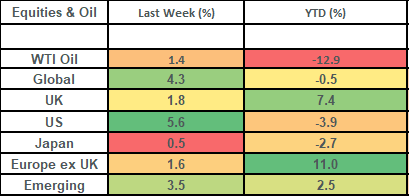

Global stock markets rose by 4.3% last week: their best week since June 2022! The rally was driven by the US share market and, in particular, technology shares. US shares got a boost following positive talks with China which opened the door to lower tariffs and relaxed trade restrictions around artificial intelligence chips. US trade relations are likely the big driver again this week – (in keeping with the last couple of months!) but we do also have a good smattering of UK companies reporting too.

Last week

- Global stock markets had their best week since June 2022!

- US stocks powered the gains, with technology shares leading the way.

- Hopes of a US trade deal with China (and a reduction in proposed tariffs for 90 days) ignited the rally.

- UK growth data surprised to the upside.

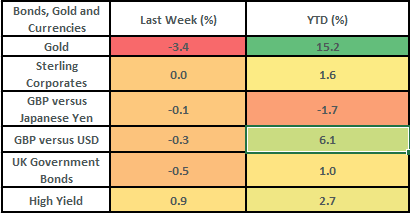

- Bond markets were mixed: government bonds sold off whilst high yield credit rose.

This week

- UK inflation is out on Wednesday (expected to rise to 3.3%) and UK Retail Sales are out on Frida

- Thursday sees Flash PMI (Manufacturing) data release for the UK, the US, Germany, and Japan as well as home sales data for the US.

- UK listed corporates such as Vodafone and Smiths (Tuesday), Marks & Spencer and Currys (Wednesday) and Mitchells & Butlers and Easyjet (Thursday) are reporting earnings this week.

Source: Bloomberg

More details:

- Global stock markets gained by 4.3% in GBP terms and have now recovered all their losses post liberation day. They have risen by 14.3% (in GBP terms) from their lows on 8th

- US stocks drove the gains last week, with US shares rising by 5.6%: their best week since June 2022! The US market makes up just over 70% of the global share market and hence is a large driver of direction. There were 2 principal drivers of US shares last week:

- Positive US / China trade talks: which benefited US shares and hence drove the gains in global shares

- Eased trade restrictions related to Artificial Intelligence chips: which benefited the US tech sector which is the biggest sector in the US share market (with a weighting of just over 30%).

- US / China trade talks:

- The US and China agreed to significantly reduce tariffs for a 90-day period whilst both sides work towards a longer-term deal. The US has agreed to reduce its tariff rate on most imports to 30% (from 145%) and China has agreed to reduce its tariff rate on most imports to 10% (from 125%).

- Relaxed trade restrictions on AI chips:

- Last week the US Administration agreed to ease trade restrictions related to AI chips: this helps enable trade agreements between US tech companies and other countries. Last week also saw an announced deal between Nvidia and Saudi Arabia which provided a further boost to the tech sector.

- US technology was the best performing sector last week, thanks to the aforementioned developments. The US tech sector rose by 8.5% last week in GBP terms, with the AI related names doing best and Nvidia up by 16.4% (Nvidia makes up 6.5% of the US share market). Whilst Nvidia’s results aren’t until 28th May, we’ve seen some positive news around relaxed regulations and the reported results of the key hyper-scaler companies which are spending lots of money on Nvidia chips. Recent corporate results from Microsoft, Meta, Amazon and Alphabet showed that these companies are committing to their aggregated $300bn capital spend this year (with much of this being directed at AI), with Meta increasing their planned spend by about 10%. This bodes well for Nvidia since these 4 companies alone account for c40% of Nvidia’s revenues!

- UK growth came in better than expected for the first quarter: coming in at 0.7% vs expectations of 0.6%. Whilst this doesn’t reflect the tariff impact (which is small for the UK), it does show an improvement. This follows a recent string of UK data which has surprised to the upside: inflation (at 2.6%) was lower than expected last month, retail sales have been better than expected and private sector wages also came in lower than expected. Last week also saw the unemployment rate tick up 0.1% to 4.5%, which (when combined with private sector wages slowing) is a sign that the labour market is cooling which should help the Bank of England cut interest rates further.

- Bond markets were mixed last week. Government bond yields rose but credit spreads narrowed. This meant that Government bonds lost value, with the UK gilt index down by about 0.5% on the week, but corporate bonds gained in value: UK investment grade credit was up by 0.02% on the week, with global high yield markets up by 0.9%. Global Investment grade credit spreads are now back below 1% (and below pre-liberation day levels), whilst US high yield spreads are now back around 3% (well below pre-liberation day levels). For context, these 2 measures got to 1.2% and 4.5% in the worst of the recent sell-off. Whilst this is a big move, it is a long way from the levels reached during Covid (3% and 11% respectively) and the GFC (5% and 19.7% respectively) and hence suggests that companies are in a healthy position.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.