Coming up Trumps!

This was certainly the view from stock markets yesterday, with US markets in particular, surging on the news of a decisive victory for Donald Trump and the Republican Party.

In this short note, we unpack some of the implications for markets and what this might mean for our Portfolios.

First, the market reaction

There were some very clear moves: US stocks rose by about 3%, the US Dollar rose by about 1% (vs the Pound) and the bond market sold off as yields rose.

These moves captured the view that President Trump 2.0 is likely positive for the economy (due to de-regulation and stimulative tax cuts) but is also likely inflationary and will add to the debt burden (due to the likely imposition of tariffs and increased spending).

How has this impacted the Magnus Portfolios?

The Magnus Portfolios have fairly high exposure to US equities, running in the range of 18.55% (Cautious portfolio) through to 45.75% (Adventurous portfolio) within the Flagship range. They are also fairly short dated when it comes to their exposure to fixed interest, running in the range of 7% (Balanced Adventurous portfolio) through to 28% (Cautious portfolio.

President Trump is likely to keep the market on its toes and we believe that a predominantly active approach within Fixed Interest makes best sense.

Using volatility as a friend (to take advantage of choppiness in markets) is key and is one of the benefits of an active approach to portfolio management. However, we’d emphasise that we don’t base our Portfolio allocations on events such the US election. The Portfolios we build on behalf of our clients are shaped by our views on where we see the best valuations and where these valuations are supported by strong business cycles (e.g. strong corporate profits and fertile economic conditions). This helps us offer our clients’ portfolios for all seasons.

Where next?

Once the market has adjusted to life with President Trump 2.0, we’d expect the focus to return to fundamentals: namely corporate earnings and the health of the consumer. The corporate earnings season has exhibited strong earnings growth (we’re on track for our 5th consecutive quarter of US earnings growth) and the US consumer (in particular) is still powering growth in a US economy which is motoring. This is a healthy backdrop for Portfolios.

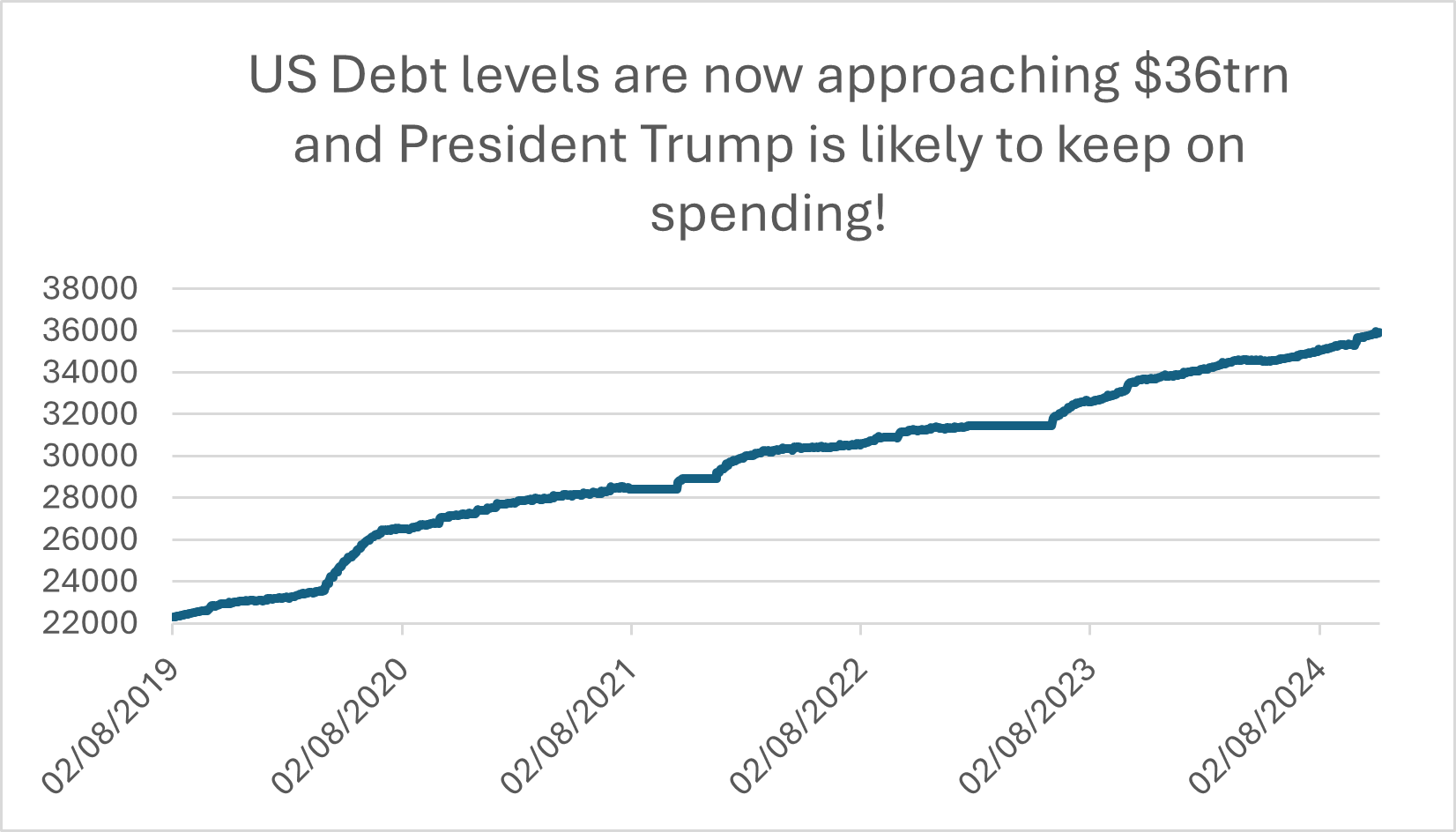

Within equities, we remain guided by the outlook for corporate earnings (which is on a positive uptrend) and within fixed interest, our positioning is guided by debt levels. To this end, we expect debt levels to increase under President Trump as spending (through lower taxes) is used to fuel growth. This likely means that whilst we still get interest rate cuts, there are perhaps less than had previously been priced and this tends us towards tempering our views on longer-dated fixed interest.

Keeping a close eye on the 4 Ds

President Trump 2.0 is one “D” (“Donald”) that we need to keep a close eye on, and 3 others would be Debt (debt levels are high and rising), Deficits (both in the US and UK) and the Dollar (as a barometer for the efficacy of any big spend policies).

The balance between these 3 “D”’s is central to the health of global markets from here, with our view being that an appropriate balance is being struck.

We’re continuously monitoring our Portfolios’ balance between defensive and riskier assets and remain confident and comfortable in the positions being taken.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.