A key part of the work we do as financial planners with our clients, is to understand their view on ‘risk’. But what do we mean by risk?

There is no singular definition of what ‘risk’ is, and there are many different forms of risk that exist, which can influence the outcome of your financial plan.

The stock market can go up, it can go down, and sometimes it can feel like a rollercoaster. Many investors recognise this as “volatility,” or the short-term ups and downs that we see in our investment accounts. One issue with volatility as a measure of risk is that when it comes to investing, it is an unavoidable part of the journey, and can also be seemingly influenced by how often you look at your investments.

However, there’s another risk to your wealth that’s quieter, long-term, and can impact the purchasing power of your money in the future: inflation.

Here’s why both volatility and inflation matter, and how understanding these risks can help you stay on track toward your goals.

Volatility: The Visible Side of Investment Risk

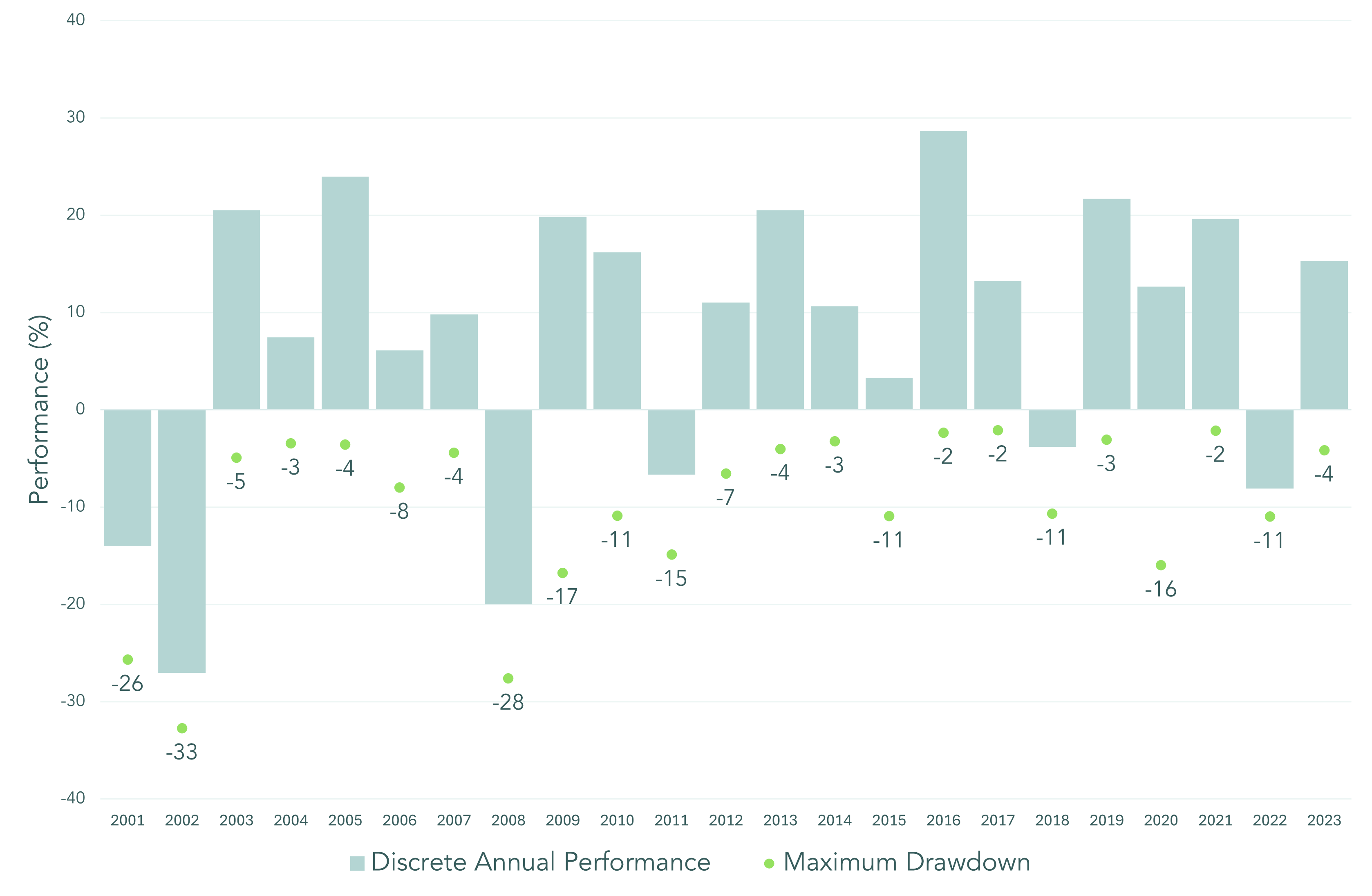

Volatility, or the day-to-day fluctuations in investment values, is a natural part of investing, even within a single year. In fact, the intra-year declines—periods when the market temporarily falls—are more common than many realise. Whilst not guaranteed, historically markets have experienced notable declines within a year before often finishing with positive gains by year-end.

