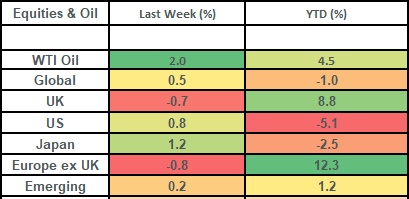

Stock markets rose modestly last week, with Dollar strength helping to boost global equity returns for Sterling based investors. This came in the face of escalating tensions in the middle east, with the US attacking Iran’s nuclear sites over the weekend.

This week the focus is likely to be on the Israel / Iran conflict and on the impact that this has for oil prices. Corporate fundamentals remain robust, and oil markets remain well supplied but an escalation in tension could well lead to further price rises which would put upwards pressure on inflation.

Last week

- Global stock markets rose modestly last week – a stronger US Dollar benefited UK investors.

- Oil prices rose 2% last week and are up strongly (c30%) since early May: this has benefited the energy sector within equity markets.

- UK stock markets sold off a touch last week but remain up for the month-to-date and strongly up for the year-to-date.

- The Bank of England kept interest rates at 4.25% but signaled that further cuts were coming.

- The US Federal Reserve maintained interest rates at 4.25% to 4.5% and maintained their guidance for 2 interest rate cuts this year.

This week

- Developments around the Israel / Iran conflict are likely to dominate market direction this week, with the key economic transmission channel being energy and the oil price.

- Alongside that, we have global survey data released this week in the form of PMIs (Purchasing Managers Indices) which will provide an insight into how the global economy is faring.

- US Consumer Confidence is released on Tuesday, with the Core PCE (the Fed’s preferred inflation measure) released on Friday.

Source: Bloomberg. Currency GBP.

More details:

- Stock markets were modestly positive last week, in the face of escalating tensions in the middle east, Central Banks that kept interest rates on hold and higher-than-expected inflation in the UK. UK investors benefited from strengthening in the US Dollar which boosted returns on their overseas’ investments, with the energy sector continuing to perform well (higher oil prices) and banks also putting in a good showing as interest rates remained elevated.

- UK equity markets sold off by about 0.7% last week (with index heavyweight AstraZeneca weighing) but remain up for the month-to-date and up by nearly 9% so far this year. Within the UK market, the Banking sector has continued to be a source of strength this year (up c22% YTD); driven by strong earnings, decent valuations, and strong buyback activity. There has also been a strong wave of bid activity which has pushed the UK market higher this year. Peel Hunt have reported that this year has seen 30 bids for UK companies with a market capitalisation of more than £100 million (a combined price tag of £25 billion), with the average premium being 43%: emphasizing both the undervaluation of the UK market but also the price kicker that this impact has had.

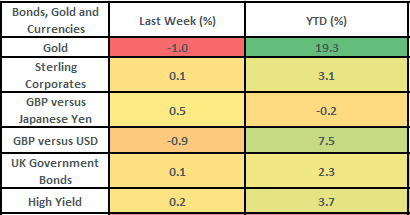

- The Bank of England (“BoE”) met last week and held interest rates at 4.25% in a 6-3 decision. BoE Governor Bailey said that interest rates would remain on a “gradual downward path.” The Bond futures markets are pricing 2 interest rate cuts this year, with the first one coming at the August meeting. The BoE also noted that the “labour market has continued to loosen” and this was evident in the slowing services inflation (more on that later).

- On the face of it, UK unemployment does not look too bad at 4.6% (the long-run average is 6.6%), but this number is distorted by the high number of “economically inactive” workers. The Bank of England will be paying attention to the chart below which shows that over 250,000 workers have been laid off since the October 30th budget last year, with the number of layoffs being more than expected in 6 out of the 7 months since October. This data likely has not fully fed through to the unemployment numbers but it’s a trend the Bank of England will be alive to.

