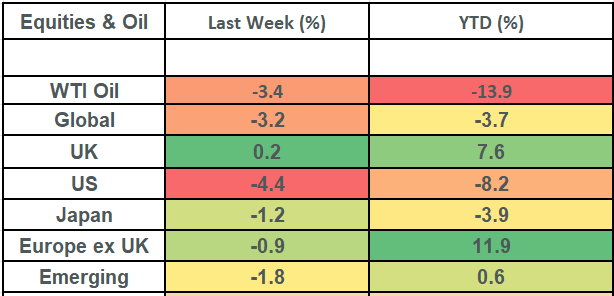

Global stock markets fell by 3.2% last week: giving up some ground after a near 14% rally (in GBP terms) from their lows in April. Renewed threats of tariffs (vs the EU) combined with concerns over US government spending and weighed on investor confidence. Worth pointing out that Sunday saw President Trump announce the postponement of the deadline of tariffs vs the EU to July 9th (from June 1st), following a “very nice” call with Ursula Von Der Leyen (European Commission Chief).

It’s quite a quiet calendar of scheduled events to round the month of May off, but we do have corporate results from Nvidia (the 2nd largest company in the global share market) on Wednesday night.

Last week

- Global stock markets fell by c3% after a very strong recent run.

- US stocks weighed most heavily on returns: further crimped by weakness in the US Dollar

- UK stocks continued to offer something different and posted modest gains.

- Bond markets posted modest losses as yields rose.

This week

- Nvidia’s earnings on Wednesday will be the big event on the corporate calendar. Nvidia is the 2nd largest stock within the global share market.

- US consumer confidence is out today, with the US Federal Reserve’s most recent set of minutes out tomorrow.

- As has been the case recently, any news from the Trump Administration will be closely watched by markets!

Source: Bloomberg

More details:

- Global stock markets fell by 3.2% last week. This fall was largely driven by US stocks (the US accounts for c70% of the global index), with big US tech stocks falling and the Pound also rising by 1.9% vs the US Dollar: which meant that losses in USD terms were amplified when they got translated back into Sterling.

- The key drivers of the fall in US stocks came from:

-

- Concern over the US debt burden, and

- Fresh tariff threats from the Trump Administration

It is also worth noting that the US market had risen about 16.5% in GBP terms from its lows in April and a pause for breath is quite normal!

- Concerns over the US debt burden:

- Credit ratings agency Moody’s downgraded the United States’ credit rating on 16th May from Aaa to Aa1. This did not come as a surprise (Moody’s had the US on “negative watch” since November 2023) and it now aligns with similar downgrades from Standard & Poor’s (in 2011) and Fitch (in 2023).

- May 22nd saw the House (Congress) pass the Trump Administrations “Big, Beautiful” tax bill: by one vote! The bill primarily extends the 2017 tax cuts and includes proposals that were highlighted in the Trump campaign. The Congressional Budget Office (“CBO”) estimates that the bill will add nearly $3 trillion to the budget deficit over the next decade and push the deficit to 7% of GDP in the next 2 years.

- Fresh tariff threats from the Trump Administration:

- President Trump announced plans on Friday 23rd May to impose a 50% tariff on imports from the EU, effective 1st June, starting that trade talks were “going nowhere”. His announcement also included a threat of 25% tariffs on iPhones unless Apple moves production of the product to the US. Apple was down by 9.3% last week. The deadline for these tariffs was subsequently (on Sunday 25th May) moved to July 9th and this helped give European assets a boost yesterday.

- The UK stock market continued to provide reasons to be cheerful, rising by 0.2% on the week. Within that, there were good gains for consumer stocks (such as M&S up 5.7% and Tesco up 5.2%), mining companies (Fresnillo up 13.3% and Anglo American up 6.1%) and telecoms companies, with Vodafone up by 8.3%. These sorts of moves highlight the diversifying role that UK stocks can play in a global portfolio, with the UK market having a very different composition than the global index: for example, the UK share market’s weighting to the technology sector is c1% as opposed to the 25% weighting in the global share index.

- Last week also showed continued signs of strength from the UK consumer, with both consumer confidence and retail sales coming in better than expected. If we discount Covid (on the basis that consumers were unable to spend), then the UK savings rate (at 12%) is the highest it has been since March 2010 – signaling a strong consumer with money to spend! UK inflation increased last week to 3.5% (per UK CPI), which was a touch higher than expected.

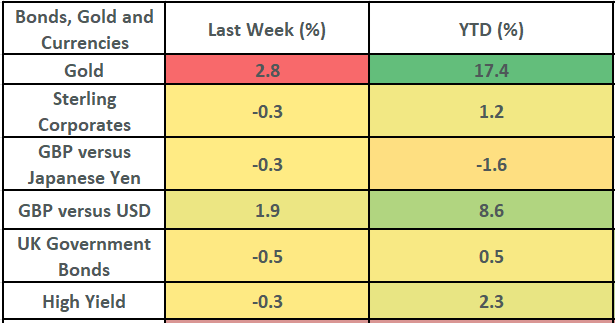

- Bond markets fell back slightly last week. UK gilts fell by about 0.5%, whilst UK corporate bonds fell by about 0.3%. These falls came amidst rising bond yields, with the UK 10-year bond yield closing out the week at 4.68%. Our view is that bond yields at these levels are attractive although we prefer shorter-dated bonds. Our view is that higher bond yields will attract more demand as well as slowing activity: which will prompt interest rate cuts.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.