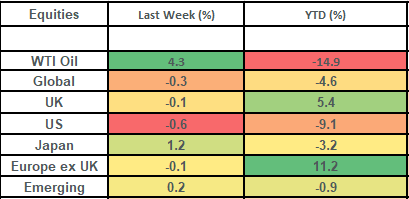

Global stock markets trod water last week having had a strong recent run. Most markets are now back to where they were at the time of the April 2nd tariff announcements and are now likely asking “what next?”. Improved visibility on improved trade terms with big nations such as China will be key as will news around the pro-growth policies that are expected from the Trump administration: notably around deregulation and tax cuts.

Last week

- Global stock traded sideways

- It was a big week for the UK, with 2 trade deals (India and the US) and an interest rate cut from the Bank of England

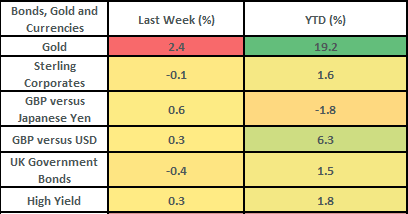

- UK Government bonds sold off modestly, but credit spreads tightened: and are now back to pre-Liberation day levels.

This week

- US inflation is the big economic data point: CPI is out on Tuesday: CPI is expected to hold steady at 2.4%.

- UK employment data is released on Tuesday: unemployment expected to hold at 4.4%.

- Corporate earnings data is fairly light, but we do have numbers from Burberry (Weds) and 3i and Walmart on Thursday.

Source: Bloomberg

More details:

- Global stock markets traded sideways last week after a very strong recent run. UK and European stock markets are now back at their pre-liberation day levels (having bounced c12% since 9th April), with the UK stock market having ended a record-breaking run of 16 consecutive days of gains. US stocks are back at pre-Liberation day levels in Dollar based terms but still have a few percentage points to make up in GBP terms due to the Dollar having sold off vs the Pound.

- UK stock returns were weighed down last week by Astrazeneca (which fell by 4.8% on the week over concerns of patent expirations hitting future sales) which is the largest stock in the index (at a 7% weighting). Outside of that, returns were pretty good! The Banking sector continued its strong bounce (up 1.5% on the week and now up 17.7% on the year-to-date) and British Airways owner IAG posted quarterly profit growth of 221% when compared to the previous period last year.

- Last week saw the UK announce 2 trade deals! Firstly, on Tuesday with India and then on Thursday with the US. The trade deal with the US was the first one that the US has made since the April 2nd tariffs and helps provide markets with a template for future deals. Although the economic impact is limited, the UK does end up in a better position than it would otherwise have been, with steel and aluminium (amongst other) tariffs being eliminated by the US on UK goods and the UK returning the favour by eliminating tariffs on ethanol and beef.

- The key trade deal for markets is with the US and China, with representatives from both sides meeting in Geneva over the weekend. US Treasury Secretary Scott Bessent noted “substantial progress” had been made. Further details are set to be released today.

- Corporate earnings were a mixed bag last week but there were some positive signs from both sides of the Pond.

- In the US, Disney beat on both earnings and revenue and posted a 20% increase in year-over-year earnings. Disney reported better-than-expected subscriber growth for its streaming platform and better revenue from its parks. They also upped their guidance for fiscal year 2025: a bullish sign for the US consumer.

- In the UK, Next raised its guidance for the 2nd time this year on the back of better-than-expected sales: full-price sales were up 11.4% YoY.

- Both the US Federal Reserve and the Bank of England met last week. The US Fed kept interest rates at 4.5% (which was expected) and the Bank of England cut rates to 4.25% (which was also expected!). The Bank of England reiterated their “gradual and careful” approach and noted that the decision was “finely balanced”. It’s worth noting the decision was split 5-2-2, with 5 members voting for a 0.25% cut, 2 voting for a 0.5% cut and 2 voted for “no change”. Bond futures markets are pricing in 2 further cuts by the BoE this year, with the next one coming at the August meeting.

- UK government bond markets sold off by about 0.4% last week, with the 10-year bond yield rising modestly on the week. It closed the week yielding 4.57%. Credit spreads narrowed on the week (reflecting improved confidence in the corporate sector), with investment grade spreads closing out the week at c1% and US high yield spreads at c3.4%: both are now back around where they were at the time of the tariff announcements on 2nd April.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.