Global equities advanced this week, with the FTSE All-World index rising 1.05%. Brazil and the US led gains, while Germany and Hong Kong trailed other major markets.

Last week

- US Markets hit record highs: The S&P 500 and Nasdaq closed at all-time highs for the second straight week.

- OBBBA legislation passed: The $3.3 trillion tax-and-spending package was narrowly approved, adding fiscal stimulus over the next decade.

- In the UK, political uncertainty over the Chancellor’s future and a £5bn fiscal gap from a welfare policy U-turn shook investor sentiment.

This week

- Important economic releases this week include the NFIB small business index and consumer credit data. The NFIB is a leading indicator of economic momentum, and reflects small business owners’ expectations for sales, hiring, inventories, and the overall economy. Consumer spending makes up around 70% of US GDP. So rising credit levels may indicate continued consumer confidence and spending.

- The deadline for the US to negotiate new deals with a host of trading partners comes to an end on Wednesday this week, following the 90-day tariff pause. It is expected that tariffs could go back to the levels announced in April for countries that haven’t yet negotiated a deal. o far President Trump has announced some trade deals, including agreements with the UK and Vietnam, but several other countries have yet to reach agreements.

- Wednesday also means the release of the minutes from the June Federal Reserve meeting. This will give investors insight into how Federal Reserve officials are viewing the economy, and their thoughts regarding interest rates.

- It’s another quiet week for UK data, but we do have a trading update from Shell (SHEL.L) on Monday and Severn Trent (SVT.L) on Thursday.

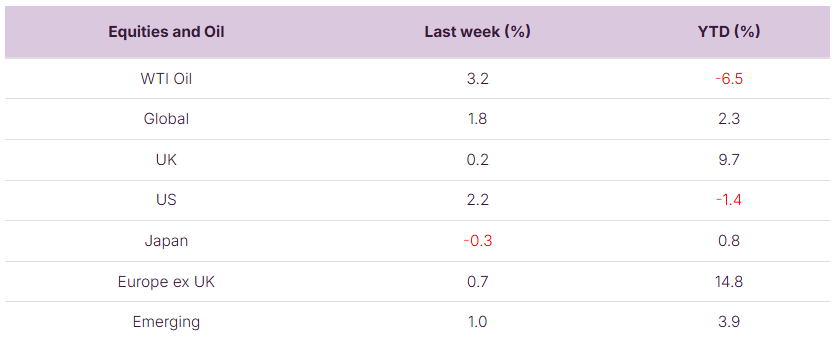

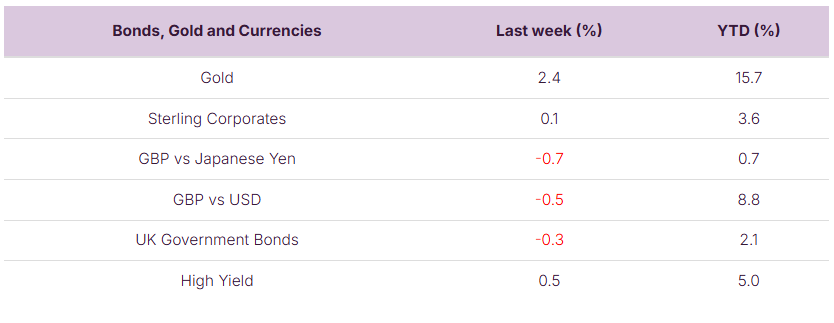

Source: Bloomberg. Currency GBP.

More details:

US

- It was a good week for markets but particularly in the US, with both the S&P 500 Index and Nasdaq Composite both closed at all-time highs for the second week in a row.

- The key drivers have been the US Labour Department report that the economy added 147,000 jobs in June, which was ahead of many economists’ estimates of 110,000. This has helped provide some much need reassurance to markets that despite the uncertainty firms are continuing to hire. There was more good news on unemployment too, with the jobless rate dipping to 4.1%, below forecasts for 4.3%.

- The key takeaway is that the data is not consistent with a slowdown in the economy and will support interest rate cuts later in the year. Markets swiftly slashed the odds of a July rate cut from 24% to just 6%[1] after the jobs data.

- The US will charge a tariff rate of 20% on goods imported from Vietnam, well below the 46% announced in early April, while Vietnam has reportedly agreed to drop levies on US imports. For goods the US deems have been transhipped through Vietnam (originated from a country other than Vietnam) a 40% tariff rate will apply.

- However, the spotlight this week was largely on the Trump administration’s One Big Beautiful Bill Act (OBBBA) legislation, which saw narrow approval—first by the Senate on Tuesday, followed by the House of Representatives on Thursday afternoon. OBBBA will deliver a very large package of tax and spending measures, which in aggregate will cost around $3.3 trillion over the next decade.

EU

- ECB President Christine Lagarde cautioned vigilance following the Eurozone inflation data. Headline inflation rose to 2.0% in June in the Eurozone Area meeting the ECB target. However, this cooled the markets expectation for further interest rate cuts later in the year, which resulted in mixed returns for the major stock indexes. France’s CAC 40 Index gained just 0.06% over these trading sessions, Germany’s DAX gave back 1.02%, and Italy’s FTSE MIB advanced just 0.30%.

UK

- The FTSE 100 ended flat after a dramatic week in Westminster as worries over the future of the UK Chancellor Rachel Reeves hit investor sentiment, knocking the pound and rocking the bond markets. The government was forced to gut its controversial welfare bill to head off a full-blown backbench revolt. During prime minister questions the next day, the Prime Minister was vague when asked if the Chancellor retained his full backing, and this led to gilt yields soaring and investor worried that a new face in number 11 might mean a change in the fiscal rules and more government borrowing. The next day the Prime Minister declared his support for the Chancellor and declared that Reeves would remain Chancellor for a “ very long time to come , into the next election and beyond it”

- Gilt markets promptly clawed back much of their losses, with 10-year yields falling back to 4.53%. Further support for the gilt market came from the Bank of England, with Governor Andrew Bailey hinting at a slowdown in the pace of its gilt sales.

Japan

- Japan’s stock markets were down this week with the Nikkei 225 Index falling 0.84 % and the broader TOPIX Index down 0.443%. The progress on the US-Japan trade negotiations is believed to have stalled and the imposition of a 35% tariff on Japanese goods should the two countries fail to reach an agreement has weighed on investor sentiment. Japan has reportedly continued to insist on the removal of all tariffs, particularly in the auto and auto parts industries, while the U.S. side is said to be pushing for Japan to import more U.S. agricultural products.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.

[1] https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-