For example, during a typical year, the stock market may experience several dips of 5-10%, and occasionally even more significant drops – and markets are still typically up by the end of the year.

Figure 1 – Source FE Analytics

But these declines are part of the market’s normal fluctuations. They’re unsettling to see, but they don’t necessarily reflect a long-term trend. Over time, markets tend to recover, rewarding those who remain patient and focused on their long-term goals.

Inflation: The Quiet Erosion of Future Wealth

While volatility can seem like the most pressing risk, inflation is a quieter threat that gradually diminishes your purchasing power over time – something that we’ve all become increasing aware of in the past few years. Inflation is simply the rate at which prices for goods and services increase, meaning that if inflation averages 2% annually, you’ll need £121.90 to buy £100 worth of goods in ten years’ time.

For long-term investors, inflation risk can be significant. If your investment returns don’t keep pace with inflation, you could find that your wealth hasn’t grown enough to meet your future needs, even if your portfolio appears to have increased in value on paper.

Different Views on Risk: The USA vs. the UK

Attitudes toward investment risk can differ significantly between countries, often shaped by cultural difference, economic, and market dynamics. Comparing the USA and UK reveals some interesting contrasts in how people perceive and approach risk in their personal savings and investments:

USA: Appetite for Risk

- A Culture of Growth: Many Americans are generally more comfortable with market volatility, viewing risk as an essential part of seeking higher returns. This stems partly from a strong equity culture, where investing in the stock market is common, even for retirement savings through their pension plans.

- Long-Term Focus: There’s a greater tendency in the U.S. to stay focused on long-term growth, with many individuals willing to ride out market fluctuations to achieve higher returns over decades.

- Awareness of Inflation: Inflation awareness in the U.S. is high, especially given historical periods of high inflation. As a result, there’s a strong emphasis on finding investments that outpace inflation.

UK: A Cautious Approach

- Preference for Stability: Many UK savers tend to prioritise capital preservation over growth, often favouring cash savings accounts or lower-risk investments like bonds. This cautious approach reflects a cultural tendency to avoid loss, even if it means lower returns.

- Short-Term Focus: UK investors are often more sensitive to market dips and may react by withdrawing investments during downturns, which can crystallise losses (something a financial planner can help guard against).

- Underestimating Inflation: Despite rising living costs, many UK investors underestimate the long-term impact of inflation, leading to over-reliance on cash savings that lose value in real terms over time.

Understanding these differing perspectives highlights the importance of tailoring advice to suit cultural preferences while addressing misconceptions. Many UK investors could benefit from a stronger focus on inflation-adjusted growth and recognising the detrimental effects of long-term cash savings in protecting against inflation.

Balancing Volatility and Inflation: A Strategy for Future Wealth

Addressing both volatility and inflation means designing a plan that balances short-term resilience with long-term growth. Here’s how that balance can be achieved:

- Investing for Growth: Growth-focused investments, like shares, offer the potential to outpace inflation over the long term. While shares are more volatile and can experience intra-year declines, they provide a chance for higher returns, helping your portfolio grow in “inflation-adjusted” terms.

- Diversification: Diversifying your investments helps manage the impact of volatility. By spreading your investments across a mix of assets, like shares, bonds, and perhaps even alternative investments, you can smooth out returns and make it easier to stay invested during turbulent periods.

- Regular Portfolio Reviews: Monitoring inflation rates and assessing your investments regularly ensures that your portfolio remains aligned with your goals. A financial planner can help you navigate the inevitable ups-and-downs of any investment and discuss adjustments if needed to keep your portfolio on track.

Avoiding the Hidden Risk: Don’t Let Inflation Sneak Up on Your Wealth

It’s easy to focus solely on market swings or to feel nervous when experiencing a period of decline. But choosing not to invest, or holding cash, can carry a long-term risk if inflation outpaces your returns. Money left in cash may feel safe, but if inflation is higher than the interest you’re earning, that cash is losing value in real terms.

Factoring inflation into your investment strategy means working to protect the future value of your wealth—not just its face value—so it can meet your needs down the road.