Source: Bloomberg data / Magnus Research

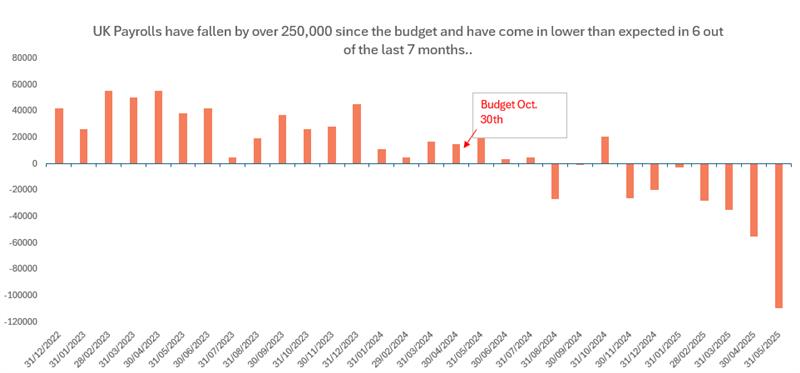

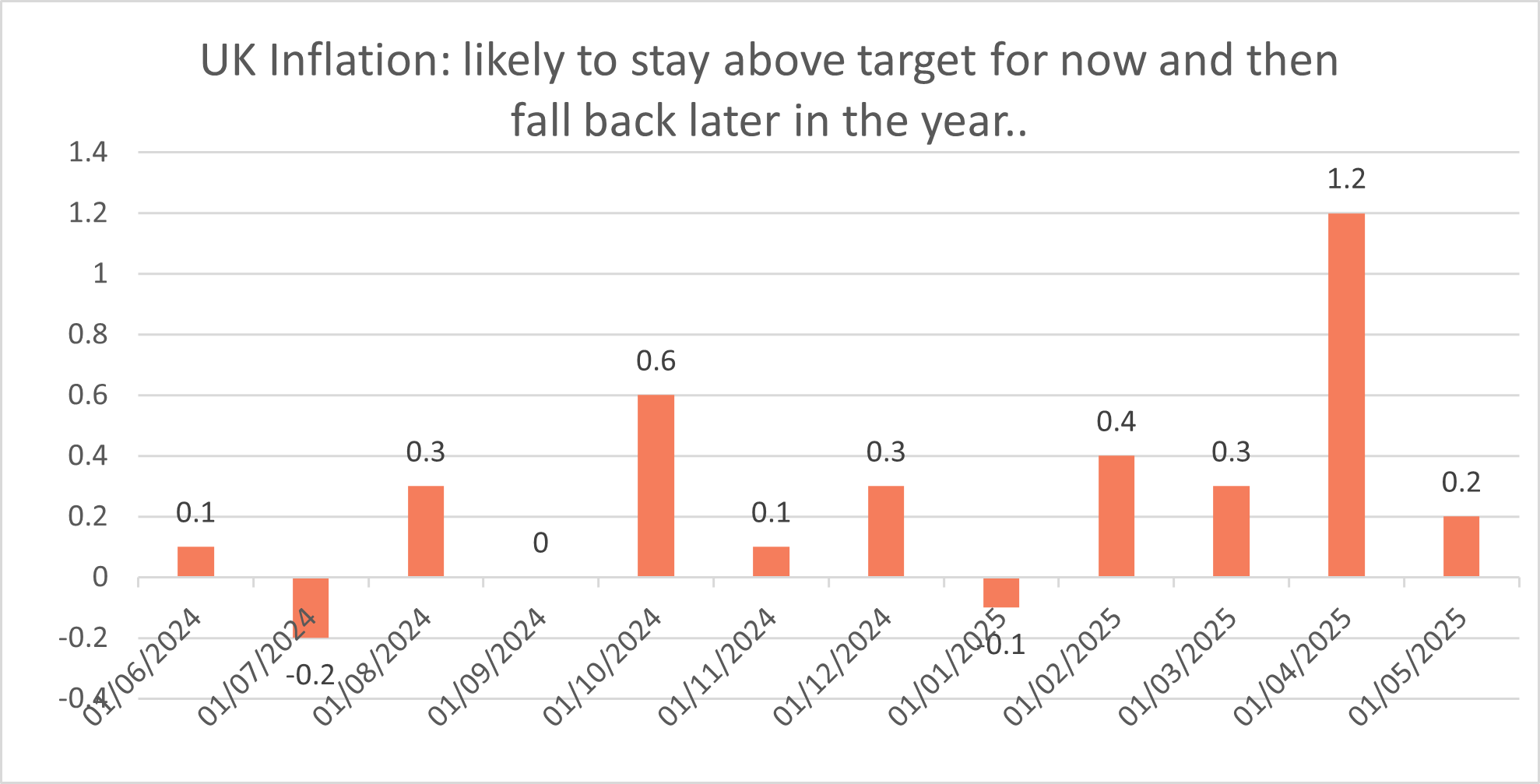

- UK inflation came in last week at 3.4%. This was a touch higher than expected (by economists surveyed by Bloomberg) and in line with the previous reading (which got revised down from 3.5% due to incorrect data on car tax). The good news was that Services inflation (driven by strong wage growth) came down by more than expected: likely due to the dynamic in the chart above. The bad news is that UK inflation is likely to remain above the BoE’s 2% target for some time to come! This is in line with the Bank of England’s forecast that inflation will not get back to 2% until Q1 2027. Our view is that this won’t stop the Bank of England from cutting interest rates but will mean that the BoE Governor will be writing a series of monthly letters to Chancellor Reeves: due to inflation being over 1% above the 2% target. A big driver for this elevated inflation is the nature of the 12-month series of inflation prints which make up the inflation number. See the chart below:

Source: Bloomberg data / Magnus Research

- This chart shows the monthly inflation prints that make up the UK CPI basket. We will have to wait until November for the 0.6% monthly reading from October last year to drop out and until May next year for the April 2025 1.2% monthly reading (driven by regulated price increases to utility bills) to drop out of the 12 month series: hence our point about the prolonged elevated level of UK inflation!

- Despite treading water over the last couple of weeks, Global stock markets are now up over 13% from their lows and have recovered nearly all their losses for the year. Whilst the effective US tariff rate coming down (to c15% from c25%) has clearly helped ease sentiment, there has also been a very strong showing from corporates and general reassurance that profit growth will continue.

