariffs and progress in U.S.–Russia diplomatic talks.

More details:

-

- Earnings season continued to spotlight technology, financials, and consumer discretionary sectors — areas often seen as leading indicators for markets. Last week brought results from key technology names including Palantir Technologies and Advanced Micro Devices (AMD), pharmaceutical giants Eli Lilly and Novo Nordisk, and financials such as Legal & General (L&G). While technology and financials generally posted solid results, investor sentiment remained cautious due to ongoing geopolitical risks. By contrast, both pharmaceutical names disappointed. Apple extended its strong run, buoyed by robust earnings and an announcement to boost domestic investment by $100bn to $600bn over the next four years — a move viewed favourably amid U.S. tariff concerns, particularly around semiconductors.

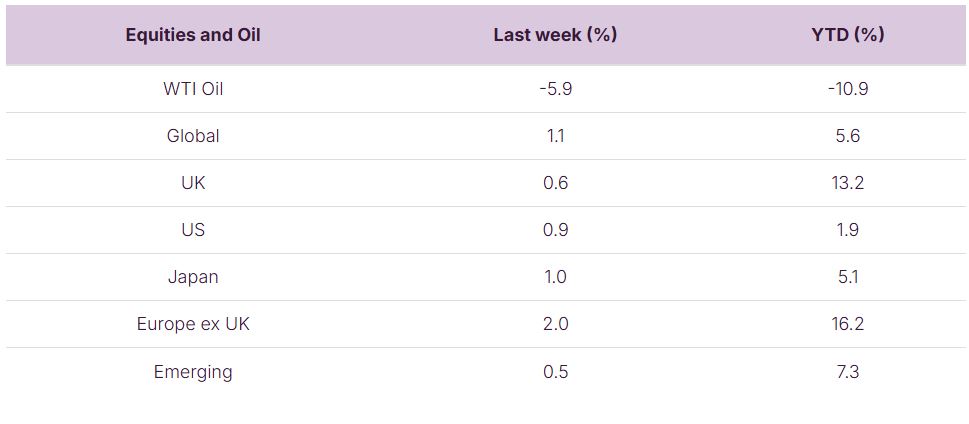

- Global equity markets rebounded from the prior week’s pullback, gaining around 1.1% in GBP terms. European markets led again, up 2.0% in GBP terms, maintaining their position as the top-performing region of 2025. In commodities, oil prices fell 5.9%, extending year-to-date losses to 10.9%, driven by the potential for a U.S.–Russia agreement to end the war in Ukraine and threats of further U.S. sanctions on Russian oil buyers. The onset of U.S. trade tariffs also weighed on the market. These developments contributed to a small pullback in gold.

- UK fixed income markets were quiet, with modest declines in gilts (–0.3%) and investment-grade corporates (–0.1%), despite the Bank of England’s policy meeting. Bond markets had already fully priced in the anticipated rate cut, leaving little surprise. In the U.S., attention turned to weaker-than-expected demand at the 10-year Treasury auction, which resulted in higher yields.

-

From a macroeconomic standpoint, the U.S. saw a relatively quiet week. The main data point was a disappointing ISM Services PMI, which came in at 50.1 versus expectations of 51.5. In the UK, the Bank of England on Thursday cut the base rate from 4.25% to 4.00%, a move that had been widely anticipated.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.