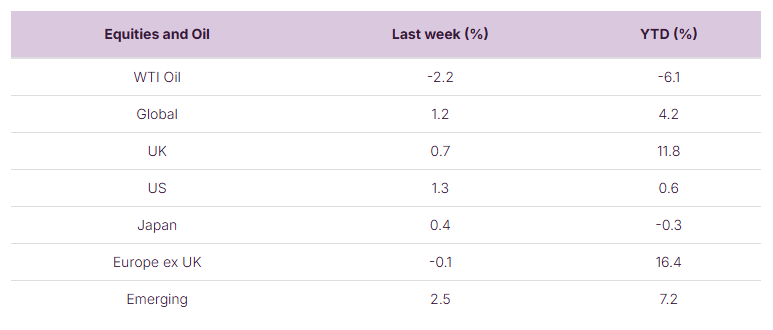

Global markets ended the week in positive territory, driven by the continued tug-of-war between solid macroeconomic performance and mounting geopolitical uncertainty. Global equities rose by 1.2%, led by Emerging Markets, while U.S. equities also posted good gains.

The Q2 2025 earnings season is well underway, with strong results from major financial institutions and TSMC contributing to optimism around the broader earnings season. Corporate performance and U.S. trade policy developments will remain central to markets in the week ahead.

European and UK equity markets remain among the standout performers year-to-date.

Last week

- Earnings season picked up pace with positive results from major U.S. banks: JPMorgan, Bank of America, and Goldman Sachs all posted better-than-expected earnings.

- In the US, inflation data was largely in line with expectations, while retail sales and consumer sentiment both beat forecasts. In the UK, inflation and jobless claims exceeded consensus.

- Trump remains a driver of market confidence, with ongoing US trade tariff negotiations and speculation that he may consider replacing Federal Reserve Chair, Jerome Powell.

This week

Looking to the week ahead, we will be paying close attention to Q2 2025 earnings season, ongoing US trade tariff negotiations, and major economic data releases.

- Earnings season continues, with the volume of earnings updates increasing as the week progresses, before quietening down on Friday. The focus this week will shift from financials to technology, with notable reports due from SAP (Tuesday), Alphabet and Tesla (Wednesday).

- The ECB’s Governing Council meets on Thursday (24 July) to deliver its latest interest rate decision. Markets will be watching for any shifts in tone, particularly in light of stronger-than-expected inflation data across parts of Europe.

- In the US, Fed Chair Jerome Powell is scheduled to speak on Tuesday. Markets will also receive fresh US data on inflation, consumer confidence, and weekly jobless claims.

- Here in the UK, Flash PMI data (Thursday) will provide early insights into Q3 economic activity. On Friday, consumer confidence and retail sales figures are due, both of which could offer clues about the direction of UK consumption amid ongoing employment concerns.

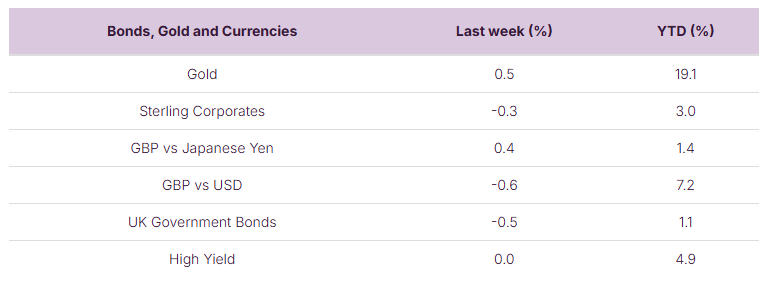

Source: Bloomberg. Currency GBP.

More details:

- Early Q2 2025 results have been encouraging, particularly in financials and semiconductors. Overall, earnings have surprised to the upside, supporting equity momentum. Investor focus will shift to technology majors over the coming couple weeks. TSMC led off the tech sector, also reporting stronger-than-anticipated results. SAP, Alphabet and Tesla earnings updates are due this week. Investors will have to wait until month-end before we get a good picture of “Mag 7” earnings, with Microsoft, Apple & Amazon due to report on 30-31 July.

- Despite ongoing US tariff negotiations, US economic and earnings data has remained resilient and generally been stronger than expected. This continues to challenge the narrative of an imminent slowdown and the need for the Federal Reserve to cut interest rates.

- In contrast, UK macroeconomic indicators have been more mixed, with inflation surprising to the upside and early signs of a softening labour market. UK inflation is expected to remain above target, with lower monthly inflation data points due to drop out over the next few months. UK payrolls have continued to decline since the October 2024 Autumn Budget. At the time of writing, markets assigned approximately a 90% probability of an interest rate cut at the 7 August Bank of England MPC meeting.

- The tale of two halves in markets last week was somewhat prompted by speculation about Trump’s consideration of having Federal Reserve Chair, Jerome Powell, removed from his position. Speculation around the independence of monetary and fiscal policy in the US temporarily spooked markets prompting safe-haven inflows, namely into gold and US treasuries. The news was quickly denied, and gold ended the week lower. However, it highlights the impact of political commentary on short term market movements.