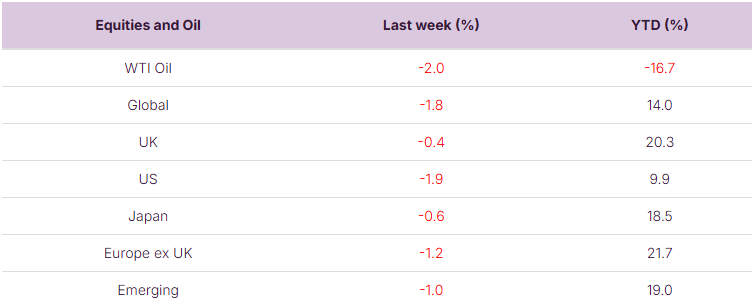

All major financial markets recorded losses over the past week, reflecting a broad-based decline in global investor sentiment. In the United States, the primary equity index fell by 1.9%, marking its weakest weekly performance in over a month. The pullback was due to valuation concerns in the technology sector. Investors who had been excited by the hopes of a Federal Reserve rate cut and the promise of AI driven growth were reassessing whether the massive infrastructure investments would deliver the expected returns.

Market sentiments also remain fragile amidst the ongoing US government shutdown which has halted the release of key economic data and clouded the outlook for monetary policy.

European markets also retreated, with the regional index down 1.2%, as concerns over slow growth and persistent inflation weighed on confidence. In Asia, Japan’s benchmark slipped 0.6%, while emerging market equities declined 1%, pressured by a stronger U.S. dollar and continued geopolitical uncertainty. Meanwhile, the UK market proved relatively resilient, easing only 0.4% over the week.

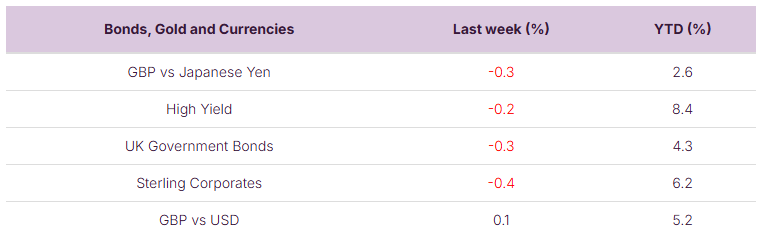

Source: Bloomberg. Currency GBP.

Last week

- It has been a mixed picture for the tech giants, most of whom have reported their earnings. The standout winners were Alphabet and Amazon with Meta the standout loser. While Alphabet, Amazon and Microsoft have cloud computing divisions that are profiting from the increased AI usage Meta’s lack of a dedicated product is cause for concern.

- In the UK, the Bank of England’s Monetary Policy Committee (MPC) did not cut interest rates this week. The bank has held the Bank Rate unchanged at 4% recently, citing ongoing inflation risks despite weaker growth.

- UK retail footfall fell in October, though the high street saw a modest rise after a week in September. The up-and-coming budget and the possible tax rises were seen as the main cause that kept shoppers away.

- Astra Zeneca third quarter sales beat expectations which it said sets it up well to sustain growth through 2026. UK Domestic Banks also rose following a newspaper report that stated the sector would be spared from tax rises in the budget – NatWest rose 2.1%, Lloyds Banking Group 1.8% and Barclays 0.6%. Elsewhere, Diageo fell following lowered guidance despite third-quarter sales coming ahead of expectations.

This week

- As earning season draws to the end, we have Q3 Trading statements due from Aviva, Rolls Royce and Spirax Group, along with Half year results from Burberry, United Utilities, 3i and We also have Q4 results from Walt Disney and a corporate sales release from TSMC. Please note Nvidia doesn’t publish it Q3 figure until the 19 November.

- With the ongoing U.S. government shutdown limiting the release of key economic reports, investor attention is expected to shift toward the data that remains available—particularly business sentiment surveys. These indicators will be closely watched for insights into how prolonged fiscal uncertainty and reduced government activity are affecting corporate confidence and near-term economic prospects.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.