As the interest rates paid on cash continue to creep up with every passing meeting of the Bank of England’s Monetary Policy Committee, and investment markets continuing to be choppy, it’s worth asking the question about whether being in cash is now better than being invested. We asked Georgie Ogilvie-Jones of Magnus, Wren Sterling Group’s discretionary fund management business to crunch the numbers based on the last time the Bank of England Base Rate hit 5%, back in 2008.

Georgie says: Interest rates have just hit 5%, would clients be better off in cash than investing in equities? It’s a resounding “no” from the team at Magnus. Let’s cast our mind back to the last time interest rates were 5% and work from there.

It’s April 2008, the Ting Tings are racing up the charts with “That’s Not My Name” and Manchester United are a month off securing their tenth Premier League win. Northern Rock has been nationalised a couple of months ago and interest rates have just been cut to 5%, after climbing to 5.75% in July 2007. Let’s assume you’ve got £10,000 in cash and need to decide whether to invest it in equities or keep it in a bank account in the context of deteriorating economic conditions. We’ve chosen the example of making a £10,000 investment in the FTSE All Share (broad UK equity) market on 10th April 2008, the date of the rate rise. We have assumed that all dividends are reinvested.

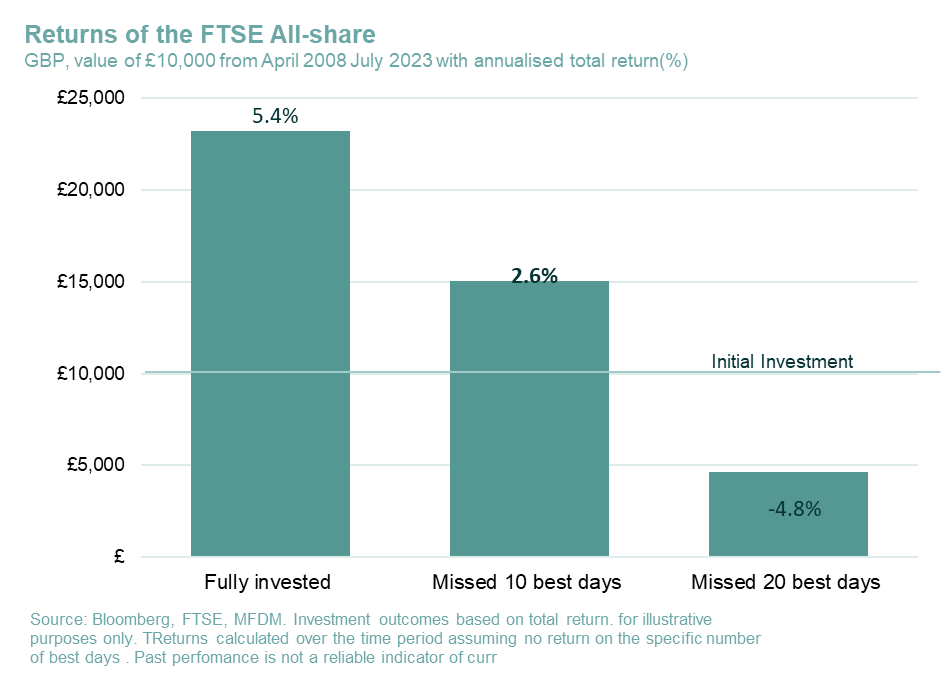

If you’d left it invested (and re-invested your dividends), it would be worth a handsome £23,223 today. This represents a return of about 5.4% per year. However, if you’d tried to be a hero (and got really unlucky) by jumping in and out of the market and had missed the best 20 days of trading you would now have around £4,647 i.e. you would have missed out on around £18,576. If you missed the best 10 trading days your annualised return would be trimmed to 2.6%, translating into £15,023 in cash i.e. £8,200 less than if fully invested.

Ironically, the best trading days often occur when markets are extremely choppy making it harder to predict which days they will fall. Sitting tight was the best option and it provided an annualised return much greater than any base interest rate between April 2008 and July 2023 which have been in the range of 0.10% to 5%.

This chart and example might help highlight that timing the market is a near impossible task and one fraught with risk. The old adage of “time in the market beats timing the market” holds true.

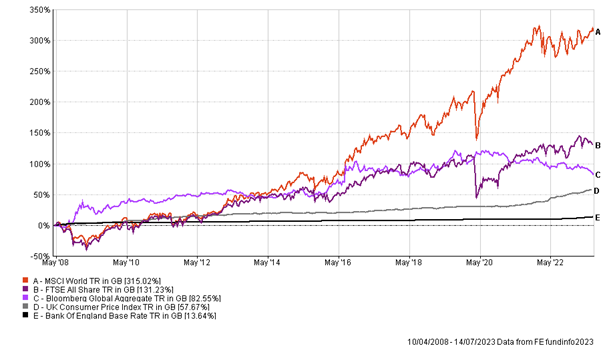

Finally, what if you’d left your money in cash between 10th April 2008 and 14th July 2023? (These are the dates the information above applies to). The chart below illustrates that on a total return basis, in Sterling terms, global equities, UK equities and global bonds (as illustrated by broad market indices) all offered significantly better returns than the Bank of England base rate and outstripped the UK Consumer Price index.

Investing in cash long term could potentially erode your wealth in real terms, even in a low inflation environment. The above data was in a low inflation regime and CPI has significantly outstripped the bank base rate over time. Cash rates today are high for a reason: inflation is high (and higher than cash rates). Many of the bonds in our portfolios yield more than 6%, together with attractively valued equities within portfolios we see potential for capital upside and decent returns over the long term.

-

Get in touch

If you would like to discuss your investment portfolio performance, please contact your Wren Sterling financial planner or make an appointment.

IMPORTANT: Past performance is not a guide for future returns. The value of your investments can go down as well as up, so you could get back less than you invested. Past performance is not a reliable indicator of future performance.