- A key driver behind the stock market recovery has been that Q1 earnings growth in the US was almost twice as good as had been expected (13.3% YoY vs estimates as per Factset analysts of 7.2%)! Furthermore, we have not seen aggressive cuts to 2025 corporate earnings as a whole. 2025 US corporate earnings growth is still expected to come in at c9%. This is about 3.5% less than what was expected at the start of the year. Whilst this level of cut to earnings’ expectations is a bit more than average (average first 5 months’ declines are c2.6%), it is notably different to the c25% cuts we saw to earnings estimates in the Global Financial Crisis and during Covid! Companies have responded well to the tariff uncertainty through a combination of cost cutting and selective price increases. Examples here would be Microsoft laying off c3% of its global staff or Burberry here in the UK announcing job cuts to c20% of its global workforce.

- The Federal Reserve kept interest rates on hold last week, which was in line with expectations. US interest rates remain at 4.25% to 4.5%. The Fed also released their “Summary of Economic Projections,” also known as their “dot plot” which shows their forecasts for future interest rates. Despite diverging views, the median dot plot still reflects expectations for 2 rate cuts in 2025. Further out, the projected path from the Fed is a touch more cautious and we’d also note that the Fed have revised down their growth forecasts from March and made modest increases to both their forecasts for unemployment and inflation. Bond futures markets in the US are also pricing in 2 interest rate cuts this year (first one in September), with a further 2 to follow in 2026.

- Bond markets posted modest gains last week, with yields falling on the somewhat more dovish tone from the Bank of England and reflecting a more cautious stance from investors in the wake of conflict in the middle east. UK 10-year gilts closed out the week with a yield of 4.54%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.